Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Integra Lifesciences Holdings Corp (NASDAQ:IART) from the perspective of those elite funds.

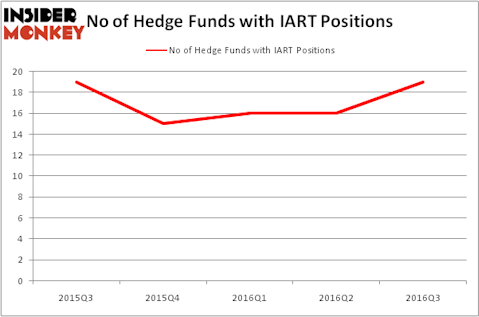

Integra Lifesciences Holdings Corp (NASDAQ:IART) shareholders have witnessed an increase in enthusiasm from smart money of late, with a net total of 3 more hedge funds owning the company’s shares. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Urban Edge Properties (NYSE:UE), CLARCOR Inc. (NYSE:CLC), and PolyOne Corporation (NYSE:POL) to gather more data points.

Follow Integra Lifesciences Holdings Corp (NASDAQ:IART)

Follow Integra Lifesciences Holdings Corp (NASDAQ:IART)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Kotin/Shutterstock.com

How have hedgies been trading Integra Lifesciences Holdings Corp (NASDAQ:IART)?

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 19% burst from the previous quarter, pushing it back to its yearly high after a few down quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Fisher Asset Management, managed by Ken Fisher, holds the largest position in Integra Lifesciences Holdings Corp (NASDAQ:IART). Fisher Asset Management has a $43.5 million position in the stock. Sitting at the No. 2 spot is Principal Global Investors of Columbus Circle Investors, with a $25.7 million position. Other hedge funds and institutional investors with similar optimism contain Phill Gross and Robert Atchinson’s Adage Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Steve Cohen’s Point72 Asset Management.