In this article we will take a look at whether hedge funds think Healthpeak Properties, Inc. (NYSE:PEAK) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

Hedge fund interest in Healthpeak Properties, Inc. (NYSE:PEAK) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare PEAK to other stocks including Restaurant Brands International Inc (NYSE:QSR), Lennar Corporation (NYSE:LEN), and Duke Realty Corporation (NYSE:DRE) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

With all of this in mind let’s view the key hedge fund action surrounding Healthpeak Properties, Inc. (NYSE:PEAK).

How have hedgies been trading Healthpeak Properties, Inc. (NYSE:PEAK)?

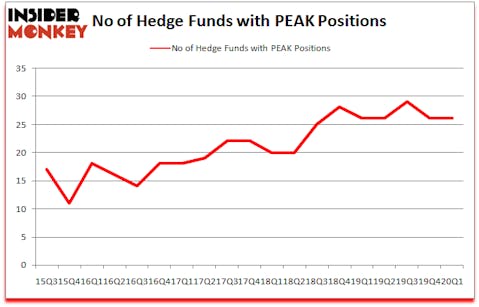

At Q1’s end, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PEAK over the last 18 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Griffin’s Citadel Investment Group has the largest position in Healthpeak Properties, Inc. (NYSE:PEAK), worth close to $96.5 million, accounting for less than 0.1%% of its total 13F portfolio. Coming in second is Zimmer Partners, led by Stuart J. Zimmer, holding a $93 million position; 2.1% of its 13F portfolio is allocated to the stock. Remaining peers with similar optimism contain D. E. Shaw’s D E Shaw, Greg Poole’s Echo Street Capital Management and Eduardo Abush’s Waterfront Capital Partners. In terms of the portfolio weights assigned to each position Zimmer Partners allocated the biggest weight to Healthpeak Properties, Inc. (NYSE:PEAK), around 2.06% of its 13F portfolio. Waterfront Capital Partners is also relatively very bullish on the stock, dishing out 1.67 percent of its 13F equity portfolio to PEAK.

Since Healthpeak Properties, Inc. (NYSE:PEAK) has witnessed a decline in interest from the smart money, logic holds that there lies a certain “tier” of hedge funds that elected to cut their full holdings by the end of the first quarter. Interestingly, John Khoury’s Long Pond Capital said goodbye to the largest position of the 750 funds monitored by Insider Monkey, worth an estimated $57.6 million in stock, and Jonathan Litt’s Land & Buildings Investment Management was right behind this move, as the fund cut about $27.8 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Healthpeak Properties, Inc. (NYSE:PEAK). We will take a look at Restaurant Brands International Inc (NYSE:QSR), Lennar Corporation (NYSE:LEN), Duke Realty Corporation (NYSE:DRE), and Jack Henry & Associates, Inc. (NASDAQ:JKHY). This group of stocks’ market caps are similar to PEAK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QSR | 41 | 2250209 | -11 |

| LEN | 57 | 1121019 | -6 |

| DRE | 16 | 64897 | -8 |

| JKHY | 27 | 277076 | -2 |

| Average | 35.25 | 928300 | -6.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.25 hedge funds with bullish positions and the average amount invested in these stocks was $928 million. That figure was $292 million in PEAK’s case. Lennar Corporation (NYSE:LEN) is the most popular stock in this table. On the other hand Duke Realty Corporation (NYSE:DRE) is the least popular one with only 16 bullish hedge fund positions. Healthpeak Properties, Inc. (NYSE:PEAK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May and surpassed the market by 13.2 percentage points. Unfortunately PEAK wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); PEAK investors were disappointed as the stock returned 4.9% during the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Healthpeak Properties Inc. (NYSE:DOC)

Follow Healthpeak Properties Inc. (NYSE:DOC)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.