Dalio Will Lose on European Bank ‘Big Short,’ Algebris CEO Says (Bloomberg)

Billionaire Ray Dalio’s “big short” bet against Italian banks will cost him dear, according to Algebris Investments Chief Executive Officer Davide Serra. Serra, whose London-based firm oversaw 10 billion euros ($12 billion) as of September, said there’s “tremendous value” in the continent’s lenders, which will receive a “big margin expansion” once the European Central Bank starts normalizing policy and raising interest rates. “Profitability of Italian banks will go up strongly,” he said in a Bloomberg Television interview on Monday.

Buffett Wins 10-Year, $1M Bet with Hedge Fund Managers (USAToday.com)

OMAHA, Neb. — Ten years ago, Omaha billionaire Warren Buffett was so sure that his chosen S&P 500 stock index fund would outperform a collection of hedge funds that he made a $1 million bet over it. The Oracle of Omaha won. On Friday, a couple of money managers with Protégé Partners LLC were in Omaha to pay up. More than $2 million is now going to Girls Inc. of Omaha. The Omaha World-Herald reports that Girls Inc. will invest the money and use the income to support a new residential program for young women leaving foster care. The facility is due to open next year in a former convent. Its name: Protégé House. Had Protégé won, it would have donated the money to Absolute Returns for Kids, a British nonprofit. Buffett’s fund gained 94% over 10 years. Protégé’s selected funds gained 24%.

Luis Louro / shutterstock.com

Hedge Fund Tycoon Dmitry Balyasny Pours Money into Advanced Micro Devices, Inc. (AMD) and Micron Technology, Inc. (MU) (SmarterAnalyst.com)

Dmitry Balyasny is the managing partner at the billion-dollar hedge fund Balyasny Asset Management. This large and diversified firm manages around $12.6 billion in hedge-fund assets and is closely tracked by investors around the world. In Q4 we can now see that Balyasny revealed a bullish sentiment towards two big semiconductor stocks: Advanced Micro Devices, Inc. (NASDAQ:AMD) and Micron Technology, Inc. (NASDAQ:MU). Presumably, Balyasny is hoping that these latest trades will help the fund down lock down alpha in an elusive market.

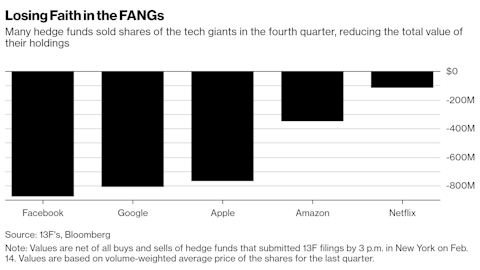

Hedge Fund Billionaires Bullish on FANG and Retail Stocks: 13F (Investopedia.com)

Top billionaire money managers like Warren Buffett, Chase Coleman and David Tepper were bullish on FANG stocks in the fourth quarter of 2017, with Facebook Inc. (FB) and Apple Inc. (AAPL) especially popular, according to Benzinga. The revelations were made in 13F filings that investment firms with at least $100 million in assets under management must file with the Securities and Exchange Commission. February 15 was the deadline for 13F filings for the last quarter of 2017. One of the benefits to the quarterly 13F season is comparing the activities of different top investors over the past few months. While billionaire Warren Buffett’s Berkshire Hathaway provides buy and sell information across quarters, it’s also useful to see how different top money managers moved their assets over the same time period.