Wide-moat companies invariably make the best long-term investments. Average companies come and go, but great businesses compound shareholder value year after year. Therefore, the best long-term risk-adjusted returns are found in wide-moat companies like Harley-Davidson, Inc. (NYSE:HOG).

Harley-Davidson is the highest-regarded brand in motorcycles. Although many competitors, including Honda Motor Co Ltd (ADR) (NYSE:HMC) and Polaris Industries Inc. (NYSE:PII) have caused it headaches through the years, Harley-Davidson is still the gold standard in the industry.

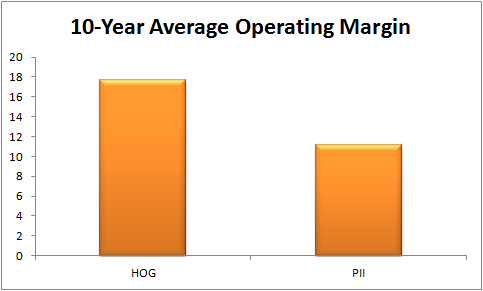

One of the key factors contributing to its long-term success is the company’s focus on the higher end of the market. While Polaris and Honda sell economical models, Harley focuses on quality. This allows it to earn higher margins than its peers.

No doubt, Harley-Davidson, Inc. (NYSE:HOG)’s scale and dealer network contributes to its outsized margins, but its exploitation of its brand equity and focus on high-quality parts and products enables the company to consistently generate high margins.

Honda sells a much wider variety of motorcycles and related products than Harley-Davidson; it sells scooters, four-wheelers, and similar vehicles that appeal to a broader base of customers. This has enabled the company to expand its motorcycle division by competing for a completely different class of customer than Harley-Davidson attracts, though Honda’s motorcycles have certainly gained a foothold in the American market.

Polaris is growing quickly in the U.S. and its international operations are better than Harley-Davidson’s overseas segment, where the latter company does not have the extensive dealer network that makes its domestic segment so profitable.

Polaris is striving to become the low-cost producer in the industry and its strong growth in free cash flow suggests it is on the way to being successful.

That Honda and Polaris focus on different segments of the market is a boon to Harley-Davidson; although the former two companies sell lower-priced products, Harley-Davidson, Inc. (NYSE:HOG)’s core base of loyal customers seek quality over economy. So, while Honda and Polaris have grown their shares of the motorcycle market, neither has significantly infringed on Harley-Davidson’s turf.

Investment case

Harley-Davidson, Inc. (NYSE:HOG)’s normal pre-tax income is about $1 billion, or $4.42 per share. The stock trades hands at about twelve times this figure. The normalized after-tax multiple is about 17.5.

At first glance, paying 17.5 times normal earnings is not an attractive investment. If you were to pay $17.50 for a never-ending stream of $1 annual dividends, your annual return would be an unremarkable 5.7%.

However, a closer glance at the numbers suggests shareholders will receive a double-digit annualized return over the next decade. First, the company is a chronic share repurchaser. Management has reduced or held even the company’s share count each year for over a decade. If earnings did not grow at all, earnings per share still would have grown 35% over the last decade simply due to share repurchases.

In addition to being a chronic share repurchaser, Harley-Davidson also invests its money at an above-average rate of return. The company’s return on invested capital — that is, the amount it earns for each dollar invested in its business — has traditionally been over 20%. Although it has fallen off in recent years as the stagnant economy takes its toll on all luxury goods providers, Harley-Davidson, Inc. (NYSE:HOG) will likely resume outsized returns as the U.S. economy picks up again.

As a result of earning an above-average return on invested capital and constantly repurchasing shares, Harley-Davidson will likely grow its earning power per share at a rate that will enable shareholders to reap double-digit annual returns from the current share price.

Ted Cooper has no position in any stocks mentioned. The Motley Fool recommends Polaris Industries.

The article Should You Add This Wide-Moat Company to Your Portfolio? originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.