We are still in an overall bull market and many stocks that smart money investors were piling into surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained more than 57% each. Hedge funds’ top 3 stock picks returned 45.7% this year and beat the S&P 500 ETFs by more than 14 percentage points. That’s a big deal. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

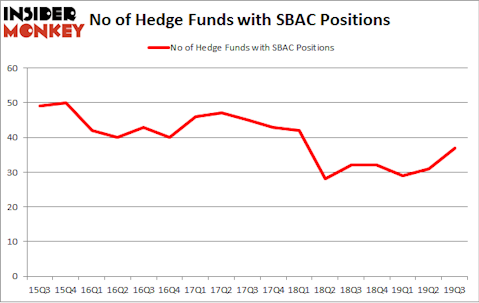

SBA Communications Corporation (NASDAQ:SBAC) investors should pay attention to an increase in hedge fund sentiment of late. Our calculations also showed that SBAC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind we’re going to take a gander at the new hedge fund action encompassing SBA Communications Corporation (NASDAQ:SBAC).

What have hedge funds been doing with SBA Communications Corporation (NASDAQ:SBAC)?

Heading into the fourth quarter of 2019, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of 19% from the second quarter of 2019. By comparison, 32 hedge funds held shares or bullish call options in SBAC a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Akre Capital Management held the most valuable stake in SBA Communications Corporation (NASDAQ:SBAC), which was worth $594.4 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $323.4 million worth of shares. Arrowstreet Capital, Two Sigma Advisors, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Akre Capital Management allocated the biggest weight to SBA Communications Corporation (NASDAQ:SBAC), around 5.86% of its 13F portfolio. Peconic Partners is also relatively very bullish on the stock, designating 4.74 percent of its 13F equity portfolio to SBAC.

As aggregate interest increased, some big names have been driving this bullishness. Akre Capital Management, managed by Charles Akre, established the largest position in SBA Communications Corporation (NASDAQ:SBAC). Akre Capital Management had $594.4 million invested in the company at the end of the quarter. Stuart J. Zimmer’s Zimmer Partners also initiated a $21.7 million position during the quarter. The other funds with new positions in the stock are David Harding’s Winton Capital Management, Matthew Tewksbury’s Stevens Capital Management, and Joe DiMenna’s ZWEIG DIMENNA PARTNERS.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as SBA Communications Corporation (NASDAQ:SBAC) but similarly valued. We will take a look at Ventas, Inc. (NYSE:VTR), Digital Realty Trust, Inc. (NYSE:DLR), Edison International (NYSE:EIX), and Dollar Tree, Inc. (NASDAQ:DLTR). All of these stocks’ market caps are similar to SBAC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VTR | 14 | 352435 | -4 |

| DLR | 17 | 135024 | -1 |

| EIX | 27 | 1708824 | -6 |

| DLTR | 49 | 1912359 | 0 |

| Average | 26.75 | 1027161 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $1027 million. That figure was $1538 million in SBAC’s case. Dollar Tree, Inc. (NASDAQ:DLTR) is the most popular stock in this table. On the other hand Ventas, Inc. (NYSE:VTR) is the least popular one with only 14 bullish hedge fund positions. SBA Communications Corporation (NASDAQ:SBAC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on SBAC as the stock returned 49.3% in 2019 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.