Alluvial Capital Management, an investment advisory firm, released its fourth-quarter 2024 investor letter. A copy of the letter can be downloaded here. The fund had a quiet fourth quarter rising 0.7% bringing the yearly returns to 16.4% beating benchmarks. Small-cap indexes swung drastically, surging 11% in November before falling 8% in December, despite the slight rise that may indicate calmness prevailed over the quarter. In contrast, Alluvial Fund was plodding, rising 3.3% in November and falling 0.3% in December. This stable performance despite significant volatility is in line with Alluvial’s eight-year history. In addition, you can check the fund’s top 5 holdings to determine its best picks for 2024.

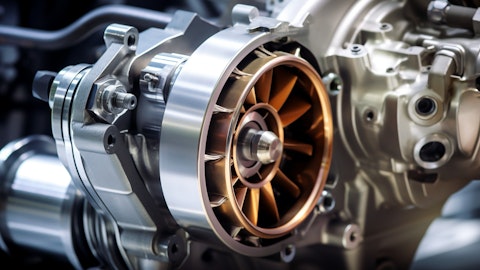

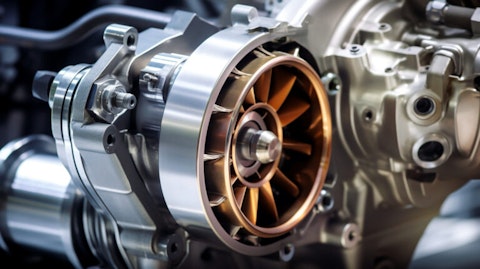

Alluvial Capital Management highlighted stocks like Garrett Motion Inc. (NASDAQ:GTX) in the fourth quarter 2024 investor letter. Headquartered in Rolle, Switzerland, Garrett Motion Inc. (NASDAQ:GTX) designs and manufactures turbocharger and electric-boosting technologies. The one-month return of Garrett Motion Inc. (NASDAQ:GTX) was 7.14%, and its shares gained 9.09% of their value over the last 52 weeks. On January 24, 2024, Garrett Motion Inc. (NASDAQ:GTX) stock closed at $9.60 per share with a market capitalization of $2.05 billion.

Alluvial Capital Management stated the following regarding Garrett Motion Inc. (NASDAQ:GTX) in its Q4 2024 investor letter:

“We have owned Garrett Motion Inc. (NASDAQ:GTX) shares since we participated in the company’s recapitalization in 2021. The theory behind our investment was that Garrett Motion’s core turbocharger business would decline much more slowly than the market expected, and that the company could reinvest in electric vehicle technologies and return tremendous amounts of capital to shareholders. The thesis has largely borne out. The global transition to electric vehicles, while still progressing, will take longer than expected and turbocharger technology will remain relevant for many more years. Garrett is returning nearly all its free cash flow to shareholders, while dedicating more than $100 million annually to research and development for electric vehicle technologies. Garrett Motion’s share count has declined by 12% in the last year. Despite all these developments, Garrett Motion shares remain stubbornly rangebound, bouncing between the mid-$8s and $9s. Why these doldrums? Garrett Motion’s share structure is the biggest culprit. As of April 2024, just four hedge funds owned 56% of Garrett Motion shares. These funds have since reduced their holdings by almost 16 million shares and are likely to continue selling as they move on to other opportunities in distressed securities. The continued selling by large holders has pressured Garrett Motion shares, but at least the company is aware of the opportunity and plans to dedicate nearly all its free cash flow to repurchases. In December, the company made its capital allocation policy explicit, initiating a dividend and committing to returning at least 75% of annual free cash flow to shareholders. It will take time, but eventually the selling shareholders will run out of shares to sell, and Garrett Motion will have bought back a large portion of the company at free cash flow yields in the high teens or better.”

A close up of an engine piston with a commercial turbocharger attached.

Garrett Motion Inc. (NASDAQ:GTX) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 34 hedge fund portfolios held Garrett Motion Inc. (NASDAQ:GTX) at the end of the third quarter which was 32 in the previous quarter. While we acknowledge the potential of Garrett Motion Inc. (NASDAQ:GTX) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Garrett Motion Inc. (NASDAQ:GTX) and shared the long-term stock picks of billionaire Prem Watsa. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.