Gartner Inc (NYSE:IT) released a report yesterday (6/24) detailing its projections for computing device sales for 2013 and 2014. Up until now, I’ve considered Gartner to be a reliable source of information on mobile device sales and market share, but after taking a closer look at their latest numbers, I have serious doubts about Gartner Inc (NYSE:IT)‘s data for 2012 as well as their projections for 2013 and 2014.

Virtuous cycles

I’ve been writing about the Mobile Device Wars for several years and have kept running tallies of device shipments as reported by Google Inc (NASDAQ:GOOG), Apple Inc. (NASDAQ:AAPL), as well as Gartner Inc (NYSE:IT). I follow the reports closely because I consider market share to be key to winning the Mobile Device Wars.

Numerous virtuous cycles take hold as the pool of users for a particular ecosystem increases. The larger the user base, the more prospective customers there are for third party apps and accessories. This increases the level of interest in the ecosystem by businesses engaged in app or accessory development. App and accessory availability increases, thereby making the ecosystem more attractive to users, and so on.

As much as Apple Inc. (NASDAQ:AAPL) management would like to downplay the importance of market share, both Apple Inc. (NASDAQ:AAPL) and Google Inc (NASDAQ:GOOG) benefit from the virtuous cycles taking hold in their respective ecosystems, while competitors find establishing healthy ecosystems increasingly difficult.

Thus, when I read over Gartner’s report, I was struck by a couple of disconnects in their 2012 data. In the report, Gartner Inc (NYSE:IT) states the number of Android devices shipped in 2012 was 505.509 million and that the number of combined iOS/MacOS devices shipped was 212.878 million.

Falling off a log

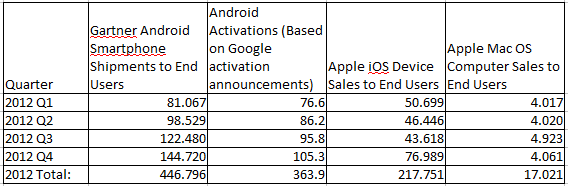

Let’s take the Apple Inc. (NASDAQ:AAPL) device number first. Getting this right should be falling-off-a-log easy because Apple Inc. (NASDAQ:AAPL) publishes exact sales numbers every quarter for iPhones, iPads, iPods, and Macs. But Gartner Inc (NYSE:IT) doesn’t even get this right, as summarized in the table below (all numbers in millions).

The table shows the number of iOS devices and Macs Apple sold each quarter, as detailed in their quarterly earnings reports. Not only did Gartner not get the iOS device total correct, it looks as though they completely forgot about Mac sales. The correct number for combined iOS and Mac sales should be 234.77 million.

Is there any way to rationalize the discrepancy? I doubt it. Although Gartner’s report doesn’t explicitly state it, their numbers represent shipments to end users, as I’ll discuss below when I go over the Android data. My understanding is that’s what Apple reports as well. But even if Apple Inc. (NASDAQ:AAPL) were adding in shipments into retail channels, I doubt this would be a significant difference when summed over an entire year.

Real disconnect

But the real disconnect that struck me was for the Android numbers. Gartner Inc (NYSE:IT)‘s assertion that 505.509 million Android devices had been shipped in 2012 is at odds with Google Inc (NASDAQ:GOOG)‘s announced Android activation data. Google Inc (NASDAQ:GOOG) periodically announces total numbers of Android devices activated to date, as when Larry Page announced that 750 million Android devices had been activated as of March 13 of this year. The number of devices shipped in 2012 is the difference between the cumulative total as of the end of 2012 and the total at the end of 2011. That difference is about 364 million, not the 505.5 million reported by Gartner. Gartner’s error for 2012 Android device shipments is at least 39%.

I consider that the 2012 total activations represents an absolute upper bound to the number of Android devices shipped to end users in 2012, and certainly an upper bound to the total number of Android smartphones shipped in 2012, since activations includes all types of Android devices.

This is why I included the Gartner reported Android smartphone shipments to end users in the first column. The total for Android smartphones of 446.8 million, according to Gartner, is well in excess of Android activations for 2012. However, the smartphone total is consistent with the total of 505.5 million Android devices in Gartner’s 6/24 report, since Gartner estimates that smartphones represent about 90% of all Android device shipments. This also confirms that the 6/24 report data represented shipments to end users.

Systematic error

In order to see if there has been a consistent pattern of overestimation of Android device shipments by Gartner, I went back through their smartphone shipment reports as far back as 2009 and have plotted the data below. Note that the curves represent cumulative device shipments or activations.

Also note that I’ve provided a curve fit to the Google Inc (NASDAQ:GOOG) activation announcements in order to interpolate between announcements, since Google management makes announcements at irregular intervals. There’s always some uncertainty about the time phasing of the Google activation announcements. For instance, Larry Page’s blog of March 13 didn’t quite come at the end of the quarter, so there’s still some uncertainty about when the 750 million activations became effective. For simplicity, and because the potential errors are small, I always treat the announcements as effective as of the end of the relevant quarter.

The cumulative Android smartphone shipments according to Gartner are way above the total Android device activations as of Q1 2013. Gartner’s errors are more difficult to detect on a quarterly basis, but it becomes apparent that these errors are systematic when you plot cumulative results. Conversely, Gartner Inc (NYSE:IT) slightly, though consistently, underestimates iPhone shipments.

The take-away

In order to accept that Gartner’s Android shipment data is valid, one has to assume that Google is deliberately low-balling their activation number announcements. This strikes me as highly implausible, given how proud Google is of their activation tallies when they do announce them.

In fact, I regard Google Inc (NASDAQ:GOOG)‘s activation claims as somewhat suspect, since, as I have previously pointed out, there is a potential to activate the same device multiple times. But I certainly don’t believe numbers that are substantially in excess of the announced activations. It would be great for investors if Google and Microsoft Corporation (NASDAQ:MSFT) followed Apple’s lead and announced product shipment data on a quarterly basis.

Google’s Android is still trouncing Apple Inc. (NASDAQ:AAPL)‘s iOS in market share, but the margin of victory is smaller than Gartner would have us believe. As of the end of Q1, Apple had sold a total of 523 million iOS devices, while at most 750 million Android devices had been sold.

If Gartner Inc (NYSE:IT)‘s numbers for Android device shipments in 2012 were in error by such large amounts, should we believe their prediction of 866.8 million Android devices shipped in 2013? In a word, no.

The article Do Gartner’s Smartphone Numbers Add Up? originally appeared on Fool.com and is written by Mark Hibben.

Mark Hibben has a position in Apple. The Motley Fool recommends Apple, Gartner, and Google. The Motley Fool owns shares of Apple and Google. Mark is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.