Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 57%. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 41.1% in 2019 (through December 23rd) and outperformed the broader market benchmark by 10.1 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

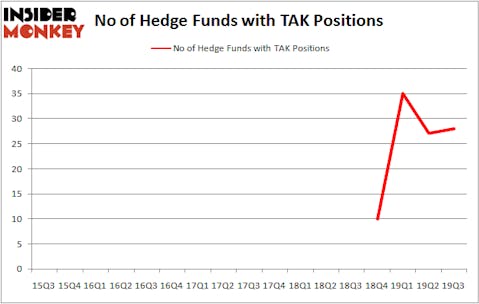

Takeda Pharmaceutical Company Limited (NYSE:TAK) investors should be aware of an increase in support from the world’s most elite money managers of late. Our calculations also showed that TAK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

To the average investor there are numerous signals shareholders use to grade stocks. A pair of the most useful signals are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the top investment managers can outpace the broader indices by a significant amount (see the details here).

Seth Klarman of Baupost Group

We leave no stone unturned when looking for the next great investment idea. For example one of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind we’re going to check out the recent hedge fund action surrounding Takeda Pharmaceutical Company Limited (NYSE:TAK).

What does smart money think about Takeda Pharmaceutical Company Limited (NYSE:TAK)?

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TAK over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Glenview Capital held the most valuable stake in Takeda Pharmaceutical Company Limited (NYSE:TAK), which was worth $472 million at the end of the third quarter. On the second spot was Paulson & Co which amassed $227.8 million worth of shares. Baupost Group, GMT Capital, and HBK Investments were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Glenview Capital allocated the biggest weight to Takeda Pharmaceutical Company Limited (NYSE:TAK), around 4.97% of its 13F portfolio. Paulson & Co is also relatively very bullish on the stock, designating 4.56 percent of its 13F equity portfolio to TAK.

As industrywide interest jumped, key money managers have jumped into Takeda Pharmaceutical Company Limited (NYSE:TAK) headfirst. Tudor Investment Corp, managed by Paul Tudor Jones, established the biggest position in Takeda Pharmaceutical Company Limited (NYSE:TAK). Tudor Investment Corp had $7.5 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $4.6 million investment in the stock during the quarter. The only other fund with a brand new TAK position is Matthew Tewksbury’s Stevens Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Takeda Pharmaceutical Company Limited (NYSE:TAK). We will take a look at Prologis Inc (NYSE:PLD), Vodafone Group Plc (NASDAQ:VOD), DuPont de Nemours, Inc. (NYSE:DD), and Deere & Company (NYSE:DE). This group of stocks’ market caps match TAK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLD | 27 | 360500 | 3 |

| VOD | 19 | 685397 | 8 |

| DD | 47 | 1502453 | 5 |

| DE | 40 | 1818266 | 0 |

| Average | 33.25 | 1091654 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.25 hedge funds with bullish positions and the average amount invested in these stocks was $1092 million. That figure was $1244 million in TAK’s case. DuPont de Nemours, Inc. (NYSE:DD) is the most popular stock in this table. On the other hand Vodafone Group Plc (NASDAQ:VOD) is the least popular one with only 19 bullish hedge fund positions. Takeda Pharmaceutical Company Limited (NYSE:TAK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately TAK wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); TAK investors were disappointed as the stock returned 24.3% in 2019 (as of 12/23) and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks already outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.