Before we spend days researching a stock idea we like to take a look at how hedge funds and billionaire investors recently traded that stock. Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018. This means hedge funds that are allocating a higher percentage of their portfolio to small-cap stocks were probably underperforming the market. However, this also means that as small-cap stocks start to mean revert, these hedge funds will start delivering better returns than the S&P 500 Index funds. In this article, we will take a look at what hedge funds think about American Financial Group, Inc. (NYSE:AFG).

American Financial Group, Inc. (NYSE:AFG) was in 24 hedge funds’ portfolios at the end of the third quarter of 2019. AFG investors should pay attention to an increase in activity from the world’s largest hedge funds lately. There were 22 hedge funds in our database with AFG holdings at the end of the previous quarter. Our calculations also showed that AFG isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most stock holders, hedge funds are viewed as underperforming, old financial vehicles of the past. While there are greater than 8000 funds with their doors open at the moment, Our experts look at the leaders of this club, approximately 750 funds. These investment experts handle the lion’s share of the hedge fund industry’s total asset base, and by following their highest performing picks, Insider Monkey has revealed a few investment strategies that have historically outperformed the market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Michael Platt of BlueCrest Capital Mgmt.

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a look at the fresh hedge fund action surrounding American Financial Group, Inc. (NYSE:AFG).

How are hedge funds trading American Financial Group, Inc. (NYSE:AFG)?

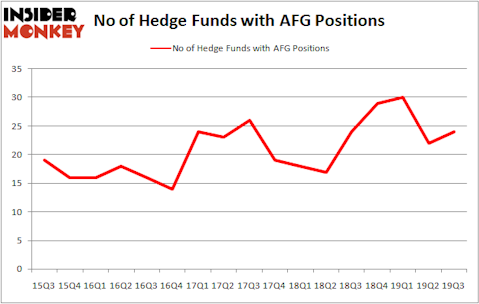

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in AFG over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in American Financial Group, Inc. (NYSE:AFG), which was worth $85.3 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $85.2 million worth of shares. Lomas Capital Management, Two Sigma Advisors, and Bishop Rock Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Lomas Capital Management allocated the biggest weight to American Financial Group, Inc. (NYSE:AFG), around 8.46% of its portfolio. Bishop Rock Capital is also relatively very bullish on the stock, setting aside 6.34 percent of its 13F equity portfolio to AFG.

With a general bullishness amongst the heavyweights, key hedge funds have jumped into American Financial Group, Inc. (NYSE:AFG) headfirst. Voleon Capital, managed by Michael Kharitonov and Jon David McAuliffe, created the largest position in American Financial Group, Inc. (NYSE:AFG). Voleon Capital had $3.6 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also initiated a $0.4 million position during the quarter. The following funds were also among the new AFG investors: Joel Greenblatt’s Gotham Asset Management and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as American Financial Group, Inc. (NYSE:AFG) but similarly valued. We will take a look at Huazhu Group, Limited (NASDAQ:HTHT), Viacom, Inc. <see ViacomCBS (VIAC)> (NASDAQ:VIAB), LKQ Corporation (NASDAQ:LKQ), and Allegion plc (NYSE:ALLE). This group of stocks’ market valuations resemble AFG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HTHT | 16 | 192637 | 2 |

| VIAB | 37 | 727074 | -4 |

| LKQ | 41 | 1409448 | -4 |

| ALLE | 26 | 450412 | 2 |

| Average | 30 | 694893 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $695 million. That figure was $421 million in AFG’s case. LKQ Corporation (NASDAQ:LKQ) is the most popular stock in this table. On the other hand Huazhu Group, Limited (NASDAQ:HTHT) is the least popular one with only 16 bullish hedge fund positions. American Financial Group, Inc. (NYSE:AFG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately AFG wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); AFG investors were disappointed as the stock returned 3.9% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.