Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about iHeartMedia, Inc. (NASDAQ:IHRT) and compare its performance to hedge funds’ consensus picks in 2019.

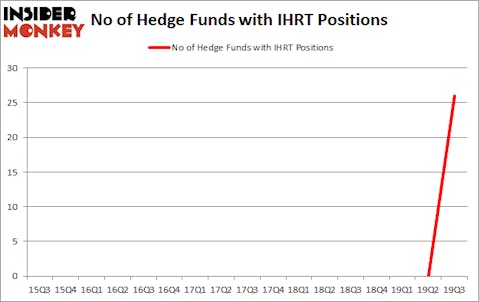

iHeartMedia, Inc. (NASDAQ:IHRT) shareholders have witnessed an increase in hedge fund sentiment lately. IHRT was in 26 hedge funds’ portfolios at the end of the third quarter of 2019. There were 0 hedge funds in our database with IHRT holdings at the end of the previous quarter. Our calculations also showed that IHRT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Howard Marks of Oaktree Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind we’re going to take a look at the fresh hedge fund action encompassing iHeartMedia, Inc. (NASDAQ:IHRT).

Hedge fund activity in iHeartMedia, Inc. (NASDAQ:IHRT)

Heading into the fourth quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 26 from the second quarter of 2019. On the other hand, there were a total of 0 hedge funds with a bullish position in IHRT a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Brigade Capital, managed by Don Morgan, holds the number one position in iHeartMedia, Inc. (NASDAQ:IHRT). Brigade Capital has a $41.8 million position in the stock, comprising 2.2% of its 13F portfolio. Sitting at the No. 2 spot is Jon Bauer of Contrarian Capital, with a $34.1 million position; 3.1% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism encompass Sculptor Capital, Howard Marks’s Oaktree Capital Management and David E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Highfields Capital Management allocated the biggest weight to iHeartMedia, Inc. (NASDAQ:IHRT), around 5.14% of its 13F portfolio. Contrarian Capital is also relatively very bullish on the stock, earmarking 3.11 percent of its 13F equity portfolio to IHRT.

As one would reasonably expect, key money managers were leading the bulls’ herd. Brigade Capital, managed by Don Morgan, created the largest position in iHeartMedia, Inc. (NASDAQ:IHRT). Brigade Capital had $41.8 million invested in the company at the end of the quarter. Jon Bauer’s Contrarian Capital also initiated a $34.1 million position during the quarter. The following funds were also among the new IHRT investors: Howard Marks’s Oaktree Capital Management, and David E. Shaw’s D E Shaw.

Let’s now take a look at hedge fund activity in other stocks similar to iHeartMedia, Inc. (NASDAQ:IHRT). We will take a look at 3D Systems Corporation (NYSE:DDD), Astronics Corporation (NASDAQ:ATRO), Range Resources Corp. (NYSE:RRC), and Noble Midstream Partners LP (NYSE:NBLX). This group of stocks’ market caps match IHRT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DDD | 12 | 39120 | 1 |

| ATRO | 13 | 103363 | -5 |

| RRC | 26 | 263175 | -5 |

| NBLX | 4 | 2598 | 0 |

| Average | 13.75 | 102064 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $102 million. That figure was $179 million in IHRT’s case. Range Resources Corp. (NYSE:RRC) is the most popular stock in this table. On the other hand Noble Midstream Partners LP (NYSE:NBLX) is the least popular one with only 4 bullish hedge fund positions. iHeartMedia, Inc. (NASDAQ:IHRT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately IHRT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on IHRT were disappointed as the stock returned 9.7% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.