“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Merit Medical Systems, Inc. (NASDAQ:MMSI) in order to identify whether reputable and successful top money managers continue to believe in its potential.

Hedge fund interest in Merit Medical Systems, Inc. (NASDAQ:MMSI) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Simpson Manufacturing Co, Inc. (NYSE:SSD), SYNNEX Corporation (NYSE:SNX), and NCR Corporation (NYSE:NCR) to gather more data points.

To most stock holders, hedge funds are perceived as slow, outdated investment vehicles of the past. While there are more than 8,000 funds trading at the moment, Our researchers look at the upper echelon of this group, approximately 700 funds. Most estimates calculate that this group of people oversee bulk of the smart money’s total capital, and by keeping an eye on their finest picks, Insider Monkey has determined various investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s analyze the recent hedge fund action surrounding Merit Medical Systems, Inc. (NASDAQ:MMSI).

Hedge fund activity in Merit Medical Systems, Inc. (NASDAQ:MMSI)

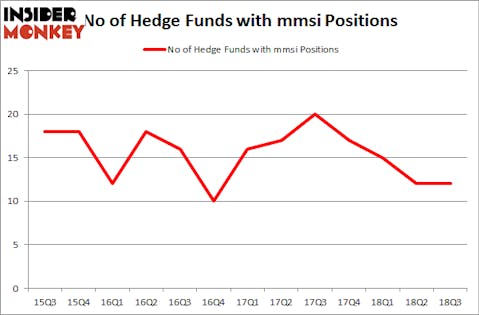

Heading into the fourth quarter of 2018, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, representing no change from the previous quarter. On the other hand, there were a total of 17 hedge funds with a bullish position in MMSI at the beginning of this year. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Partner Fund Management held the most valuable stake in Merit Medical Systems, Inc. (NASDAQ:MMSI), which was worth $82.8 million at the end of the third quarter. On the second spot was Point72 Asset Management which amassed $82.7 million worth of shares. Moreover, Perceptive Advisors, Royce & Associates, and Arrowstreet Capital were also bullish on Merit Medical Systems, Inc. (NASDAQ:MMSI), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Two Sigma Advisors. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Impax Asset Management).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Merit Medical Systems, Inc. (NASDAQ:MMSI) but similarly valued. We will take a look at Simpson Manufacturing Co, Inc. (NYSE:SSD), SYNNEX Corporation (NYSE:SNX), NCR Corporation (NYSE:NCR), and Trinseo S.A. (NYSE:TSE). This group of stocks’ market caps resemble MMSI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSD | 17 | 235777 | 2 |

| SNX | 17 | 205450 | 4 |

| NCR | 17 | 123213 | 1 |

| TSE | 18 | 208871 | 1 |

| Average | 17.25 | 193328 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $193 million. That figure was $278 million in MMSI’s case. Trinseo S.A. (NYSE:TSE) is the most popular stock in this table. On the other hand Simpson Manufacturing Co, Inc. (NYSE:SSD) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Merit Medical Systems, Inc. (NASDAQ:MMSI) is even less popular than SSD. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.