While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the third quarter and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Alio Gold Inc. (NYSE:ALO).

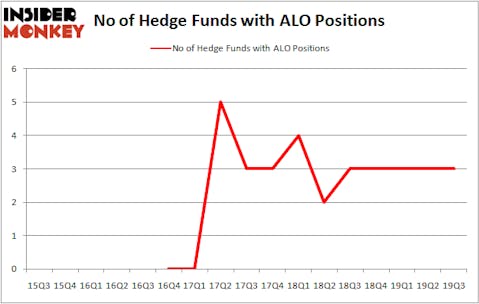

Hedge fund interest in Alio Gold Inc. (NYSE:ALO) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as FuelCell Energy, Inc. (NASDAQ:FCEL), Melinta Therapeutics, Inc. (NASDAQ:MLNT), and CohBar, Inc. (NASDAQ:CWBR) to gather more data points. Our calculations also showed that ALO isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are seen as worthless, outdated financial vehicles of yesteryear. While there are more than 8000 funds with their doors open today, We look at the moguls of this club, around 750 funds. These investment experts preside over most of the smart money’s total capital, and by following their highest performing picks, Insider Monkey has determined several investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Ken Griffin of Citadel Investment Group

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Keeping this in mind let’s analyze the fresh hedge fund action regarding Alio Gold Inc. (NYSE:ALO).

What does smart money think about Alio Gold Inc. (NYSE:ALO)?

Heading into the fourth quarter of 2019, a total of 3 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. By comparison, 3 hedge funds held shares or bullish call options in ALO a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Alio Gold Inc. (NYSE:ALO) was held by Renaissance Technologies, which reported holding $1 million worth of stock at the end of September. It was followed by Sun Valley Gold with a $0.8 million position. The only other hedge fund that is bullish on the company was Citadel Investment Group.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s now take a look at hedge fund activity in other stocks similar to Alio Gold Inc. (NYSE:ALO). These stocks are FuelCell Energy, Inc. (NASDAQ:FCEL), Melinta Therapeutics, Inc. (NASDAQ:MLNT), CohBar, Inc. (NASDAQ:CWBR), and Lincoln Educational Services Corporation (NASDAQ:LINC). This group of stocks’ market caps resemble ALO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FCEL | 3 | 360 | -4 |

| MLNT | 4 | 2690 | -2 |

| CWBR | 4 | 509 | 2 |

| LINC | 4 | 12664 | -1 |

| Average | 3.75 | 4056 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.75 hedge funds with bullish positions and the average amount invested in these stocks was $4 million. That figure was $2 million in ALO’s case. Melinta Therapeutics, Inc. (NASDAQ:MLNT) is the most popular stock in this table. On the other hand FuelCell Energy, Inc. (NASDAQ:FCEL) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Alio Gold Inc. (NYSE:ALO) is even less popular than FCEL. Hedge funds dodged a bullet by taking a bearish stance towards ALO. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately ALO wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); ALO investors were disappointed as the stock returned -3.2% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.