Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does RR Donnelley & Sons Co (NASDAQ:RRD) fit the bill? Let’s look at what its recent results tell us about its potential for future gains.

What we’re looking for

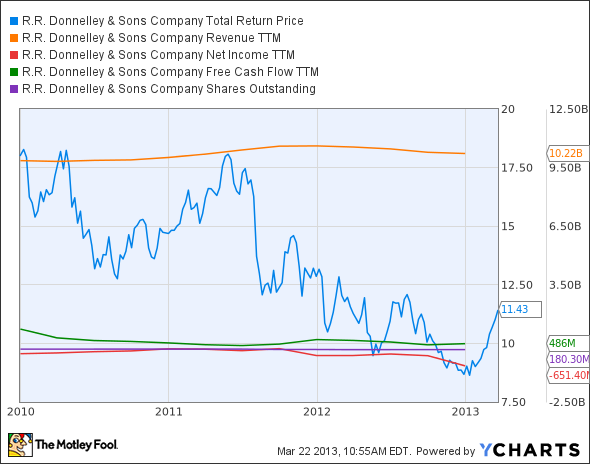

The graphs you’re about to see tell Donnelly’s story, and we’ll be grading the quality of that story in several ways:

Growth: are profits, margins, and free cash flow all increasing?

Valuation: is share price growing in line with earnings per share?

Opportunities: is return on equity increasing while debt to equity declines?

Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s look at RR Donnelley & Sons Co (NASDAQ:RRD)’s key statistics:

RRD Total Return Price data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 3.7% | Fail |

| Improving profit margin | (936.4%) | Fail |

| Free cash flow growth > Net income growth | (60.5%) vs. (2,286.1%) | Pass |

| Improving EPS | (2,676.9%) | Fail |

| Stock growth (+ 15%) < EPS growth | (36.5%) vs. (2,676.9%) | Fail |

Source: YCharts.

*Period begins at end of Q4 2009.

RRD Return on Equity data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | (5,995.8%) | Fail |

| Declining debt to equity | 3,160.0% | Fail |

| Dividend growth > 25% | 0.0% | Fail |

| Free cash flow payout ratio < 50% | 38.5% | Pass |

Source: YCharts.

*Period begins at end of Q4 2009.

How we got here and where we’re going

RR Donnelley & Sons Co (NASDAQ:RRD) barely squeaks through with two passing grades, and one of those is a technicality. Free cash flow might be in positive territory, but over the past three years, the company has shaved a great deal of that amount off as its businesses have declined. Is there any hope for this high-yielder with the near-double-digit payout, or is this one dangerous stock best left on the rejection pile?

Donnelly has actually been trending higher through 2013, which could be the start of a sustainable turnaround, but which is more likely to be a short-term dead-cat bounce based on dividend seekers jumping into a depressed stock. Consider what happened to the company in 2012: Its biggest news-making event was a pitiful filing error on Google Inc (NASDAQ:GOOG)‘s behalf with the SEC.

Someone at Donnelly got fat fingers with Big Google (NASDAQ:GOOG)’s quarterly report, and the reaction was so intense that trading in the stock had to be halted. Think about that. A $200 billion-plus company’s stock was halted because someone at Donnelly screwed up with the SEC. RR Donnelley & Sons Co (NASDAQ:RRD)’s ownership of the EDGAR online system, where millions of stock researchers (including yours truly) go to find SEC filings, makes this more egregious. Accuracy is essential, and human errors are unavoidable — but how can you let it happen to one of the most-followed companies in the world? Google Inc (NASDAQ:GOOG) switched filing providers after that brouhaha. How many other companies did the same, or are considering it?

On a more fundamental basis, Donnelly’s core printing business is nothing to get excited about. Donnelly has ample competition from both VistaPrint Limited (NASDAQ:VPRT) and Quad/Graphics, Inc. (NYSE:QUAD), neither of which is performing especially well on a share-price basis, and of which only Quad/Graphics has sustained any free cash flow momentum over the past couple of years:

RRD Total Return Price data by YCharts.

It’s not a strong industry right now. RR Donnelley & Sons Co (NASDAQ:RRD), unlike the small-business-focused VistaPrint, has occasion to tout its big corporate contracts, such as one renewed with the soon-to-merge Office Depot Inc (NYSE:ODP) for catalog and direct-mail printing, or one announced earlier this month with the International Airlines Group of Europe that also includes logistics and other related business services. The latter deal is somewhat more promising than the former — really, when was the last time you needed a bulk-mailed print catalog to decide what to buy at an office-supply store?

The market’s long discounted a rebound in this core business, which is why Donnelly’s forward P/E remains in the single digits (7.4, to be exact). Donnelly’s high debt load is also a concern, and a recent offering of 7.9% debt securities is another red flag. If the company is cash flow-positive, why does it need to keep going back to the debt well, especially at such unpalatable terms in a zero-interest-rate environment? The stock’s recent rebound offers some hope, and the dividend remains appealing, but RR Donnelley & Sons Co (NASDAQ:RRD) has yet to offer the market real signs that it’s worth a long-term investment.

Putting the pieces together

Today, Donnelly has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy — or to stay away from a stock that’s going nowhere.

The article Is R.R. Donnelly Destined for Greatness? originally appeared on Fool.com and is written by Alex Planes.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends Google and Vistaprint and owns shares of Google.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.