The European Union could be destroyed by the “nightmare” euro crisis, and Germany needs to take the responsibility to save the common currency, billionaire fund manager George Soros said on Monday. …The crisis “is pushing the EU into a lasting depression, and it is entirely self-created,” said Soros, chairman of Soros Fund Management. “There is a real danger of the euro destroying the European Union.” He added: “The way to escape it is for Germany to accept … greater commitment to helping not only its interests but the interests of the debtor countries, and playing the role of the benevolent hegemon.”

SALT Conference kicks off in Singapore to fire up Asian hedge funds (Opalesque)

The latest round of the SkyBridge Alternatives Conference (Salt) kicks off in Singapore on Wednesday with the aim of reviving Asian hedge funds, various media reported. The three-day event will be held at the Marina Bay Sands and is expected to be attended by major Asian hedge fund managers, including Dymon’s Danny Yong and Joe Zhou of Ortus as well as Australian superannuation funds and sovereign wealth funds from China, Korea and Singapore, reported AsianInvestor.net.

US leads the world in number of single manager hedge funds (Opalesque)

The United States continue to lead the world as the jurisdiction of choice for single manager hedge funds – 61% of all single manager hedge funds are located in the US according to a new report from, US-based hedge fund research provider, Preqin. Europe follows the US with 23% of single manager hedge funds, but has a larger population of hedge fund of funds, he 1,230 hedge fund firms located in Europe, 29% manage funds of hedge funds. Data in the report shows that the two most widely used hedge fund domiciles are Delaware in the US and the Cayman Islands, together they account for 69% of all hedge fund domiciles. In Europe, Ireland and Luxembourg continue to be the most favored locations.

DiMaio’s Mead Park Creating Loan-Investing Venture With Doral (BusinessWeek)

Mead Park Holdings LLC, the hedge fund led by former Credit Suisse Group AG (CSGN) trader Jack DiMaio, is creating a partnership with Doral Financial Corp. (DRL) to invest in junk-grade loans. The hedge fund will take a 75.1 percent stake in the venture, Redan Park Asset Management LLC, which will have $1.1 billion in assets, New York-based Mead Park said yesterday in an e-mailed statement. The assets include collateralized loan obligations, or CLOs, an investment vehicle that buys loans to companies with low credit grades and finances them by selling bonds, a portion of which are rated triple-A.

Sustainable hedge fund models to meet challenges (AsianInvestor)

The hedge fund industry in Asia has been steadily recovering in the wake of the global financial crisis. Even so, there is still some way to go before all the lost ground is regained. Between June 2004 and June 2011, total assets in Asian hedge funds increased from $49 billion to $144.7 billion, but total assets under management are still well below the $197.7 billion peak they reached at the end of 2007, according to HedgeFund Intelligence.

William Lyon Homes Gets $30M Paulson Investment (OCBJ)

Newport Beach-based William Lyon Homes said on Monday that it has gotten a $30 million investment from New York-based hedge fund giant Paulson & Co. Inc. The homebuilder sold a combination of common stock and convertible preferred stock to affiliates of Paulson & Co. Inc., a hedge fund which reportedly had close to $20 billion in assets under management as of this summer. The subscription agreement calls for William Lyon Homes to increase its board of directors from seven to eight, with Paulson & Co. having a say in the new member, among other changes.

California Unions Hate All Hedge Fund Managers… Almost (HotAir)

The November ballot in California has its usual complement of initiatives attracting vast swaths of money. The state may be a budgetary basket case, but the political advocacy business is booming. Two of the 11 measures are getting the most attention and, indeed, share many of the same donors. The folks who support Proposition 30, Gov. Jerry Brown’s tax hike initiative, are opposing Proposition 32, yet another initiative attempting to limit the political power of public employees unions in the state. In California, the “no” side has historically had the advantage and the trend seems to be holding. The “yes” sides of both initiatives are currently polling below 50 percent. It’s clear that both sides of the Prop 32 campaign are going after the so-called “low information voter” or, as I like to call it, “the ignorant bloc.” You have to be only mildly informed to see the cynicism involved in two special interest groups deciding on “special interests” as their battleground issue.

