The market has been volatile as the Federal Reserve continues its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points through November 16th. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Columbia Property Trust Inc (NYSE:CXP) and find out how it is affected by hedge funds’ moves.

Columbia Property Trust Inc (NYSE:CXP) has seen an increase in hedge fund sentiment recently. CXP was in 13 hedge funds’ portfolios at the end of the third quarter of 2018. There were 10 hedge funds in our database with CXP positions at the end of the previous quarter. Our calculations also showed that CXP isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are perceived as worthless, outdated investment tools of yesteryear. While there are greater than 8,000 funds with their doors open at the moment, Our researchers hone in on the aristocrats of this group, approximately 700 funds. It is estimated that this group of investors handle the lion’s share of the hedge fund industry’s total asset base, and by tracking their first-class investments, Insider Monkey has unearthed numerous investment strategies that have historically outperformed Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a gander at the recent hedge fund action regarding Columbia Property Trust Inc (NYSE:CXP).

How are hedge funds trading Columbia Property Trust Inc (NYSE:CXP)?

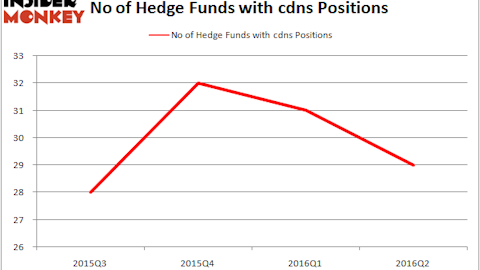

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 30% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CXP over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Long Pond Capital was the largest shareholder of Columbia Property Trust Inc (NYSE:CXP), with a stake worth $55.7 million reported as of the end of September. Trailing Long Pond Capital was Citadel Investment Group, which amassed a stake valued at $26 million. Waterfront Capital Partners, Millennium Management, and Snow Park Capital Partners were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Millennium Management, managed by Israel Englander, initiated the most valuable position in Columbia Property Trust Inc (NYSE:CXP). Millennium Management had $15.9 million invested in the company at the end of the quarter. Jeffrey Pierce’s Snow Park Capital Partners also initiated a $6.3 million position during the quarter. The following funds were also among the new CXP investors: Matthew Halbower’s Pentwater Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s check out hedge fund activity in other stocks similar to Columbia Property Trust Inc (NYSE:CXP). These stocks are Exponent, Inc. (NASDAQ:EXPO), Aerie Pharmaceuticals Inc (NASDAQ:AERI), Delphi Automotive PLC (NYSE:DLPH), and FTI Consulting, Inc. (NYSE:FCN). All of these stocks’ market caps are closest to CXP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EXPO | 12 | 100619 | 2 |

| AERI | 23 | 924919 | -1 |

| DLPH | 22 | 295869 | -1 |

| FCN | 18 | 108657 | 4 |

| Average | 18.75 | 357516 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $358 million. That figure was $136 million in CXP’s case. Aerie Pharmaceuticals Inc (NASDAQ:AERI) is the most popular stock in this table. On the other hand Exponent, Inc. (NASDAQ:EXPO) is the least popular one with only 12 bullish hedge fund positions. Columbia Property Trust Inc (NYSE:CXP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AERI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.