We at Insider Monkey have gone over 821 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, near the height of the coronavirus market crash. In this article, we look at what those funds think of Green Dot Corporation (NYSE:GDOT) based on that data.

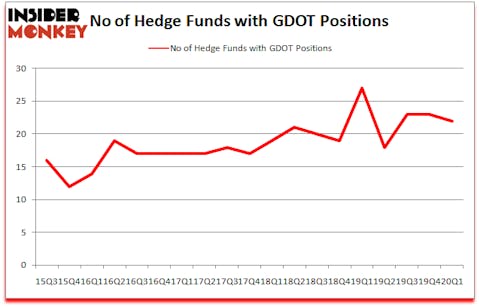

Green Dot Corporation (NYSE:GDOT) investors should be aware of a decrease in hedge fund sentiment recently. Our calculations also showed that GDOT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are numerous tools market participants use to appraise publicly traded companies. A pair of the best tools are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can beat the S&P 500 by a healthy amount (see the details here).

Jeremy Mindich of Scopia Capital

Now we’re going to review the recent hedge fund action encompassing Green Dot Corporation (NYSE:GDOT).

How are hedge funds trading Green Dot Corporation (NYSE:GDOT)?

At Q1’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from the fourth quarter of 2019. On the other hand, there were a total of 27 hedge funds with a bullish position in GDOT a year ago. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Starboard Value LP held the most valuable stake in Green Dot Corporation (NYSE:GDOT), which was worth $125.9 million at the end of the third quarter. On the second spot was No Street Capital which amassed $55.6 million worth of shares. Scopia Capital, Coatue Management, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position No Street Capital allocated the biggest weight to Green Dot Corporation (NYSE:GDOT), around 11.21% of its 13F portfolio. Parian Global Management is also relatively very bullish on the stock, earmarking 5.97 percent of its 13F equity portfolio to GDOT.

Seeing as Green Dot Corporation (NYSE:GDOT) has witnessed a decline in interest from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of funds who sold off their positions entirely last quarter. At the top of the heap, Steve Cohen’s Point72 Asset Management cut the largest investment of the “upper crust” of funds followed by Insider Monkey, valued at about $19.5 million in stock. John Petry’s fund, Sessa Capital, also dropped its stock, about $13 million worth. These moves are important to note, as aggregate hedge fund interest was cut by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Green Dot Corporation (NYSE:GDOT). These stocks are Brooge Energy Limited (NASDAQ:BROG), American Eagle Outfitters Inc. (NYSE:AEO), Corecivic Inc. (NYSE:CXW), and Main Street Capital Corporation (NYSE:MAIN). This group of stocks’ market caps are closest to GDOT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BROG | 7 | 49414 | 4 |

| AEO | 26 | 133187 | 2 |

| CXW | 18 | 109733 | -7 |

| MAIN | 7 | 14571 | -2 |

| Average | 14.5 | 76726 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $77 million. That figure was $377 million in GDOT’s case. American Eagle Outfitters Inc. (NYSE:AEO) is the most popular stock in this table. On the other hand Brooge Energy Limited (NASDAQ:BROG) is the least popular one with only 7 bullish hedge fund positions. Green Dot Corporation (NYSE:GDOT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.9% in 2020 through June 10th but still beat the market by 14.2 percentage points. Hedge funds were also right about betting on GDOT as the stock returned 51.6% in Q2 (through June 10th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Green Dot Corp (NYSE:GDOT)

Follow Green Dot Corp (NYSE:GDOT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.