Tiger Global, Coatue, and Other Hedge Funds Tried to Upend Venture Capital. It Backfired and Now They’re ‘Licking Their Wounds,’ VCs say. (Business Insider)

As 2022 rolls to a close, the statistics are clear: So-called crossover investment firms like Tiger Global and Coatue Management — which whipped the venture-capital industry into a dealmaking frenzy in 2021 — slammed on the brakes this year. Their 2022 retreat demonstrates that crossover firms, which are venture funds run by hedge-fund firms, don’t fully understand the venture-capital industry, some traditional VCs insist.

Scaramucci Talks FTX, Sam Bankman-Fried and ‘the Worst Week in Cryptocurrency History’ (CNBC)

Anthony Scaramucci, founder of SkyBridge Capital and a short-time Trump administration communications director, spoke Friday morning on CNBC’s “Squawk Box” about friend and business partner Sam Bankman-Fried, CEO of crumbling crypto exchange FTX. FTX, which took a 30% stake in Scarmucci’s SkyBridge Capital in September, is facing potential bankruptcy after a “bank run” on the crypto exchange left it about $8 billion short. Bankman-Fried says he was unaware of the extent of user leverage because of poor internal labeling of bank-related accounts.

Fund Manager Gagliardi Faces Block-Trading Probe, Ex-Employer Says (Bloomberg)

A lawsuit filed by the hedge fund Evolution Capital Management says that federal authorities are probing the activities of Robert Gagliardi, a former fund manager at the firm, as part of a criminal investigation into block trading. Evolution, which said in its filing that US Marshals seized Gagliardi’s mobile phone last year in connection with the probe, added that it received a subpoena from the Securities and Exchange Commission earlier this year that was “clearly focused in large part upon Gagliardi,” the complaint said. The fund, which also goes by ECM, is suing Gagliardi in New York state court over a pay dispute.

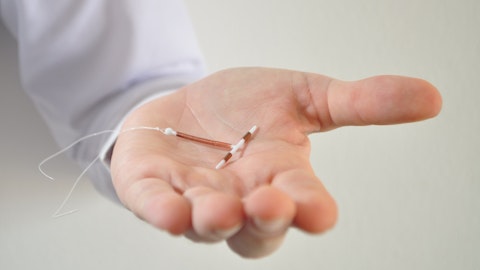

Phongphan/Shutterstock.com

Reinsurance Hedge Fund Tangency Capital Raises $200 mln (Reuters)

Reinsurance hedge fund Tangency Capital has raised $200 million from investors, bringing its total assets under management to “north of $600 million,” one of its co-founders told Reuters, as the market anticipates sharp rises in premium rates. Tangency Capital launched in 2018 and invests in the property reinsurance market. Reinsurers, who reinsure insurers, have suffered losses in recent years as a result of large natural catastrophes such as Hurricane Ian, which hit in September and may lead to claims of up to $60 billion.

Bridgewater’s China Bets Suffer Again After Stock Sell-Off But Founder Dalio Sees Bright Long-Term Outlook (SCMP.com)

Bridgewater Associates took another knock on its bets on Chinese stocks last quarter amid the biggest sell-off since 2015, stoked by Beijing’s enduring zero-Covid policy and monetary tightening policy in developed markets. A sharp market rebound this week suggests it might get better from here. The world’s biggest hedge fund recorded an 11 per cent decline to US$1.21 billion in the value of its equity stakes in 44 US-listed Chinese companies, according to its latest 13F regulatory filing for the September quarter on Thursday. Its portfolio suffered a 37 per cent drop in value in the preceding three months.