George Soros’, Soros Fund Management, a hedge fund management company, which he founded in 1969, bought 2% convertible Bond holdings in Digital River, Inc. (NASDAQ:DRIV), which can be converted any time, and are set to expire in 2030. The transaction took place on October 4, indirectly via Robert Soros, the son of George Soros. The bonds are convertible into $71,543 shares of common stock at a unit price of $49.131 per share. George Soros’ newly acquired bonds are valued at $3,378,793.75, and he now holds a total of $255,137,000, worth of derivative securities in the Minnesota-based Internet and Software services company. The famous hedge fund manager, also acquired 2,465,754 shares of Exar Corporation (NASDAQ:EXAR), as per a July 2nd Form 13G filing, and added 100,000 shares of the California-based semiconductor company, on September 28, to bring his total holding in the company to 6,366,666, or nearly 6%.

Meet Mitt Romney’s Hedge Fund Backers (InstitutionalInvestor)

Anthony Scaramucci makes no apologies for backing U.S. Republican presidential candidate Mitt Romney. “Most of the hedge fund managers I know are very pragmatic,” says Scaramucci, founder of New York–based hedge fund firm SkyBridge Capital. Many managers supported President Barack Obama in 2008 because they believed in his promise of governing for all Americans and uniting government, he adds. “Since he failed at that, a Republican who can work with the late Ted Kennedy” — as Romney did when governor of Massachusetts — is the practical choice, Scaramucci contends. He’s in rich company. On September 14 the Romney campaign held a breakfast with the candidate at the Hilton New York. For a table of ten, suggested contributions ranged from $25,000 to $50,000. Scaramucci couldn’t attend because he was in Beijing, but he and his 117 fellow co-chairs of the event were a who’s who of Romney’s Wall Street backers, including several top hedge fund founders and financiers. Among them: Blue Ridge Capital’s John Griffin, Third Point’s Daniel Loeb, John Paulson of Paulson & Co., WL Ross & Co.’s Wilbur Ross, Ricky Sandler of Eminence Capital, Paul Singer of Elliott Associates and Appaloosa Management’s David Tepper. The previous night Lee Ainslie, founder of hedge fund firm Maverick Capital, and his wife, Elizabeth, co-hosted a cocktail reception for Romney at their Long Island home.

Prince William dines with women hedge fund chiefs (DemocratAndChronicle)

It’s been a busy week for the young royals, culminating tonight in Prince William’s annual visit to the charity fundraising dinner held by women hedge-fund chiefs at St. James’s Palace in London. The Duke of Cambridge is the patron of the charity, 100 Women in Hedge Funds Philanthropic Initiatives; this is his third year attending the gala, and he also delivered a short speech. But he was on his own; his wife Catherine, Duchess of Cambridge, was not scheduled to accompany him.

TCI sues CIL directors for causing Rs 2.15 lakh crore loss to the company (IndiaTimes)

London based The Children’s Investment Fund (TCI) has filed a law suit in the Kolkata High Court against directors of Coal India Limited (CIL) for breach of their fiduciary duties and for failing to perform their functions with adequate care and skill. The hedge fund said failing to raise coal prices to market levels, the directors have cost CILBSE 0.24 % Rs 2,15,250 crore loss in pre-tax profits since the state-miner’s initial public offer. TCI estimates that, by the end of the current financial year, CIL will lose over Rs 8,700 crore in pre-tax profits due to reversal of the price increase of December 31, 2011, a statement issued by the hedge fund on Friday said.

Court Orders Argentine Tall Ship Detention (MarineLink)

A Ghana court judge rejected plea to release the ‘ARA Libertad’ training ship, detained through complaint by a US hedge fund creditor. The sail training ship has been detained with more than 200 hundred crew members on board since 2, October 2012 in a port close to the West African port of Accra, reports Bernama. The ARA Libertad is a three-masted tall ship that stopped at Tema while training hundreds of Argentine navy cadets.??The seizure of the flagship of Argentina’s Navy stems from a complaint from a US hedge fund. Elliott Capital Management’s lawyers have searched worldwide for ways of collecting on Argentine bonds bought at fire-sale prices following Argentina’s record debt default a decade ago. The complicated case involves players in three nations: Argentina, Ghana and the United States.

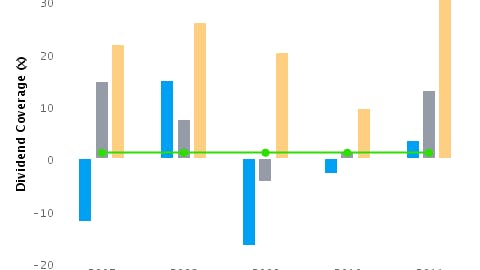

A clear outline (FM)

Managers hope investors will fall in love with an industry that has had only a modest increase in funds under management. Is the public about to fall in love with hedge funds? That is what the hedge fund industry hopes. Carla de Waal, who compiles the annual Novare hedge fund survey, says the industry can handle inflows of up to R45bn before it deems the available funds have run out of capacity. Hedge funds use a combination of leverage and short selling to achieve returns uncorrelated – as far as possible – with equity and bond markets. There has been limited appeal so far. The Novare survey says there has been only a modest increase in hedge fund assets in 2012, to R33,6bn. Of this less than 16% is held directly in retail funds or by wealthy individuals. The total net inflow into hedge funds in the year to June 2012 was R461m (see graphic).

