Barclays set to fight FERC over bragging, not rigging (Reuters)

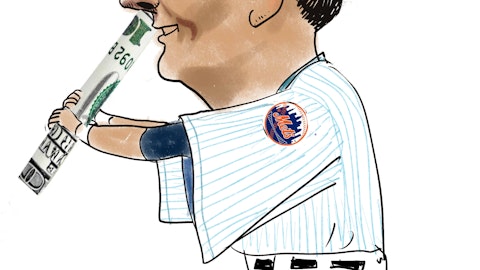

British bank Barclays PLC (NYSE:BCS) is set to fight a potentially record $470 million penalty from U.S. energy regulators by arguing its traders were guilty of braggadocio, not of rigging California electricity prices. The four traders in question, who boasted in emails and instant messages about how “fun” it was to “crap on” certain physical power prices, did not actually carry out the complex scheme they are accused of by the Federal Energy Regulatory Commission, a source familiar with the bank’s thinking said.

Agecroft Wins HFMweek’s and Hedge Funds Review’s 2012 Best Third Party Marketing Firm (PRWeb)

Agecroft Partners was recognized by Hedge Funds Review as the 2012 Best US Third Party Marketing Firm. This was determined by voters in their industry survey which included single manager hedge funds, institutional investors, and funds of hedge funds from around the globe. Over 50% of voters manage more than $1 billion and hold executive positions in their organization. Agecroft received more votes than the second and third place finalists combined. Hedge Funds Review has over 10,000 global readers per month. Agecroft Partners was also recognized at the HFMWeek US Service Awards as the winner in the “2012 Best Third Party Marketing Firm” category, which is the fourth year in a row they have been selected for the award. Winners were named in 39 different categories at the 2012 gala lunch and awards ceremony at Cipriani in New York City.

Opportunities for alternatives lie in private sector pension fund shortfall (Opalesque)

In his latest white paper, Shane Brett of hedge fund consultancy firm Global Perspectives looks at the subject of Asset management & the future Global Pension Crisis, and how alternatives can help fill the gap. Brett opens with a quote from The New York Times from 2010. “Prichard is the future, we’re all on the same conveyor belt. Prichard is just a little further down the road” Michael Aguirre wrote at the time. Back in 2009 the small Alabama city of Prichard, outside Mobile became the first city in America to stop paying pensions to its retired workers. It actively chose, despite State court orders to the contrary, to put funding into services such as hospitals, street lights and teachers’ salaries. The result has been that it could not fund the city’s pension liabilities and many affected retirees have now filed for bankruptcy or been forced back to work.

Investors unconvinced that new hedge fund regulations are protecting them (Opalesque)

Despite a spate of new regulations aimed at protecting hedge fund investors, a mere 10% of them feel that the new regulations will actually protect their interests according a recent survey completed by Ernst & Young. The 2012 survey, Finding Common Ground, was compiled by consulting firm Greenwich Associates for Ernst & Young, and compares opinions from 100 hedge fund managers who manage over US$710bn and 50 institutional investors with over US$190bn allocated to hedge funds on current topics related to the hedge fund industry. Findings show that although the two groups agree on increasing investments in headcount, technology and risk management, stark contrasts exist on compensation structure, fees and expenses.

CC, Bakers assist PE fund launch (LegalBusinessOnline)

Clifford Chance has advised Singapore’s Heliconia Capital Management, a Temasek-seeded fund manager, on its investment into a newly launched private equity fund managed by hedge fund Dymon Asia Capital, which is being represented by Baker & McKenzie.Wong & Leow. The fund, named Dymon Asia Private Equity (DAPE), will target small and medium enterprises (SMEs) in Singapore and Southeast Asia, and be focused on making investments ranging from S$20 million to S$50 million.

Greg Coffey: Stellar trader or faded star? (eFinancialNews)

Coffey, 41, announced in an investor letter he was calling time on an almost 20-year career to spend more time with his family and in his native Australia, as reported in Financial News. His GC Emerging Macro Fund was down about 10% this year before making back most of the losses in September, investors said. Assets in the fund have fallen from about $1.6bn in 2010 to $450m. Coffey became one of the best-known traders in the hedge fund industry, when he turned down a $250m retention offer from his employer GLG Partners in 2008 to join Moore Capital as co-chief investment officer. Then 38, he was estimated to have contributed about half of GLG’s total $679m performance fees in 2007, according to sources.

