Out of thousands of stocks that are currently traded on the market, it is difficult to determine those that can really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of over 700 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Curtiss-Wright Corp. (NYSE:CW) .

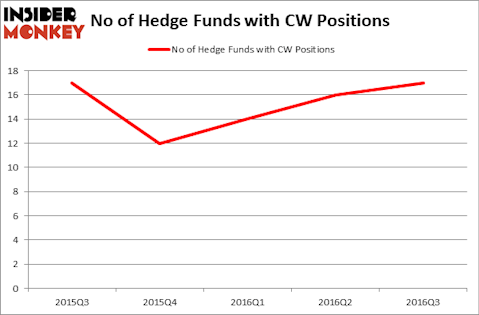

Curtiss-Wright Corp. (NYSE:CW) was in 17 hedge funds’ portfolios at the end of September. CW shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. There were 16 hedge funds in our database with CW positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Teradata Corporation (NYSE:TDC), First Solar, Inc. (NASDAQ:FSLR), and XPO Logistics Inc (NYSE:XPO) to gather more data points.

Follow Curtiss Wright Corp (NYSE:CW)

Follow Curtiss Wright Corp (NYSE:CW)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

With all of this in mind, let’s take a look at the key action surrounding Curtiss-Wright Corp. (NYSE:CW).

Hedge fund activity in Curtiss-Wright Corp. (NYSE:CW)

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, an increase of 6% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in CW at the beginning of this year. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Mario Gabelli’s GAMCO Investors holds the biggest position in Curtiss-Wright Corp. (NYSE:CW) worth an estimated $144.4 million at the end of the quarter. On GAMCO Investors’s heels is Cliff Asness of AQR Capital Management, with a $40.4 million position. Other members of the smart money with similar optimism encompass Jeffrey Smith’s Starboard Value LP, Joel Greenblatt’s Gotham Asset Management and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that Starboard Value LP is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Consequently, some big names have been driving this bullishness. Mike Vranos of Ellington assembled the most outsized position in Curtiss-Wright Corp. (NYSE:CW). According to regulatory filings, the fund had $0.8 million invested in the company at the end of the quarter. Brian Taylor’s Pine River Capital Management also made a $0.8 million investment in the stock during the quarter. The other funds with brand new CW positions are Israel Englander’s Millennium Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Curtiss-Wright Corp. (NYSE:CW) but similarly valued. We will take a look at Teradata Corporation (NYSE:TDC), First Solar, Inc. (NASDAQ:FSLR), XPO Logistics Inc (NYSE:XPO), and Quanta Services Inc (NYSE:PWR). This group of stocks’ market caps are closest to CW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TDC | 23 | 377584 | -3 |

| FSLR | 23 | 245591 | -7 |

| XPO | 25 | 1091398 | 9 |

| PWR | 22 | 317676 | -8 |

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $508 million. That figure was $217 million in CW’s case. XPO Logistics Inc (NYSE:XPO) is the most popular stock in this table. On the other hand Quanta Services Inc (NYSE:PWR) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Curtiss-Wright Corp. (NYSE:CW) is even less popular than PWR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None