Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before 2018’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Taylor Morrison Home Corp (NYSE:TMHC) changed recently.

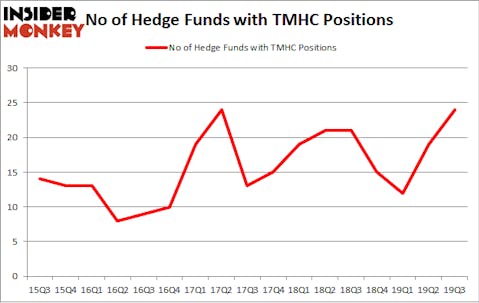

Is Taylor Morrison Home Corp (NYSE:TMHC) a buy here? Prominent investors are taking an optimistic view. The number of bullish hedge fund positions advanced by 5 lately. Our calculations also showed that TMHC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings). TMHC was in 24 hedge funds’ portfolios at the end of September. There were 19 hedge funds in our database with TMHC holdings at the end of the previous quarter.

To most investors, hedge funds are perceived as underperforming, outdated investment vehicles of yesteryear. While there are over 8000 funds trading at present, We look at the masters of this group, around 750 funds. These money managers have their hands on bulk of the hedge fund industry’s total asset base, and by keeping track of their finest investments, Insider Monkey has identified many investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Paul Tudor Jones of Tudor Investment Corp

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind we’re going to take a gander at the recent hedge fund action surrounding Taylor Morrison Home Corp (NYSE:TMHC).

What have hedge funds been doing with Taylor Morrison Home Corp (NYSE:TMHC)?

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 26% from one quarter earlier. By comparison, 21 hedge funds held shares or bullish call options in TMHC a year ago. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

More specifically, Echo Street Capital Management was the largest shareholder of Taylor Morrison Home Corp (NYSE:TMHC), with a stake worth $51.9 million reported as of the end of September. Trailing Echo Street Capital Management was Capital Growth Management, which amassed a stake valued at $51.5 million. Polar Capital, Marshall Wace, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Capital Growth Management allocated the biggest weight to Taylor Morrison Home Corp (NYSE:TMHC), around 3.94% of its 13F portfolio. SG Capital Management is also relatively very bullish on the stock, setting aside 2.53 percent of its 13F equity portfolio to TMHC.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Capital Growth Management, managed by Ken Heebner, assembled the largest position in Taylor Morrison Home Corp (NYSE:TMHC). Capital Growth Management had $51.5 million invested in the company at the end of the quarter. Cliff Asness’s AQR Capital Management also made a $13.7 million investment in the stock during the quarter. The other funds with brand new TMHC positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Renee Yao’s Neo Ivy Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Taylor Morrison Home Corp (NYSE:TMHC) but similarly valued. We will take a look at Transocean Ltd (NYSE:RIG), SINA Corp (NASDAQ:SINA), CONMED Corporation (NASDAQ:CNMD), and Herman Miller, Inc. (NASDAQ:MLHR). All of these stocks’ market caps resemble TMHC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RIG | 36 | 256394 | 5 |

| SINA | 19 | 256685 | 0 |

| CNMD | 22 | 201980 | 3 |

| MLHR | 26 | 209936 | 1 |

| Average | 25.75 | 231249 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $231 million. That figure was $375 million in TMHC’s case. Transocean Ltd (NYSE:RIG) is the most popular stock in this table. On the other hand SINA Corp (NASDAQ:SINA) is the least popular one with only 19 bullish hedge fund positions. Taylor Morrison Home Corp (NYSE:TMHC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. A small number of hedge funds were also right about betting on TMHC, though not to the same extent, as the stock returned 37.5% in 2019 and surpassed the market.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.