“I have been following Dr. Inan Dogan since this outbreak, and he is a phenomenally intelligent researcher. One month ago, Dr. Dogan’s prediction that the total U.S. death toll would be 20,000+ by April 15th was deemed “radical”. His Recession is Imminent article in February was very timely. Now he believes we could quickly end lockdowns in NYC after some simple testing. A must read” were the words used by our readers to describe our latest article.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether Alibaba Group Holding Limited (NYSE:BABA) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research even though the mainstream financial media journalists don’t agree with this approach. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

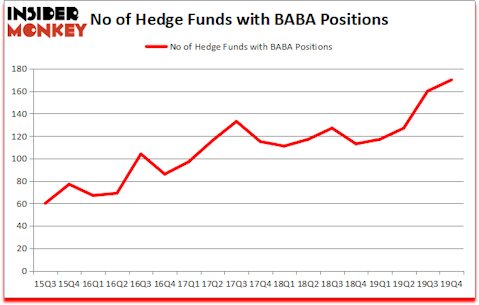

Alibaba Group Holding Limited (NYSE:BABA) has experienced an increase in hedge fund interest recently. Our calculations also showed that BABA currently sits at #4 spot among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

If you listen to the mainstream financial media, you should avoid stock picking and invest in low-cost index funds. This is indeed what you should do if you want to generate average returns. Mainstream financial media journalists try to make you believe that it isn’t possible to pick winners and losers, and you should ignore the stock picks of hedge fund managers. You may remember reading an article in the WSJ that said “random dart throwing monkeys beat hedge fund stars”. What they fail to tell you is that the top 5 hedge fund stocks returned more than 30% since the end of 2018 and beat the S&P 500 Index by nearly 25 percentage points. You can’t explain this kind of outperformance by luck or coincidence. WSJ will need an army of monkeys to throw darts and tens of thousands of attempts to match these returns.

John Armitage of Egerton Capital

We leave no stone unturned when looking for the next great investment idea. For example, this trader is claiming triple digit returns, so we check out his latest trade recommendations We are probably at the peak of the COVID-19 pandemic, so we check out this biotech investor’s coronavirus picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a gander at the recent hedge fund action encompassing Alibaba Group Holding Limited (NYSE:BABA).

Hedge fund activity in Alibaba Group Holding Limited (NYSE:BABA)

At Q4’s end, a total of 170 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the previous quarter. By comparison, 113 hedge funds held shares or bullish call options in BABA a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of Alibaba Group Holding Limited (NYSE:BABA), with a stake worth $2795.6 million reported as of the end of September. Trailing Fisher Asset Management was GQG Partners, which amassed a stake valued at $1620.9 million. Citadel Investment Group, Lone Pine Capital, and Egerton Capital Limited were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Serenity Capital allocated the biggest weight to Alibaba Group Holding Limited (NYSE:BABA), around 41.24% of its 13F portfolio. Athos Capital is also relatively very bullish on the stock, earmarking 29.81 percent of its 13F equity portfolio to BABA.

As industrywide interest jumped, specific money managers have jumped into Alibaba Group Holding Limited (NYSE:BABA) headfirst. Steadfast Capital Management, managed by Robert Pitts, initiated the biggest position in Alibaba Group Holding Limited (NYSE:BABA). Steadfast Capital Management had $391.9 million invested in the company at the end of the quarter. Eashwar Krishnan’s Tybourne Capital Management also made a $310.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Frank Brosens’s Taconic Capital, Anthony Bozza’s Lakewood Capital Management, and Howard Marks’s Oaktree Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Alibaba Group Holding Limited (NYSE:BABA) but similarly valued. These stocks are JPMorgan Chase & Co. (NYSE:JPM), Visa Inc (NYSE:V), Johnson & Johnson (NYSE:JNJ), and Walmart Inc. (NYSE:WMT). This group of stocks’ market caps are similar to BABA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JPM | 98 | 13134286 | 4 |

| V | 143 | 16812443 | -4 |

| JNJ | 85 | 8257996 | 1 |

| WMT | 52 | 5252501 | -6 |

| Average | 94.5 | 10864307 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 94.5 hedge funds with bullish positions and the average amount invested in these stocks was $10864 million. That figure was $22443 million in BABA’s case. Visa Inc (NYSE:V) is the most popular stock in this table. On the other hand Walmart Inc. (NYSE:WMT) is the least popular one with only 52 bullish hedge fund positions. Compared to these stocks Alibaba Group Holding Limited (NYSE:BABA) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 1.0% in 2020 through April 20th but still managed to beat the market by 11 percentage points. Hedge funds were also right about betting on BABA as the stock returned 0% so far in 2020 (through April 20th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.