HB Fuller Co (NYSE:FUL) is a small cap dividend growth stock that few investors are familiar with. However, this dependable business has increased dividends paid for 46 consecutive years and is worth some attention.

The company operates in a large and stable industry with strong growth prospects. Management is also shifting more of H.B. Fuller’s mix into higher-margin applications, which is expected to drive profits higher over the next five years.

Given the company’s potential for meaningful income growth and capital appreciation, H.B. Fuller is the type of investment we look for in our Top 20 Dividend Stocks and Long-term Dividend Growth portfolios.

Among the smart money investors in the Insider Monkey, H.B. Fuller is not very popular, with just 13 funds holding shares as of the end of 2015, having amassed $112.07 million worth of stock, which represented around 6.10% of the company’s outstanding stock. During the last quarter of 2015, the number of funds long the stock went up by two, while the total value of their holdings increased by $11.49 million. The largest shareholder of H.B. Fuller in the Insider Monkey database is Mariko Gordon’s Daruma Asset Management, which owns some 1.57 million shares, according to its last 13F filing

Business Overview

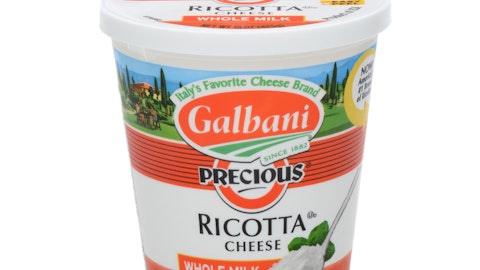

H.B. Fuller is a leading provider of specialty adhesives used to create hundreds of brand name goods around the world. An adhesive is any substance applied to the surfaces of materials that binds them together and resists separation. Just about everywhere you look you will find adhesives and sealants produced by H.B. Fuller – baby diapers, apparel, toilet paper, cereal boxes, shoes, bags of chips, tile flooring, magazines, cars, tablets, refrigerators, and more.

HB Fuller Co (NYSE:FUL) has been producing adhesives for nearly 130 years since its founding in 1887. The company focuses primarily on hygiene (20% of sales), packaging (20%), durable assembly (20%), and engineering (10%) markets. By geography, approximately 69% of H.B. Fuller’s sales are in developed markets with the remaining 31% from emerging and developing economies.

Business Analysis

Our interest in H.B. Fuller begins with our attraction to the global adhesives market. While not the most exciting of markets, adhesives have been in use of more than 200,000 years. We like industries that are characterized by a slow pace of change, and adhesives certainly appear to fit that profile.

H.B. Fuller, Henkel, and Bostik (its two largest competitors) all continue to sell the products they were founded on (glue) in 1887, 1876, and 1889, respectively. Talk about resiliency!

Adhesives have demonstrated impressive longevity because they are used in almost every end market and have continually evolved from a technological perspective (e.g. become more heat resistant or stronger) to replace mechanical fasteners and improve all sorts of products – adhesives can make disposable diapers thinner yet more absorbent, food packaging safer and fresher, and window more energy-efficient.

The market has staying power and should continue to grow in size. Radian Insights expects the global market for adhesives and sealants to reach $43 billion by 2020, with adhesives growing at a compound annual growth rate of 5.6% from 2014 to 2020. Adhesives are growing faster than global GDP because they are increasingly being used in more applications and replacing traditional fastening methods in categories where mobility and light weight are important.

For example, a Wall Street Journal article provided a quote from Daniel Murad, chief executive of ChemQuest Group, mentioning that the typical car today uses about 27 pounds of adhesives compared to just 18 pounds a decade ago.

With wind at its back and a relatively modest revenue base ($2.1 billion in 2015) compared to the global market, we think H.B. Fuller has plenty of opportunity to continue expanding.

Adhesive manufacturers can also be appealing businesses because of their importance to customers. The cost of an adhesive usually represents less than 3% of the customer’s total manufacturing cost for a product, but it provides significant value.

Adhesives improve the functionality of a product and can help customers save costs and improve manufacturing efficiency (e.g. faster drying glue results in greater throughput). H.B. Fuller has close to 20 R&D and technical excellence centers around the world where its team of application experts helps customers develop new products and improve their manufacturing processes.

As a result of these factors, there are many high-profit niches with good pricing power for the company to pursue.

Looking more closely at H.B. Fuller, it’s worth mentioning that the current management team is really the first professional group to run the company. H.B. Fuller was previously family-run until the 2000s.

The new team is focused on high value, high margin opportunities. Management has spent the last several years transforming H.B. Fuller’s business in Europe through its $400 million acquisition of Forbo, an industrial adhesives business, and substantial investments in new manufacturing equipment. These moves were meant to improve profits in the region, which had been underperforming.

Follow Fuller H B Co (NYSE:FUL)

Follow Fuller H B Co (NYSE:FUL)

Receive real-time insider trading and news alerts