It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like New Relic Inc (NYSE:NEWR).

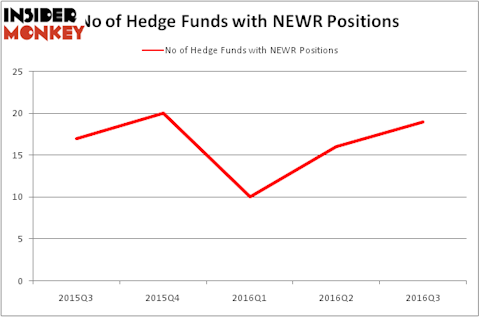

New Relic Inc (NYSE:NEWR) has seen an increase in hedge fund interest recently, with 3 more hedge funds owning the stock. At the end of this article we will also compare NEWR to other stocks including TriNet Group Inc (NYSE:TNET), Sohu.com Inc (NASDAQ:SOHU), and Plantronics, Inc. (NYSE:PLT) to get a better sense of its popularity.

Follow New Relic Inc. (NYSE:NEWR)

Follow New Relic Inc. (NYSE:NEWR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

leungchopan/Shutterstock.com

What does the smart money think about New Relic Inc (NYSE:NEWR)?

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 19% from the second quarter of 2016. Ownership among hedgies has gained 90% over the past 2 quarters after a selloff in Q1. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Matrix Capital Management, managed by David Goel and Paul Ferri, holds the most valuable position in New Relic Inc (NYSE:NEWR). Matrix Capital Management has a $185.8 million position in the stock, comprising 7.8% of its 13F portfolio. Sitting at the No. 2 spot is Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, which holds a $21.8 million position. Some other peers that are bullish include Leon Shaulov’s Maplelane Capital, Matthew Knauer and Mina Faltas’ Nokota Management and Clint Murray’s Lodge Hill Capital.

With general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Maplelane Capital assembled the biggest position in New Relic Inc (NYSE:NEWR). Maplelane Capital had $17.2 million invested in the company at the end of the quarter. Lodge Hill Capital also initiated an $8.6 million position during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Bruce Garelick’s Garelick Capital Partners, and Ken Griffin’s Citadel Investment Group.

Let’s also examine hedge fund activity in other stocks similar to New Relic Inc (NYSE:NEWR). We will take a look at TriNet Group Inc (NYSE:TNET), Sohu.com Inc (NASDAQ:SOHU), Plantronics, Inc. (NYSE:PLT), and Banner Corporation (NASDAQ:BANR). All of these stocks’ market caps resemble NEWR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TNET | 14 | 124160 | -7 |

| SOHU | 16 | 497731 | -2 |

| PLT | 12 | 48573 | -2 |

| BANR | 16 | 185244 | -1 |

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $214 million. That figure was $275 million in NEWR’s case. Sohu.com Inc (NASDAQ:SOHU) is the most popular stock in this table. On the other hand Plantronics, Inc. (NYSE:PLT) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks New Relic Inc (NYSE:NEWR) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers and funds are piling into it, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None