The Broad Market Index was down 2.26% last week and only 25% of stocks out-performed the index.

The big surprise in the first quarter financial statements (now 85% complete) was an increase in the proportion of market capital accounted for by rising sales growth companies and an increase in the average sales growth rate from 7.1% to 7.4%.

Improvements In Healthcare Industry And Amazon

All sectors except energy recorded a small increase in capital value accounted for by improving sales growth while the improvement was not evident at the average company. That reflects that large companies (particularly Amazon.com, Inc. (NASDAQ:AMZN) where sales growth increased to 22.8% from 20% at year-end) are performing better than small companies. Overall, sales growth has improved at 38% of companies which is down from 42% last quarter.

antoniodiaz/Shutterstock.com

Q1 2020 hedge fund letters, conferences and more

The numbers also, so far, do not reflect retailers who will report their fiscal quarters ended April at the end of this month. Those sales growth numbers will reflect two months of virus impact whereas companies reporting their fiscal quarter results ended March are displaying only one month of virus impact.

Still, we wanted to get a predictive measure of the market decline. The reports received as of yet indicate a strong pattern of small companies performing worse than large ones and not surprisingly most of the improvement is in healthcare and Amazon.

Asset Allocation in a Falling Market

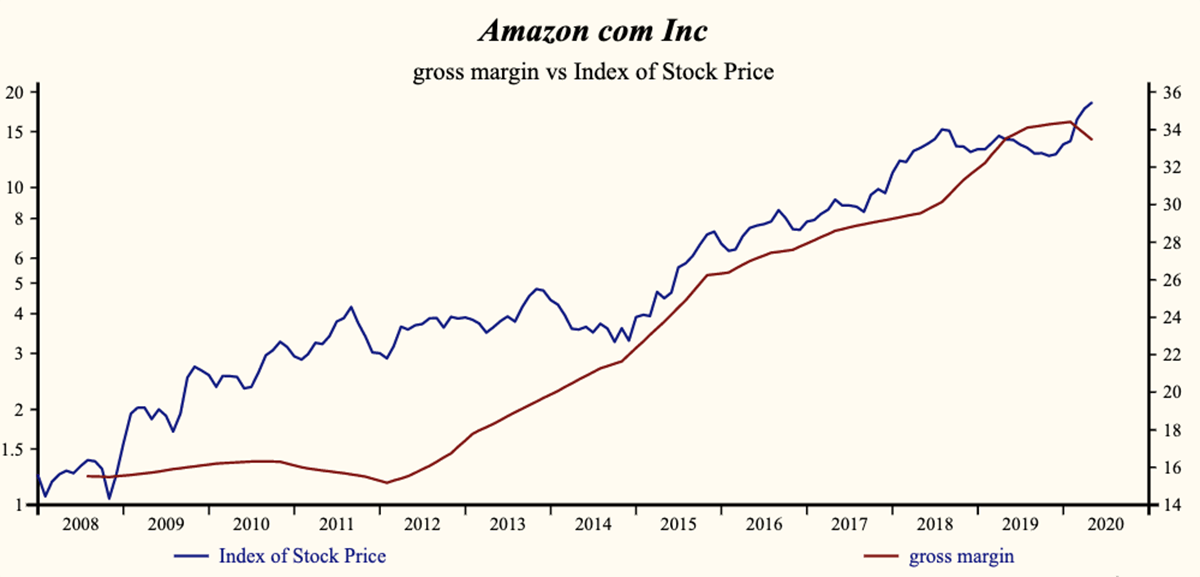

The more important factor for asset allocation is the gross profit margin which fell on average and more frequently for the third consecutive quarter. Amazon’s gross margin has been 96% correlated with the direction of the share price (five-quarter lead) and fell last quarter from its all-time high. Historically the direction of the profit margin is a very reliable indicator of the direction of stock prices.

The primary downtrend in stocks that began in November 2018 is unlikely to reverse until the market’s gross profit margin improves. That suggests that we will be managing stock portfolios in a falling market for a while yet.

The other surprise in the first quarter update was an improvement in the basic industrial sector. Although it is too soon to see how the shape of the recovery from the virus crisis will look, the aggressive policy response has shifted to deficit spending (from monetary easing). That should benefit industrial companies and we may be seeing some of that already in the numbers.

For now, continue to focus investments in rising sales growth and rising profit-margin companies and avoid poor financial condition. Shift to active management now and maintain a portfolio of companies with high and rising profitability.

Whatever shape the recovery takes Machine Learning and AI will be an important component of it. Empower yourself with data and analytics that has identified every market peak and trough in the past 50 years.

Our calculations showed that Amazon.com Inc (NASDAQ:AMZN) is among the 30 most popular stocks among hedge funds.

The top 10 stocks among hedge funds returned 185% since the end of 2014 and outperformed the S&P 500 Index ETFs by more than 109 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Below you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

Video: Top 5 Stocks Among Hedge Funds

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. You can subscribe to our free enewsletter below to receive our stories in your inbox:

Disclosure: None.