Is Genfit SA (NASDAQ:GNFT) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

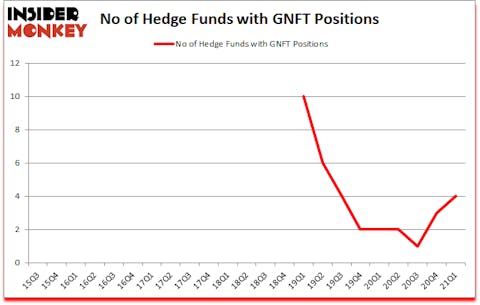

Is Genfit SA (NASDAQ:GNFT) a buy here? Prominent investors were getting more bullish. The number of bullish hedge fund bets went up by 1 lately. Genfit SA (NASDAQ:GNFT) was in 4 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 10. Our calculations also showed that GNFT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 115 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Nathan Fischel of DAFNA Capital Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, an activist hedge fund wants to buy this $27 biotech stock for $50. So, we recommended a long position to our monthly premium newsletter subscribers. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s review the new hedge fund action regarding Genfit SA (NASDAQ:GNFT).

Do Hedge Funds Think GNFT Is A Good Stock To Buy Now?

At first quarter’s end, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from the previous quarter. On the other hand, there were a total of 2 hedge funds with a bullish position in GNFT a year ago. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Millennium Management, managed by Israel Englander, holds the biggest position in Genfit SA (NASDAQ:GNFT). Millennium Management has a $1.5 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is DAFNA Capital Management, managed by Nathan Fischel, which holds a $0.9 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining peers that hold long positions consist of Ken Griffin’s Citadel Investment Group, Julian Baker and Felix Baker’s Baker Bros. Advisors and . In terms of the portfolio weights assigned to each position DAFNA Capital Management allocated the biggest weight to Genfit SA (NASDAQ:GNFT), around 0.21% of its 13F portfolio. Millennium Management is also relatively very bullish on the stock, setting aside 0.001 percent of its 13F equity portfolio to GNFT.

As industrywide interest jumped, key hedge funds have jumped into Genfit SA (NASDAQ:GNFT) headfirst. Citadel Investment Group, managed by Ken Griffin, established the largest position in Genfit SA (NASDAQ:GNFT). Citadel Investment Group had $0.2 million invested in the company at the end of the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Genfit SA (NASDAQ:GNFT) but similarly valued. We will take a look at Evogene Ltd. (NASDAQ:EVGN), Secoo Holding Limited (NASDAQ:SECO), Axcella Health Inc. (NASDAQ:AXLA), Eton Pharmaceuticals, Inc. (NASDAQ:ETON), Polar Power, Inc. (NASDAQ:POLA), Esquire Financial Holdings, Inc. (NASDAQ:ESQ), and Tsakos Energy Navigation Ltd. (NYSE:TNP). This group of stocks’ market caps are similar to GNFT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EVGN | 7 | 33056 | 3 |

| SECO | 6 | 6149 | 2 |

| AXLA | 2 | 394 | -1 |

| ETON | 6 | 31704 | 1 |

| POLA | 2 | 3105 | -1 |

| ESQ | 2 | 17992 | -1 |

| TNP | 5 | 15402 | -1 |

| Average | 4.3 | 15400 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.3 hedge funds with bullish positions and the average amount invested in these stocks was $15 million. That figure was $3 million in GNFT’s case. Evogene Ltd. (NASDAQ:EVGN) is the most popular stock in this table. On the other hand Axcella Health Inc. (NASDAQ:AXLA) is the least popular one with only 2 bullish hedge fund positions. Genfit SA (NASDAQ:GNFT) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for GNFT is 38. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.2% in 2021 through June 11th and surpassed the market again by 3.3 percentage points. Unfortunately GNFT wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); GNFT investors were disappointed as the stock returned -11.7% since the end of March (through 6/11) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2021.

Follow Genfit Sa (NASDAQ:GNFT)

Follow Genfit Sa (NASDAQ:GNFT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.