Golden Tree fund gets stake in lender BAWAG PSK (Reuters)

U.S. hedge fund Golden Tree has converted debt into equity of Austrian lender BAWAG PSK , an Austrian newspaper reported, saying it could get a stake as high as nearly 10 percent. The Wiener Zeitung paper gave no source for its report on Friday, which said Austrian supervisors were trying to get more clarity on the Cerberus Capital Management unit’s ownership structure. A BAWAG spokeswoman declined to comment on the report.

Hedge funds gain USD5.1bn in August (HedgeWeek)

The hedge fund industry took in USD5.1bn (0.3 per cent of assets) in August, reversing a USD9.2bn outflow (0.5 per cent of assets) in July, according to BarclayHedge and TrimTabs Investment Research. Based on data from 2,999 funds, the TrimTabs/BarclayHedge Hedge Fund Flow Report estimated that industry assets stood at USD1.7trn in August, down 28.7 per cent from their June 2008 peak of USD2.4trn.

AIMA launches Middle East initiative (HedgeWeek)

The Alternative Investment Management Association (AIMA), the global hedge fund association, has launched a Middle East initiative. AIMA is seeking to create a network for managers and service providers in the Middle East that can give the local industry a voice in terms of engaging with investors and its relations with policymakers and regulators. The initiative will be spearheaded by former AIMA chairman and current AIMA EMEA Regional Advisory Council member Sohail Jaffer of FWU Group, who is based in Dubai.

Blackstone-backed Senrigan creates separate vehicle after losses (Reuters)

Senrigan Capital, an Asia-focused hedge fund backed by Blackstone Group, has removed five investments from its portfolio and placed them into a separate vehicle after heavy losses this year, two sources familiar with the matter said. Senrigan, headed by former Citadel trader Nick Taylor, has seen its $1 billion under management last year fall by half and its 2012 record is among the worst performing of the major regional hedge funds.

SEC begins process toward compliance exams for newly registered managers (PIOnline)

The SEC introduced a new “presence exam” campaign for private investment advisers, including hedge fund and private equity firms, that no longer are exempt from registering with the agency, thanks to changes enacted as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. As of March 30, that included private fund managers with at least $150 million in assets under management. The initiative calls for risk-based examinations of private fund investment advisers over the next two years, according to a letter sent Tuesday to thousands of the newly covered advisers from Drew Bowden, acting national associate director of the Securities and Exchange Commission’s office of compliance inspections and examinations.

Carl Icahn Pursues $3 Billion Bid To Purchase Oshkosh Corp (ValueWalk)

Activist investor, Carl Icahn, the owner of Icahn Enterprises LP and Icahn Capital LP hedge fund, has put forward a bid of $3 billion seeking to acquire Oshkosh Corporation (NYSE:OSK). Icahn is the majority shareholder at Oshkosh Corp, with approximately 9.5% holding, as per the June 30, SEC Form 13F filing, by the activist hedge fund. Carl Icahn has been a key figure in major decisions made by the Wisconsin-based Automobile company, including a push for the separation of JLG industries, which it acquired in December 2006. Icahn was of the opinion that JLG had recovered enough to stand on its own and no longer need support from Oshkosh.

SEC, FINRA Enforcement Roundup: Schwab’s BrokersXpress Hit With Another Fine (AdvisorOne)

The Financial Industry Regulatory Authority and the Securities and Exchange Commission recently took action against a number of firms for everything from fraud to supervisory failure that in some cases cost the firms dearly. FINRA Fines Guggenheim Securities $800,000, Sanctions Two Traders FINRA announced that it has fined Guggenheim Securities, LLC of New York $800,000 for failing to supervise two collateralized debt obligation traders who engaged in activities to hide a trading loss. FINRA also sanctioned the two traders; Alexander Rekeda, the former head of Guggenheim’s CDO desk, was suspended for one year and fined $50,000, and Timothy Day, a trader on Guggenheim’s CDO desk, was suspended for four months and fined $20,000.

Big winner in government’s JPMorgan suit: A hedge fund (Fortune)

A hedge fund manager who made money betting against the housing bubble, and the terrible mortgage loans that came with it, is cashing in on the prosecutions as well. Seth Klarman, the reclusive Boston hedge fund manager, could be the big winner in the recently filed New York Attorney General’s lawsuit against JPMorgan Chase (JPM). Klarman’s Baupost Group is acting as the lead plaintiff in a private case against EMC, the former Bear Stearns mortgage unit that is also the focus of NY AG Eric Schneiderman’s case against JPMorgan. And if things go Klarman’s way, Baupost alone could end up collecting about $310 million from JPMorgan, with a big assist from the government.