Creditors weigh up Argentina debt ruling (FT)

Money managers, lawyers and inter-governmental organisations are scrambling to understand the ramifications of an unexpected legal victory by the hedge fund Elliott Associates against the state of Argentina. There is even some concern that the International Monetary Fund may be affected by a ruling from the US Appeals Court in New York on October 26 that Argentina cannot discriminate against different groups of international creditors by making payments on restructured debt while refusing to pay holders of its defaulted bonds.

Fortress and Och-Ziff report strong returns, rising AUM (HedgeFundsReview)

A strong third quarter for two of the largest publicly listed US hedge fund managers – Fortress Investment Group and Och-Ziff – suggests the industry’s fortunes may be improving. Fortress Investment Group’s credit-focused Drawbridge Special Opportunities Fund gained 5.1% in the third quarter and is up 13.1% year-to-date (YTD), while its Fortress Macro Funds returned 3.6% in the quarter and 11.1% for the year. Fortress has raised more than $5 billion for its alternative investment funds this year, including $700 million for its liquid and credit hedge funds.

Fund launches for Hermes Fund Managers, Stratton Street, TT International, Barclays introduces quant-based M&A fund… (HedgeWeek)

TT International, one of Europe’s oldest hedge fund management companies, has teamed up with Deutsche Bank to launch the UCITS-compliant DB Platinum TT International Fund. The fund is managed by Tim Tacchi, who founded the firm way back in 1988. It follows a global macro mandate, combining investments in a portfolio of largely European equities with a macro overlay of fixed income securities and FX positions.

Utility group transaction under scrutiny (NCTimes)

Back in 2005, the Utility Consumers’ Action Network collected $2 million from a class-action lawsuit against Rent-A-Center, a furniture and accessories retailer based in Plano, Texas. Terms of the award to the San Diego-based consumer protection group required UCAN to keep the money in California. The funds were to be set aside for nonprofit efforts to educate people about their legal rights. The agreement was signed by former UCAN Executive Director Michael Shames seven years ago last month. Shames invested $1 million of the award in a money-market account and later in an out-of-state hedge fund called Red Rock Capital Fund LP.

The survey: helping to uncover quality investments (FT)

Periodic hedge fund surveys highlight the best-performing funds, the largest funds, and the top-earning managers. But they fail to look behind the numbers to discern the quality of returns: their accuracy, risk, management and adherence to investment strategy. Two funds each delivering 15 per cent in one year invariably have very different profiles that inform their respective risks and ability to deliver future gains. This review is designed to help investors discern those differences. Our selection process was premised on the belief that funds with assets between $100m and $500m generally outperform their larger peers. As reported by a number of surveys, this segment of the industry appears to offer superior performance by being more focused on net returns rather than asset preservation. Smaller funds can react more quickly to a wider range of mispriced opportunities without moving markets, requiring less absolute exposure than larger funds to profit significantly.

Hedge funds suffer from outflows but remain attractive for Japanese institutions (Opalesque)

Peter Bakker, former high yield portfolio manager at Lazard and SGS, and Frits Lieuw-kie-song, former high yield portfolio manager at LKS and SGS, re-united to establish a liquid credit strategy at Channel Capital Advisors LLP; former Cofunds boss Brett Williams launched a new alternative investments business, Old Burlington Investments and will initially create two EIS-focused funds; Maverick Capital launched a new fund that places concentrated bets on the firm’s best stock trades, called Maverick Select; TT International launched a global macro UCITS-compliant hedge fund on the Deutsche Bank Platinum platform; and Stratton Street started a UCITS version of its Renminbi Bond fund ahead of what it believes will be a massive appreciation in the value of the Chinese currency.

New York Chocolate investor indicted (ValleyNewsOnline)

The man who brought to light allegations of money laundering and wrong doing with the now-defunct New York Chocolate and Confections Company in Fulton is currently facing similar charges in California. In early October, the U.S. Securities and Exchange Commission brought fraud charges San Francisco-based hedge fund manager Hausmann-Alain Banet and his firm Lion Capital Management. He reportedly stole more than a half-million dollars from a retired schoolteacher who thought she was investing her retirement savings in Banet’s hedge fund.