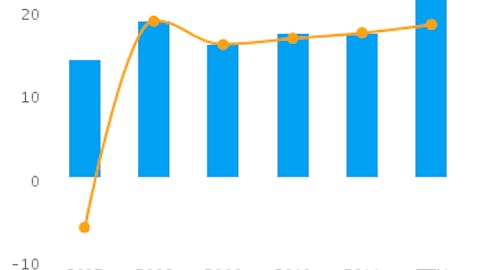

Hedge Funds Correlation with S&P 500 Extremely High: BAML (ValueWalk)

The performance of hedge funds remained strongly coordinated with the S&P 500 (INDEX.INX), despite its under-performance, according to Mary Ann Bartels, analyst at Bank of America Corp (NYSE:BAC) Merrill Lynch. The one-year correlation of hedge funds with S&P 500 (INDEX.INX) is still high, at 82 percent in September 2012, compared with the historical average of 30 percent. Last year, the one-year correlation of hedge funds with the S&P 500 reached as high as 98 percent. Bartels said, “The drop in correlation comes with a staggering underperformance relative to the S&P 500. The question remains: are there too many hedge funds chasing too few returns?”

MLC Appoints DGAM as hedge fund advisor (Opalesque)

MLC, the wealth management division of the National Australia Bank, has appointed Diversified Global Asset Management Corporation, a leading institutional alternative investment manager and advisor, as its hedge fund advisor. MLC conducted a global search for a partner to expand its coverage of alternative investment managers and strategies. MLC expects to grow its hedge fund assets from A$500 million to over A$1 billion over the next 12-18 months. Gareth Abley, Head of Alternative Strategies at MLC said: “We selected DGAM based on their combination of investment, advisory and risk management knowledge and experience. We are confident that DGAMs expertise will help us build on MLC’s strong track record in this space and enable us to deliver the complementary net return stream that will enhance our client’s diversified portfolios.”

Emerging market hedge funds stand out in mediocre year (CNBC)

Fund managers that specialize in investing in emerging markets have achieved standout gains of nearly 8 percent in a year when the typical hedge fund has eked out returns of about 5 percent, recent data showed. Emerging market-focused hedge funds gained 4.5 percent in the third quarter, adding about 2.6 percent in September, according to industry tracker eVestment|HFN. Hedge funds, on average, gained only 1 percent in September and 2.79 percent for the quarter. Year-to-date average returns in the more than $2 trillion industry were about 5 percent through September, compared to emerging market funds, which were up 7.8 percent over the same period.

Wall Street’s Fund-Raising Push for Romney (NYTimes)

The Wall Street supporters of Republican candidate Mitt Romney are making a last fund-raising push as the election heads into its final three weeks. DealBook has obtained an invitation for a cocktail and photo reception at the Hilton New York on Monday afternoon with Representative Paul D. Ryan, the vice presidential candidate. The price of entry is $1,000 per person and $5,000 for a photo, presumably with Mr. Ryan.

Hedge Fund Seeder Acquires Parent Company (HedgeFund)

Fund of hedge funds Larch Lane Advisors announced that it has agreed to buy its parent company. New York-based Larch Lane announced last Thursday that it will acquire Old Mutual Asset Management, which is expected to close by the end of 2012. Following the transaction, Larch Lane will be 100% employee-owned and its management team will continue operating in the same mode as it is currently.

Did Bernie Madoff Run a Hedge Fund? (HedgeCo)

Everyone knows the name Bernie Madoff. But very few people know the true story behind his deceptive Ponzi scheme. “A lot of people don’t know this but Bernie Madoff was not a hedge fund,” Mitch Ackles, President of the Hedge Fund Association and CEO of Hedge Fund PR, told StreetID. “Bernie Madoff was a broker-dealer — a regulated entity. He committed fraud. What you’ve seen of the cases that have come out, insider trading is top of mind for people, but even those rules need some clarity.” Ackles has not held back in sharing his feelings about regulation, which he wholeheartedly supports, along with clarifications to the existing set of rules.

How Israeli hedge funds can exploit their US potential (Globes)

Israel’s emerging hedge fund managers are beginning to attract interest from United States investors, including seed investors. To make the most of this opportunity, it is important for Israeli managers to understand the implications of potentially becoming regulated by the United States Securities and Exchange Commission (“SEC”). Israeli managers considering raising capital in the United States need to know whether they will be required to register with the SEC or whether they may take advantage of an exemption from registration. Israeli managers may even want to consider registering voluntarily with the SEC, because many potential United States institutional investors prefer to invest with SEC-registered investment advisers.

