It is interesting to watch a bio company change tactics and go into an area it hasn’t explored before. This, to me, is like watching a child suddenly grow up. For a startup to thrive in this sector, it takes a lot of patience and focus. Investors cannot give a pre-developmental bio company enough money to diversify. Only when a company grows and starts making money out of its initial products does it develop the wherewithal to divert into different specialties. It ceases to be a struggling small biotech and becomes a conglomerate. That is when the company grows up.

Although that is not absolutely true of Gilead Sciences, Inc. (NASDAQ:GILD), a market leader in HIV medications, I am intrigued that it entered into the highly competitive oncology market already dominated by the world’s leading players such as Novartis AG (ADR) (NYSE:NVS), Roche (NASDAQOTH: RHHBY) and Pfizer Inc. (NYSE:PFE).

The company is currently focusing on leukemia and other blood cancers with a series of product candidates involving different mechanisms. Currently, most of the products are in clinical stages, including Idelalisib in Phase III for blood cancer and Simtuzumab in Phase II for pancreatic and colorectal cancer.

Table1:

| Products/Product candidates | Mechanism of action | Indications | Status | |

| Oncology | Idelalisib | PI3K delta inhibitor | Chronic Lymphocytic Leukemia | Phase III |

| Idelalisib | PI3K delta inhibitor | Indolent non-Hodgkin’s Lymphoma | Phase III | |

| Momelotinib | JAK inhibitor | Myelofibrosis | Phase II | |

| Simtuzumab | monoclonal antibody | Myelofibrosis | Phase II | |

| Simtuzumab | monoclonal antibody | Pancreatic Cancer | Phase II | |

| Simtuzumab | monoclonal antibody | Colorectal Cancer | Phase II | |

| GS-9973 | Syk inhibitor | B-Cell Malignancies | Phase II | |

| GS-9820 | PI3K delta inhibitor | Lymphoid Malignancies | Phase II | |

| GS-5745 | MMP9 mAb inhibitor | Solid Tumors | Phase I |

Source: Gilead annual report

Idelalisib, an experimental drug from Gilead Sciences, Inc. (NASDAQ:GILD), blocks the PI3 Kinase delta (a subtype of PI3K proteins) function that is primarily responsible for tumor growth in patients with chronic lymphocytic leukemia and indolent non-Hodgkin’s Lymphoma. Chronic lymphocytic leukemia, also known as CLL, is a blood and bone-marrow disease that usually grows slowly. It mostly occurs in adults rather than children.

Interestingly, in 2010, chronic lymphocytic leukemia dominated the blood-cancer market compared to acute lymphocytic leukemia, acute myeloid leukemia, and chronic myeloid leukemia. However, it is expected that the market will equally be distributed across all forms of blood cancer by 2020. In 2010, North America alone contributed nearly 62% of the total sales of leukemia drugs of which Gleevec, the market leader, comprised of around 56% of total sales.

Currently, Novartis, GlaxoSmithKline plc (ADR) (NYSE:GSK), Roche, Bristol Myers Squibb Co. (NYSE:BMY), Celgene Corporation (NASDAQ:CELG) and Biogen Idec Inc. (NASDAQ:BIIB) are the key players in the leukemia market. This market is still under-served due to increasing unmet needs and limited treatment options available for larger populations. Therefore, it is expected that the Leukemia market will grow at a compound annual growth rate of 3.84% from 2015 to 2020. This will provide an opportunity for Gilead Sciences, Inc. (NASDAQ:GILD) in the CLL market as most companies aim at novel products with higher efficacy for the treatment of CLL.

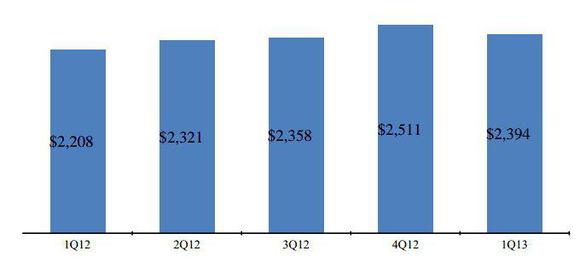

Fundamentally, Gilead Sciences, Inc. (NASDAQ:GILD) is strong in its performance with a solid product portfolio in the anti-viral segment. In the first quarter of 2013, Gilead Sciences, Inc. (NASDAQ:GILD) reported revenue of $2.53 billion, up 11% compared to $2.28 billion during the first quarter of 2012. This was due to 8% year-over-year growth in overall product sales, which again resulted from increased anti-viral and cardiovascular product sales. Anti-viral products alone contributed 86% of total product sales.

Figure1:

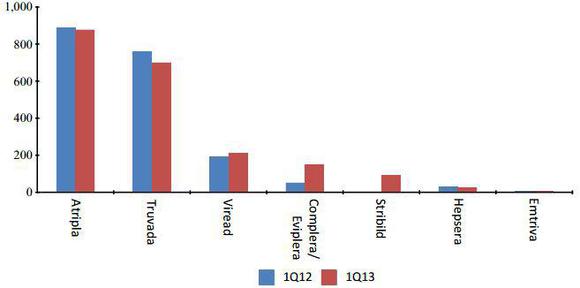

In the first quarter of 2013, anti-viral products reported sales of $2.06 billion, up by 7% compared to 2012. This was due to: a) strong demand in Complera and Stribild; b) a significant rise in Viread sales; partly offsetting a 8% decline in sales of Truvada.

Figure2:

Also, non-GAAP net income during the first quarter of 2013 was $801.9 million or $0.48 per diluted share compared to $704.4 million or $0.45 per diluted share during the same quarter in 2012.