The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have gone over 730 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 28th. In this article we look at what those investors think of The Carlyle Group LP (NASDAQ:CG).

Hedge fund interest in The Carlyle Group LP (NASDAQ:CG) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare CG to other stocks including Xerox Holdings Corporation (NYSE:XRX), Tata Motors Limited (NYSE:TTM), and Carlisle Companies, Inc. (NYSE:CSL) to get a better sense of its popularity. Our calculations also showed that CG isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are many methods shareholders put to use to evaluate stocks. A pair of the most useful methods are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outperform the broader indices by a healthy margin (see the details here).

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the new hedge fund action surrounding The Carlyle Group LP (NASDAQ:CG).

Hedge fund activity in The Carlyle Group LP (NASDAQ:CG)

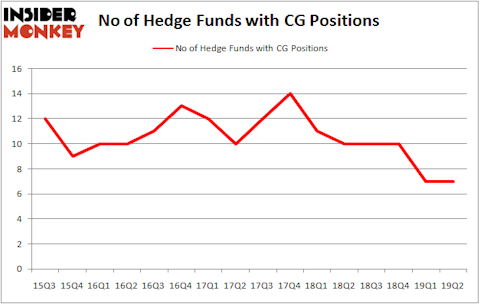

At Q2’s end, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CG over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Alkeon Capital Management held the most valuable stake in The Carlyle Group LP (NASDAQ:CG), which was worth $116.2 million at the end of the second quarter. On the second spot was Markel Gayner Asset Management which amassed $26.6 million worth of shares. Moreover, Miller Value Partners, PEAK6 Capital Management, and Royce & Associates were also bullish on The Carlyle Group LP (NASDAQ:CG), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: PEAK6 Capital Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Miller Value Partners).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as The Carlyle Group LP (NASDAQ:CG) but similarly valued. These stocks are Xerox Holdings Corporation (NYSE:XRX), Tata Motors Limited (NYSE:TTM), Carlisle Companies, Inc. (NYSE:CSL), and Masimo Corporation (NASDAQ:MASI). This group of stocks’ market valuations are similar to CG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XRX | 28 | 1378620 | -5 |

| TTM | 11 | 134501 | -1 |

| CSL | 25 | 329481 | 3 |

| MASI | 28 | 350309 | -6 |

| Average | 23 | 548228 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $548 million. That figure was $164 million in CG’s case. Xerox Holdings Corporation (NYSE:XRX) is the most popular stock in this table. On the other hand Tata Motors Limited (NYSE:TTM) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks The Carlyle Group LP (NASDAQ:CG) is even less popular than TTM. Hedge funds clearly dropped the ball on CG as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on CG as the stock returned 15.1% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.