Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

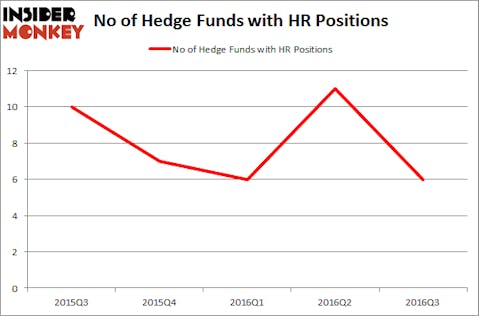

Is Healthcare Realty Trust Inc (NYSE:HR) a good investment right now? The best stock pickers are genuinely selling. The number of bullish hedge fund bets that are revealed through the 13F filings contracted by 5 in recent months. There were 6 hedge funds in our database with HR positions at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as IDACORP Inc (NYSE:IDA), Western Alliance Bancorporation (NYSE:WAL), and RSP Permian Inc (NYSE:RSPP) to gather more data points.

Follow Hrti Llc (NYSE:HR)

Follow Hrti Llc (NYSE:HR)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

With all of this in mind, let’s take a look at the recent action encompassing Healthcare Realty Trust Inc (NYSE:HR).

Hedge fund activity in Healthcare Realty Trust Inc (NYSE:HR)

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a plunge of 45% from one quarter earlier. On the other hand, there were a total of 7 hedge funds with a bullish position in HR at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Millennium Management, one of the 10 largest hedge funds in the world, has the largest position in Healthcare Realty Trust Inc (NYSE:HR), worth close to $80.6 million, accounting for 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Andrew Sandler of Sandler Capital Management, with a $9.2 million position; the fund has 1.1% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions consist of Cliff Asness’s AQR Capital Management, Brian Ashford-Russell and Tim Woolley’s Polar Capital and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.