How to avoid the average hedge fund (FT)

Kent Clark, who oversees $20bn as chief investment officer of hedge fund strategies at Goldman Sachs Asset Management, knows a thing or two about hedge funds. But when asked recently about the current state of the industry, he quipped: “if you can find any managers with good long-term returns and moderate volatility, let me know.” Having reviewed more than 800 funds for FTfm’s second annual survey of model hedge funds, we can attest that Mr Clark’s riposte is not far from the truth. The nature of the trailing five-year period in which this review is focused, from July 2007 to June 2012, explains much of the difficulties.

Hedge fund masters flunk money-making test (GulfNews)

Generating strong returns is getting so tough for hedge fund managers, supposedly the high-earning masters of any market, that some are shutting up shop and more look poised to follow. Years of choppy markets whipsawed by political risk have crippled performance and left many firms with little in the way of income earned by hefty fees. Now, with an investor base increasingly ready to pull out, several are calling it quits. Edoma Partners, one of the most talked about hedge fund launches since the financial crisis, said on Thursday it was closing just two years after it started, hit by poor performance and a flurry of investor redemptions.

How last year’s selected funds fared till mid-2012 (FT)

Last year’s model funds showed that when investors do their homework, hedge fund exposure can deliver superior returns both in relative and absolute terms. Calculated as an equally weighted portfolio, the five funds we selected last year generated a net return of 3.19 per cent in the year to June 2012. That was nearly 6 full percentage points better than the average return of the five strategies cited. And it was more than 7.5 percentage points better than the BarclayHedge average for all single-manager funds.

Billionaire Kravis-Led Fund Has $35 Million for New York (Bloomberg)

Henry Kravis, the billionaire co- founder of KKR & Co. L.P. (NYSE:KKR), the buyout firm that manages $66 billion in assets, knows a thing or two about disaster recovery. Following the terrorist attacks of Sept. 11, he helped secure interest-free loans for 89 damaged businesses so they could re- open. Now, days after Hurricane Sandy wreaked economic havoc in New York and the surrounding states, the 68-year-old is already thinking about how to support future infrastructure that can withstand similar disasters. Through the Partnership for New York City Fund, which he created in 1996, Kravis wants to help fund businesses that strengthen and diversify the city’s economy.

Restoration Hardware Jumps 30% After IPO (WSJ)

Restoration Hardware Holdings Inc.’s initial public offering got off to a strong start Friday, a firm reboot for the furniture retailer that was taken private amid the housing downturn. Shares of the company gained 30%, or $7.10, at $31.10 on the New York Stock Exchange. Restoration Hardware sold 5.16 million shares at $24 apiece. The deal was valued at $124 million and fetched a price at the top end of its expected range of between $22 and $24 a share.

Hurricane Sandy causes massive damage to hedge fund trader’s house, year after he suffered from MF Global’s collapse (NYPost)

Hedge fund trader Nick Gentile is starting to dread this time of year. “October is a bad month for me,” the Staten Islander told The Post yesterday while taking a break from cleaning up debris outside his two-story Oakwood Beach house. Hurricane Sandy pushed the nearby Raritan Bay into his home, flooding his basement with seven feet of water, ruining furniture and appliances and turning his life upside down. Again. “It was MF Global last year and Hurricane Sandy this year,” Gentile said, referring to the spectacular Halloween flame-out of the commodities broker last year that ruined his business. Sandy struck two days before the anniversary of the MF disaster, trashing his non-business world.

Hedge Funds Reduce Bullish Bets Most in Five Months (Bloomberg)

Hedge funds cut bullish wagers on commodities by the most since June as prices retreated to a three-month low on mounting concern that Europe’s debt crisis will worsen and U.S. growth slow. Money managers reduced combined net-long positions across 18 U.S. futures and options in the week ended Oct. 30 by 11 percent to 1.05 million contracts, the lowest since July 10, Commodity Futures Trading Commission data show. Copper holdings fell to an eight-week low, and gold wagers are now the smallest since September. Gasoline bets declined for a fourth week, and those in oil reached the lowest level in four months as Hurricane Sandy forced U.S. East Coast refineries to shut.