Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before 2018’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to PPG Industries, Inc. (NYSE:PPG) changed recently.

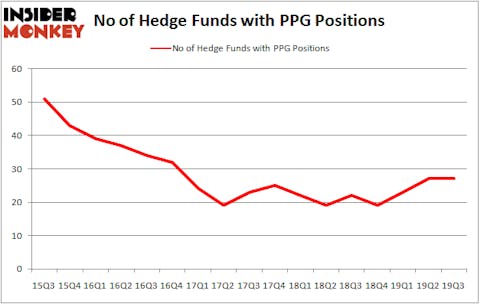

PPG Industries, Inc. (NYSE:PPG) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 27 hedge funds’ portfolios at the end of the third quarter of 2019. At the end of this article we will also compare PPG to other stocks including Sirius XM Holdings Inc (NASDAQ:SIRI), TransDigm Group Incorporated (NYSE:TDG), and Republic Services, Inc. (NYSE:RSG) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind let’s view the latest hedge fund action encompassing PPG Industries, Inc. (NYSE:PPG).

What does smart money think about PPG Industries, Inc. (NYSE:PPG)?

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2019. On the other hand, there were a total of 22 hedge funds with a bullish position in PPG a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of PPG Industries, Inc. (NYSE:PPG), with a stake worth $211.8 million reported as of the end of September. Trailing Citadel Investment Group was Renaissance Technologies, which amassed a stake valued at $55.5 million. Adage Capital Management, AQR Capital Management, and Winton Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Alight Capital allocated the biggest weight to PPG Industries, Inc. (NYSE:PPG), around 2.41% of its 13F portfolio. Unio Capital is also relatively very bullish on the stock, designating 0.56 percent of its 13F equity portfolio to PPG.

Because PPG Industries, Inc. (NYSE:PPG) has experienced declining sentiment from the smart money, it’s easy to see that there lies a certain “tier” of hedge funds that elected to cut their entire stakes heading into Q4. Intriguingly, Nelson Peltz’s Trian Partners said goodbye to the biggest investment of the “upper crust” of funds monitored by Insider Monkey, totaling an estimated $493.1 million in stock. Steve Cohen’s fund, Point72 Asset Management, also cut its stock, about $6.1 million worth. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to PPG Industries, Inc. (NYSE:PPG). We will take a look at Sirius XM Holdings Inc (NASDAQ:SIRI), TransDigm Group Incorporated (NYSE:TDG), Republic Services, Inc. (NYSE:RSG), and Chunghwa Telecom Co., Ltd (NYSE:CHT). This group of stocks’ market valuations match PPG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIRI | 33 | 1274312 | 4 |

| TDG | 56 | 5183262 | 8 |

| RSG | 31 | 625488 | 7 |

| CHT | 5 | 117483 | 2 |

| Average | 31.25 | 1800136 | 5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $1800 million. That figure was $422 million in PPG’s case. TransDigm Group Incorporated (NYSE:TDG) is the most popular stock in this table. On the other hand Chunghwa Telecom Co., Ltd (NYSE:CHT) is the least popular one with only 5 bullish hedge fund positions. PPG Industries, Inc. (NYSE:PPG) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. A small number of hedge funds were also right about betting on PPG, though not to the same extent, as the stock returned 32.8% in 2019 and surpassed the market.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.