State Street closes acquisition of Goldman hedge unit (BizJournals)

State Street Corp. has completed its acquisition of Goldman Sachs Administration Services in the latest effort by the Boston-based financial firm to expand its hedge fund services business. The $550 million cash acquisition was announced in July. GSAS administers about $200 billion in hedge fund assets for about 150 investment manager clients. Cory Thackeray, its managing director, will continue to lead the unit under State Street.

Aquila Capital Hires Hedge Fund Vet MacDonald (Finalternatives)

European hedge fund firm Aquila Capital has named Stuart MacDonald as managing director to assist in developing the firm’s growing institutional business. MacDonald joins Aquila Capital from Gems Advisors, having previously worked in a senior capacity at firms such as Henderson Global Investors, West Merchant Bank and Buchanan Partners. In addition to many years of developing UK and international institutional clients, MacDonald hosts the award-winning investment radio show, The Naked Short Club, on London’s Resonance 104.4FM.

Nikkei gains as Softbank rebounds and boosts lenders (Reuters)

Japan’s Nikkei share average advanced 1.4 percent on Tuesday as index heavyweight Softbank Corp rebounded after the company reassured investors a $20 billion deal to buy 70 percent of Sprint Nextel Corporation (NYSE:S) would not dilute their shares. Softbank bounced back 9.6 percent after having lost over 20 percent since rumours of the deal emerged last Friday. Three of the four banks that sources say will lend Softbank cash for the deal – Mizuho Financial Group Inc, Sumitomo Mitsui Financial Group and Mitsubishi UFJ Financial Group – gained between 1.1 and 1.6 perc e nt.

Nomura Gets Biggest Fine in 12 Years by Japan Brokers Group (Bloomberg)

Nomura Holdings Inc. (8604) was fined 300 million yen ($3.8 million), the biggest penalty by the Japan Securities Dealers Association against any firm in 12 years, after employees leaked information on clients’ plans. The Nomura Securities Co. domestic brokerage unit lacked internal controls to safeguard information on share sales it managed in 2010, the self-regulatory group for brokers said in a statement on its website today. The fine follows an Aug. 3 order by regulators that Tokyo-based Nomura, Japan’s biggest brokerage, improve compliance.

MetLife Bets on Brazil Farms as Bond Yields Hurt Results (Bloomberg)

Metlife Inc (NYSE:MET), the largest U.S. life insurer, started a business to make agricultural loans in Brazil as insurers expand in developing markets and seek investments to boost income with interest rates near record lows. “This is about taking advantage of opportunities that will benefit us over the next several years, perhaps decades,” Chief Investment Officer Steven Goulart said in an interview. “As we build our business in Latin America, identifying investment opportunities like we’ve done with agricultural lending will be an important part of how we manage our portfolio.”

A rising class of emerging managers: Women- and minority-owned hedge funds (PIOnline)

Over the past few years, the demand from institutional investors for women- and minority-owned hedge funds (typically known as women and minority business enterprises) has grown significantly. Various states have enacted legislation either mandating that a minimum percentage of public pension assets be allocated to such enterprises (Illinois) or at least encouraging that the firms be considered in the allocation process (New York, Maryland). Even where states might not have legislatively mandated women and minority business enterprise investment by their pension plans, many state or local government pension plans — including those in California, Texas, Florida, New Jersey, Oregon, Wisconsin, North Carolina, Virginia and Ohio — are actively investing in, or seeking to invest in, WMBE-managed hedge funds.

Yanks out to keep Verlander from building playoff legacy (NYPost)

Justin Verlander is the star hedge fund manager who has a stunning Fifth Avenue apartment and beautiful house right on the water in Amagansett, but could really use a country cottage, too. The Yankees are the block of land he needs to acquire. “Obviously that’s a dream of mine, to help pitch my team to a World Series championship,” the Tigers’ ace and American League Championship Game 3 starter said yesterday in a conference call. “And that’s a big reason why I admire those guys. You talk about Roger [Clemens] and Curt [Schilling], and obviously everybody knows what they did in the postseason.