“I have been following Dr. Inan Dogan since this outbreak, and he is a phenomenally intelligent researcher. One month ago, Dr. Dogan’s prediction that the total U.S. death toll would be 20,000+ by April 15th was deemed “radical”. His Recession is Imminent article in February was very timely. Now he believes we could quickly end lockdowns in NYC after some simple testing. A must read” were the words used by our readers to describe our latest article.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going even though the mainstream financial media journalists don’t agree with this approach. Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 835 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Paypal Holdings Inc (NASDAQ:PYPL) in this article.

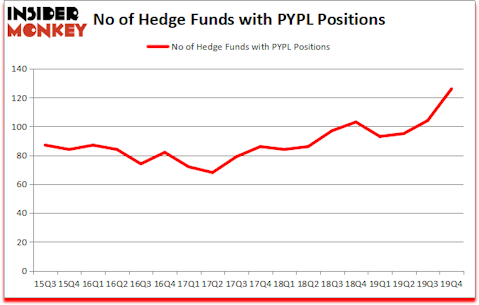

Paypal Holdings Inc (NASDAQ:PYPL) was in 126 hedge funds’ portfolios at the end of the fourth quarter of 2019. PYPL investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. There were 104 hedge funds in our database with PYPL holdings at the end of the previous quarter. Our calculations also showed that PYPL ranked 8th among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

If you listen to the mainstream financial media, you should avoid stock picking and invest in low-cost index funds. This is indeed what you should do if you want to generate average returns. Mainstream financial media journalists try to make you believe that it isn’t possible to pick winners and losers, and you should ignore the stock picks of hedge fund managers. You may remember reading an article in the WSJ that said “random dart throwing monkeys beat hedge fund stars”. What they fail to tell you is that the top 5 hedge fund stocks returned more than 30% since the end of 2018 and beat the S&P 500 Index by nearly 25 percentage points. You can’t explain this kind of outperformance by luck or coincidence. WSJ will need an army of monkeys to throw darts and tens of thousands of attempts to match these returns.

Chase Coleman of Tiger Global

We leave no stone unturned when looking for the next great investment idea. For example, this trader is claiming triple digit returns, so we check out his latest trade recommendations We are probably at the peak of the COVID-19 pandemic, so we check out this biotech investor’s coronavirus picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a glance at the key hedge fund action regarding Paypal Holdings Inc (NASDAQ:PYPL).

How are hedge funds trading Paypal Holdings Inc (NASDAQ:PYPL)?

At Q4’s end, a total of 126 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 21% from the previous quarter. By comparison, 103 hedge funds held shares or bullish call options in PYPL a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Paypal Holdings Inc (NASDAQ:PYPL) was held by Citadel Investment Group, which reported holding $492.3 million worth of stock at the end of September. It was followed by Fisher Asset Management with a $457.3 million position. Other investors bullish on the company included D E Shaw, Arrowstreet Capital, and Lone Pine Capital. In terms of the portfolio weights assigned to each position Ogborne Capital allocated the biggest weight to Paypal Holdings Inc (NASDAQ:PYPL), around 9.68% of its 13F portfolio. Concourse Capital Management is also relatively very bullish on the stock, designating 8.25 percent of its 13F equity portfolio to PYPL.

Now, some big names have been driving this bullishness. Lone Pine Capital, founded by Stephen Mandel, created the biggest position in Paypal Holdings Inc (NASDAQ:PYPL). Lone Pine Capital had $363.9 million invested in the company at the end of the quarter. Chase Coleman’s Tiger Global Management LLC also initiated a $264.8 million position during the quarter. The following funds were also among the new PYPL investors: Aaron Cowen’s Suvretta Capital Management, Josh Resnick’s Jericho Capital Asset Management, and James Parsons’s Junto Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Paypal Holdings Inc (NASDAQ:PYPL). We will take a look at Honeywell International Inc. (NYSE:HON), Eli Lilly and Company (NYSE:LLY), Sanofi (NASDAQ:SNY), and Broadcom Inc (NASDAQ:AVGO). This group of stocks’ market valuations are similar to PYPL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HON | 55 | 2282262 | -3 |

| LLY | 43 | 1493296 | -1 |

| SNY | 31 | 1113585 | 3 |

| AVGO | 61 | 2513808 | 2 |

| Average | 47.5 | 1850738 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 47.5 hedge funds with bullish positions and the average amount invested in these stocks was $1851 million. That figure was $6226 million in PYPL’s case. Broadcom Inc (NASDAQ:AVGO) is the most popular stock in this table. On the other hand Sanofi (NASDAQ:SNY) is the least popular one with only 31 bullish hedge fund positions. Compared to these stocks Paypal Holdings Inc (NASDAQ:PYPL) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 1.0% in 2020 through April 20th but still managed to beat the market by 11 percentage points. Hedge funds were also right about betting on PYPL as the stock returned 3.7% so far in 2020 (through April 20th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.