The next George Soros? (Seattlepi)

What is it about Hungarian-born billionaires and political activism? Meet Thomas Peterffy, who is emerging as the conservative yin to the liberal yang of fellow countryman George Soros. The 68-year-old discount brokerage pioneer and Greenwich, Conn., transplant, who Forbes.com estimates is worth a handsome $4.6 billion, is creating quite the buzz in the political world with an unprecedented television advertising campaign. Peterffy, the founder of Interactive Brokers, an online discount trading platform based in Connecticut, is buying up millions of dollars of air time nationally on CNN, CNBC and Bloomberg for a television ad indicting socialism and asserting that the country he immigrated to as boy is heading down that path.

USGBC Green Gala Awards: Duke Energy headquarters (BizJournals)

Duke Energy Center in uptown serves as the headquarters for the largest electric utility in the nation. Inspired by Chief Executive Jim Rogers’ vision for a future that includes sustainable and renewable energy, the space reflects a commitment to the environment. The 48-story, 1.5 million-square-foot building is certified under the Leadership in Energy and Environmental Design platinum standard, the highest level. It has a module-based system for office layout that can be adapted to meet changing needs without relocating lighting, HVAC ducts or power supply. The project was designed by architecture firm Gensler and built by Balfour Beatty Construction.

Stocks better than bonds: Marc Faber (EmergingMarkets)

Equities are a much better investment than bonds despite the rally in the debt of some emerging markets, according to Marc Faber, the bearish investor and author of The Doom, Gloom and Boom Report. Investors have been snapping up sovereign bonds issued by emerging and frontier countries as they search for yield after quantitative easing – massive money printing – in the US, Japan and Europe. “I would not own sovereign bonds. Maybe in some Asian countries, as they have been more prudent with their fiscal situation,” Faber told Emerging Markets in an interview. “People are chasing yields but I think there is a risk in sovereign bonds. I don’t care what other people do, that’s what I do,” he added.

Pamela Dyson Named SEC’s Deputy Chief Information Officer (SEC)

The Securities and Exchange Commission today announced that Pamela C. Dyson has been named the SEC’s Deputy Chief Information Officer and will work to further modernize and enhance the agency’s information technology systems. Technology is a vital component of SEC initiatives to protect investors, maintain orderly markets, and promote capital formation. Ms. Dyson has filled a number of key roles in the agency’s Office of Information Technology (OIT) since joining the SEC staff in November 2010. As Deputy Director, Ms. Dyson will coordinate closely with the agency’s divisions and offices to maintain an innovative, secure, and efficient technology infrastructure.

Oerlikon Faces Chinese Delay on $268 Million Solar Unit Sale (Bloomberg)

OC Oerlikon AG, the Swiss engineering group that is selling a solar unit to Tokyo Electron Ltd. (8035), said it faces a delay from Chinese authorities to approve the $268 million deal. “The case is still with the Chinese authorities,” Burkhard Boendel, an Oerlikon spokesman, said in an e-mail confirmed today.“We expect a decision within a foreseeable timeframe.” Oerlikon had expected the deal to close in the third quarter, Chief Executive Officer Michael Buscher said on an August 3 conference call.

New Stream’s Ex-Employees to Take the Fifth (WSJ)

The feds will decide within six months whether those involved with New Stream Capital LLC will face criminal charges, but until then, founder David Bryson and other ex-employees will be taking the Fifth Amendment and refusing to answer questions about the “hedge fund” operation that dabbled in the life-settlement business, as well as T-shirts, jewelry operations and real estate, court papers say. The pending criminal investigation means depositions of Bryson and other former leaders, which were set for later this month, can’t be held until next year, according to papers filed by Michael Buenzow, the official administering New Stream’s confirmed Chapter 11 plan.

Bain Capital to Buy Call Center Business for $1.3 Billion (NYTimes)

The private equity firm Bain Capital agreed on Friday to buy the call center unit of the European telecommunications giant Telefónica for 1 billion euros ($1.3 billion). The deal is the second announced by Bain Capital this week. The private equity firm co-founded by the U.S. presidential candidate Mitt Romney agreed on Wednesday to acquire the Apex Tool Group, a maker of hand and power tools, for $1.6 billion. The deal for Atento, Telefónica’s call center division, comes after the Madrid-based telecommunications company canceled a proposed listing for the unit last year. Telefónica is eager to raise cash as it seeks to reduce its debt burden of around $75 billion.

Nephila Promotes Oliveira To Partner (Finalternatives)

Bermuda-based catastrophe reinsurance hedge fund Nephila Capital has promoted David Oliveira to partner. Oliveira, who has been with the firm since 2006, is a senior portfolio manager. Prior to joining Nephila, Oliveira was head of business development at HSBC Investments (Bermuda), responsible for providing asset management solutions to the captive, and reinsurance community. He began his career at the Bank of Bermuda in 1996 as an investment analyst and later a foreign exchange trader. In 2000, he joined the Bermuda-based global macro hedge fund Nexus Capital in a role encompassing trade execution, acquisition of market information and monitoring portfolio risk. He joined XL Capital’s Weather & Energy group in 2003, trading European and Japanese weather derivatives.