Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space. Nevertheless, it is also possible to identify cheap large cap stocks by following the footsteps of best performing hedge funds. What do these smart investors think about East West Bancorp, Inc. (NASDAQ:EWBC)?

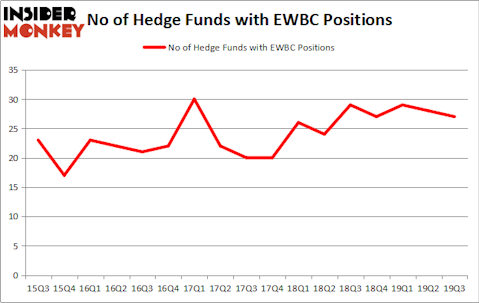

East West Bancorp, Inc. (NASDAQ:EWBC) shareholders have witnessed a decrease in hedge fund sentiment in recent months. EWBC was in 27 hedge funds’ portfolios at the end of the third quarter of 2019. There were 28 hedge funds in our database with EWBC holdings at the end of the previous quarter. Our calculations also showed that EWBC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind let’s go over the fresh hedge fund action surrounding East West Bancorp, Inc. (NASDAQ:EWBC).

Hedge fund activity in East West Bancorp, Inc. (NASDAQ:EWBC)

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from one quarter earlier. On the other hand, there were a total of 29 hedge funds with a bullish position in EWBC a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the largest position in East West Bancorp, Inc. (NASDAQ:EWBC). Fisher Asset Management has a $84.7 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Citadel Investment Group, led by Ken Griffin, holding a $54.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other peers that hold long positions contain John Overdeck and David Siegel’s Two Sigma Advisors, David E. Shaw’s D E Shaw and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position Basswood Capital allocated the biggest weight to East West Bancorp, Inc. (NASDAQ:EWBC), around 1.42% of its 13F portfolio. Algert Coldiron Investors is also relatively very bullish on the stock, designating 0.9 percent of its 13F equity portfolio to EWBC.

Judging by the fact that East West Bancorp, Inc. (NASDAQ:EWBC) has witnessed a decline in interest from the smart money, we can see that there was a specific group of money managers that slashed their full holdings last quarter. At the top of the heap, George Soros’s Soros Fund Management dropped the biggest stake of the 750 funds monitored by Insider Monkey, totaling about $6.7 million in stock, and Michael Kharitonov and Jon David McAuliffe’s Voleon Capital was right behind this move, as the fund said goodbye to about $2.6 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 1 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as East West Bancorp, Inc. (NASDAQ:EWBC) but similarly valued. We will take a look at Watsco Inc (NYSE:WSO), HubSpot Inc (NYSE:HUBS), Momo Inc (NASDAQ:MOMO), and Israel Chemicals Ltd. (NYSE:ICL). This group of stocks’ market valuations are closest to EWBC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WSO | 18 | 138904 | -4 |

| HUBS | 34 | 820740 | 1 |

| MOMO | 27 | 827296 | 5 |

| ICL | 5 | 21431 | -1 |

| Average | 21 | 452093 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $452 million. That figure was $427 million in EWBC’s case. HubSpot Inc (NYSE:HUBS) is the most popular stock in this table. On the other hand Israel Chemicals Ltd. (NYSE:ICL) is the least popular one with only 5 bullish hedge fund positions. East West Bancorp, Inc. (NASDAQ:EWBC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately EWBC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on EWBC were disappointed as the stock returned 14.3% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.