Why does Buffett get a free pass from the media? (Marketwatch)

Uber-billionaire Warren Buffett hosted the annual shareholders meeting for Berkshire Hathaway Inc. (NYSE:BRK.B) in Omaha last weekend. Folks came from far and wide to listen to the Oracle of Omaha, as the financial media lovingly call him, talk about the state of the global economy, management theories and investing ideas. They also love to watch Buffett exchange snappy one-liners with his longtime colleague, Charlie Munger, the Ed McMahon to Buffett’s Johnny Carson. The special weekend in Omaha, where Buffett lives below his means, is often referred to as “Woodstock for Millionaires” because so many of his supporters have become rich by investing with Berkshire Hathaway.

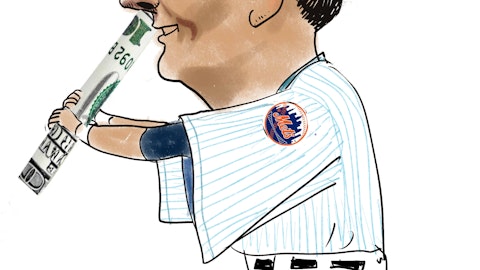

Bill Ackman’s Hedge Fund Is Killing It This Year (Business Insider)

While most hedge funds are struggling in 2014, Bill Ackman‘s Pershing Square is having a spectacular year. According to the Wall Street Journal, Ackman’s $13.7 billion Pershing Square Capital is up 18.7% for the year through the end of April. To put that in perspective, the S&P 500 is up about 1.6% year to date. According to HFR’s HFRX Equity Hedge Index, the average equity hedge fund is down -0.31% year to date.

Carl Icahn’s Son Brett Is Setting Up a Hedge Fund (Wall Street Journal)

Carl Icahn‘s son, Brett Icahn, is about to have an official coming-out party on Wall Street. The younger Icahn and a partner, the duo behind some of Mr. Icahn’s recent winning investments, including Netflix, Inc. (NASDAQ:NFLX), are set to launch a new hedge-fund-management company, people close to the situation say. The new company is expected to take money from outside investors, they said. The elder Mr. Icahn’s public company, Icahn Enterprises LP (NASDAQ:IEP), will own 35% of the new fund company and is expected to give $1 billion in capital to it to manage, the people said. Icahn Enterprises doesn’t manage money for outside investors.

Man Group hit by cautious outlook after ‘challenging’ Q1 (Reuters)

Shares in British hedge fund manager Man Group slid on Friday after its cautious outlook took the shine off an in-line trading statement. The firm, founded in 1783 as a barrel maker, said it took in a net $2 billion of new money during the first quarter, mostly into its GLG alternatives unit, which partially compensated for the money pulled by investors from its FRM funds. When combined with a net $700 million performance loss across its investments, funds under management at the end of March rose to $55 billion, from $54.1 billion at the end of December.

Sotheby’s To Cover Third Point’s Costs (FINalternatives)

To end its battle with Third Point, Sothebys (NYSE:BID)’s capitulation was not enough. The auction house on Monday gave Third Point the three seats on its board that the hedge fund was seeking through a nasty proxy battle. Sotheby’s also agreed to relax its poison pill’s impact on Third Point, in spite of the fact that on Friday it won a court battle with the hedge fund, which had sought to junk the poison pill and delay its annual meeting.

Kerrisdale Capital Management Short Retailer Quiksilver (Wall Street Journal)

Kerrisdale Capital Management is wagering against retailer Quiksilver, Inc. (NYSE:ZQK), its founder Sahm Adrangi said at a conference on Thursday. The investment manager, who often talks publicly about its “short” positions against a stock, said that he believes the brands at Quiksilver, which cater to surfer and skating cultures, are fading from style and declining. “Once fashion changes, there really is no going back,” Mr. Adrangi said while speaking at a gathering hosted by the New York Society of Security Analysts on Thursday.