Last year’s fourth quarter was a rough one for investors and many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 41.1% in 2019 (through December 23) and outperformed the S&P 500 ETF by more than 10 percentage points. In this article we will study how hedge fund sentiment towards Vereit Inc (NYSE:VER) changed during the third quarter and how the stock performed in comparison to hedge fund consensus stocks.

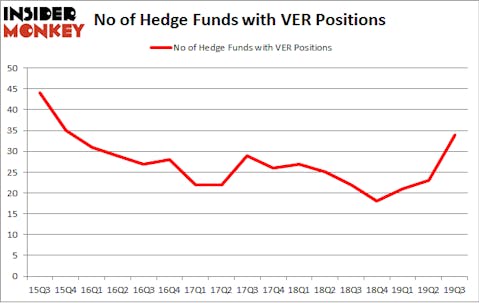

Vereit Inc (NYSE:VER) was in 34 hedge funds’ portfolios at the end of September. VER has experienced an increase in enthusiasm from smart money recently. There were 23 hedge funds in our database with VER holdings at the end of the previous quarter. Our calculations also showed that VER isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

According to most investors, hedge funds are seen as underperforming, outdated investment tools of yesteryear. While there are greater than 8000 funds trading today, Our experts hone in on the elite of this group, about 750 funds. It is estimated that this group of investors direct bulk of the hedge fund industry’s total asset base, and by tracking their best picks, Insider Monkey has figured out numerous investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Ricky Sandler of Eminence Capital

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind we’re going to view the latest hedge fund action encompassing Vereit Inc (NYSE:VER).

What have hedge funds been doing with Vereit Inc (NYSE:VER)?

Heading into the fourth quarter of 2019, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 48% from the previous quarter. On the other hand, there were a total of 22 hedge funds with a bullish position in VER a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

The largest stake in Vereit Inc (NYSE:VER) was held by Eminence Capital, which reported holding $141.1 million worth of stock at the end of September. It was followed by Redwood Capital Management with a $91 million position. Other investors bullish on the company included Glendon Capital Management, Renaissance Technologies, and Long Pond Capital. In terms of the portfolio weights assigned to each position Courage Capital allocated the biggest weight to Vereit Inc (NYSE:VER), around 30.95% of its 13F portfolio. Glendon Capital Management is also relatively very bullish on the stock, designating 18.05 percent of its 13F equity portfolio to VER.

As aggregate interest increased, specific money managers were breaking ground themselves. Long Pond Capital, managed by John Khoury, initiated the largest position in Vereit Inc (NYSE:VER). Long Pond Capital had $51.3 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also made a $35.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Stuart J. Zimmer’s Zimmer Partners, Jeffrey Hinkle’s Shoals Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Vereit Inc (NYSE:VER) but similarly valued. We will take a look at Advanced Semiconductor Engineering (NYSE:ASX), Galapagos NV (NASDAQ:GLPG), PerkinElmer, Inc. (NYSE:PKI), and Kirkland Lake Gold Ltd. (NYSE:KL). This group of stocks’ market valuations match VER’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ASX | 8 | 192875 | 0 |

| GLPG | 13 | 142930 | -1 |

| PKI | 24 | 975011 | 0 |

| KL | 16 | 376065 | -5 |

| Average | 15.25 | 421720 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $422 million. That figure was $613 million in VER’s case. PerkinElmer, Inc. (NYSE:PKI) is the most popular stock in this table. On the other hand Advanced Semiconductor Engineering (NYSE:ASX) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Vereit Inc (NYSE:VER) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on VER, though not to the same extent, as the stock returned 33.1% during the same period and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.