Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Global Blood Therapeutics Inc (NASDAQ:GBT) and compare its performance to hedge funds’ consensus picks in 2019.

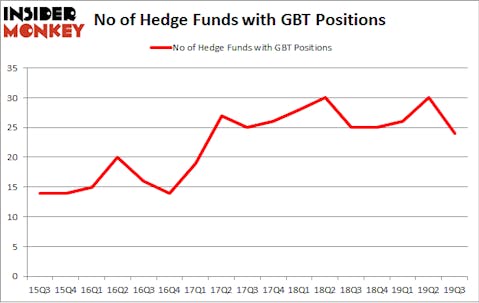

Is Global Blood Therapeutics Inc (NASDAQ:GBT) the right investment to pursue these days? The smart money is getting less optimistic. The number of bullish hedge fund bets were trimmed by 6 recently. Our calculations also showed that GBT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings). GBT was in 24 hedge funds’ portfolios at the end of September. There were 30 hedge funds in our database with GBT positions at the end of the previous quarter.

At the moment there are a large number of indicators stock traders put to use to value publicly traded companies. A couple of the best indicators are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top investment managers can outperform the broader indices by a superb margin (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind let’s take a peek at the recent hedge fund action surrounding Global Blood Therapeutics Inc (NASDAQ:GBT).

How are hedge funds trading Global Blood Therapeutics Inc (NASDAQ:GBT)?

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of -20% from the second quarter of 2019. On the other hand, there were a total of 25 hedge funds with a bullish position in GBT a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

More specifically, Perceptive Advisors was the largest shareholder of Global Blood Therapeutics Inc (NASDAQ:GBT), with a stake worth $285.1 million reported as of the end of September. Trailing Perceptive Advisors was Farallon Capital, which amassed a stake valued at $78.2 million. venBio Select Advisor, Point72 Asset Management, and Casdin Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Perceptive Advisors allocated the biggest weight to Global Blood Therapeutics Inc (NASDAQ:GBT), around 7.68% of its 13F portfolio. venBio Select Advisor is also relatively very bullish on the stock, dishing out 2.02 percent of its 13F equity portfolio to GBT.

Since Global Blood Therapeutics Inc (NASDAQ:GBT) has faced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of fund managers that slashed their full holdings in the third quarter. It’s worth mentioning that Jonathan Barrett and Paul Segal’s Luminus Management cut the largest investment of all the hedgies monitored by Insider Monkey, totaling an estimated $20.4 million in stock, and Ken Greenberg and David Kim’s Ghost Tree Capital was right behind this move, as the fund said goodbye to about $15.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 6 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Global Blood Therapeutics Inc (NASDAQ:GBT) but similarly valued. These stocks are International Game Technology PLC (NYSE:IGT), TC Pipelines, LP (NYSE:TCP), Advanced Disposal Services, Inc. (NYSE:ADSW), and Magnolia Oil & Gas Corporation (NYSE:MGY). This group of stocks’ market values match GBT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IGT | 27 | 234121 | -3 |

| TCP | 5 | 17286 | 0 |

| ADSW | 24 | 668160 | -2 |

| MGY | 17 | 132628 | -2 |

| Average | 18.25 | 263049 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $263 million. That figure was $543 million in GBT’s case. International Game Technology PLC (NYSE:IGT) is the most popular stock in this table. On the other hand TC Pipelines, LP (NYSE:TCP) is the least popular one with only 5 bullish hedge fund positions. Global Blood Therapeutics Inc (NASDAQ:GBT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on GBT as the stock returned 93.6% in 2019 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.