“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Boot Barn Holdings Inc (NYSE:BOOT) in order to identify whether reputable and successful top money managers continue to believe in its potential.

Hedge fund interest in Boot Barn Holdings Inc (NYSE:BOOT) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Alector, Inc. (NASDAQ:ALEC), Callon Petroleum Company (NYSE:CPE), and Kadant Inc. (NYSE:KAI) to gather more data points. Our calculations also showed that BOOT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s go over the key hedge fund action regarding Boot Barn Holdings Inc (NYSE:BOOT).

How are hedge funds trading Boot Barn Holdings Inc (NYSE:BOOT)?

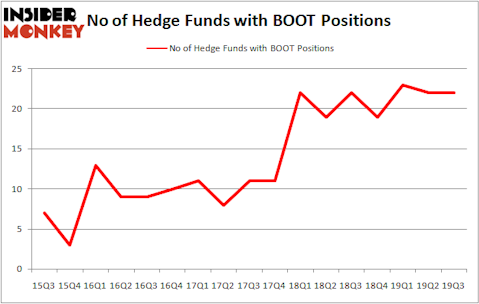

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BOOT over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Half Sky Capital held the most valuable stake in Boot Barn Holdings Inc (NYSE:BOOT), which was worth $30.3 million at the end of the third quarter. On the second spot was Shellback Capital which amassed $25 million worth of shares. Intrinsic Edge Capital, Driehaus Capital, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Half Sky Capital allocated the biggest weight to Boot Barn Holdings Inc (NYSE:BOOT), around 19.57% of its 13F portfolio. Stormborn Capital Management is also relatively very bullish on the stock, earmarking 5.26 percent of its 13F equity portfolio to BOOT.

Due to the fact that Boot Barn Holdings Inc (NYSE:BOOT) has experienced declining sentiment from the smart money, it’s easy to see that there is a sect of money managers who were dropping their full holdings heading into Q4. It’s worth mentioning that Andrew Sandler’s Sandler Capital Management said goodbye to the largest investment of all the hedgies monitored by Insider Monkey, comprising an estimated $4 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund dumped about $1.4 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Boot Barn Holdings Inc (NYSE:BOOT) but similarly valued. These stocks are Alector, Inc. (NASDAQ:ALEC), Callon Petroleum Company (NYSE:CPE), Kadant Inc. (NYSE:KAI), and ARMOUR Residential REIT, Inc. (NYSE:ARR). This group of stocks’ market valuations are closest to BOOT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALEC | 13 | 259407 | 0 |

| CPE | 28 | 383202 | 16 |

| KAI | 12 | 72191 | 1 |

| ARR | 11 | 69052 | 3 |

| Average | 16 | 195963 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $196 million. That figure was $173 million in BOOT’s case. Callon Petroleum Company (NYSE:CPE) is the most popular stock in this table. On the other hand ARMOUR Residential REIT, Inc. (NYSE:ARR) is the least popular one with only 11 bullish hedge fund positions. Boot Barn Holdings Inc (NYSE:BOOT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on BOOT as the stock returned 14.1% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.