“Sticks and stones may break my bones, but words will never hurt me.”

“Sticks and stones may break my bones, but words will never hurt me.”

Try telling that to a company that has just been “Einhorned.”

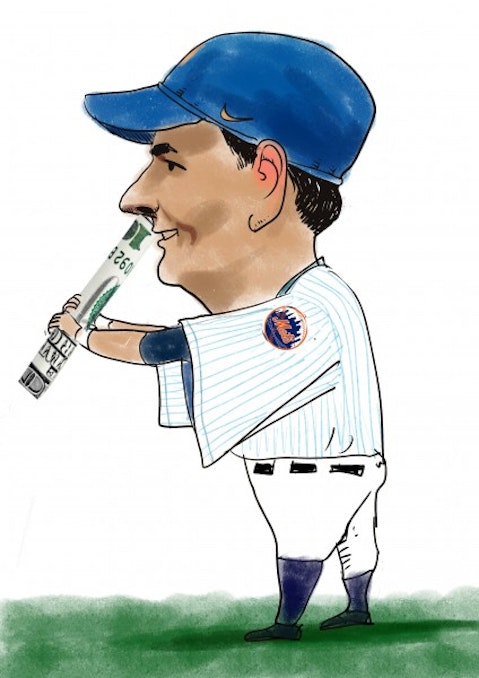

Hedge fund billionaire David Einhorn has the ability to crater a company’s share price with the mere mention of its name in one of his closely followed investment presentations. That ability has turned his name into a verb, spawning the expression that a company is being “Einhorned” when targeted by short sellers.

That has turned Einhorn into one of the most popular figures on the Street — but also one of its most polarizing. Some call him a genius; others oppose his ability to profit from struggling companies. But there is no disputing that Einhorn’s Greenlight Capital boasts one of the best performances in the past 20 years, averaging a market-crushing annual return of 20%. That makes Einhorn one of the most influential and closely followed hedge fund billionaires on the Street.

David Einhorn’s Bio

Einhorn isn’t a stereotypical fund manager like Carl Icahn, Warren Buffett or George Soros. Although he’s already a hedge fund Hall of Famer, Einhorn is only 44 years old. His youthful looks belie an incredible intellect and competitive fire that have pushed him to the top of one of the world’s most competitive industries.

Einhorn’s attention to detail and expertise with numbers showed up early in life, leading him from high school in Wisconsin to the Ivy League at Cornell University, where he graduated with highest honors in 1991. After graduation, Einhorn developed his analytical chops with a four-year run at an investment bank and hedge fund. By the age of 27, he was ready to set out on his own, launching a fund in 1996 with just $1 million under management.

Einhorn quickly produced a couple of monster years, including a 58% return in 1997 and a 32% in 2001 when the S&P 500 index was crashing. As Einhorn’s reputation began growing within the hedge fund community, he took his reputation to another level with a string of amazing shorts that dazzled the Street before and during the financial crisis. That has propelled his net worth to $1.2 billion while his firm’s assets under management have grown to $4 billion.

Einhorn is also a noted poker nut, with some serious skills to match. In July 2012, Einhorn finished third at the World Series of Poker, pocketing $4.35 million in prize money that he quickly donated to one of the many charitable foundations he supports.

David Einhorn’s Investment Philosophy

Einhorn’s rock-star reputation was built on the short sale, which is how he rose to prominence and scored some of his biggest victories. But Einhorn is no one-trick pony. He has also seen big gains playing the long side of the market, including positions in Apple Inc. (NASDAQ:AAPL) and Microsoft Corporation (NASDAQ:MSFT) that both produced outsize returns. But in either case, whether long or short, Einhorn is known for producing copious amounts of research and incredibly detailed analysis.

When searching for his next big short, Einhorn likes to dig deep into a company’s financial statements and business model. He then relies on his forensic approach to research and analysis to identify accounting inconsistencies, unsustainable leverage ratios or unsustainable growth. These are the tools Einhorn used to nail two of his biggest trades, shorting Allied Capital and Lehman Brothers.

But when playing from the long side, Einhorn’s approach looks a lot like Buffett’s, placing value among his highest priorities. He also likes to invest in industry leaders that enjoy high barriers to entrance, which insulates them from new competition and margin compression. These were the driving forces behind two of Einhorn’s biggest longs in the past few years with Microsoft Corporation (NASDAQ:MSFT) and Apple Inc. (NASDAQ:AAPL).