Himanshu H. Shah‘s Shah Capital is one of more than 749 hedge funds in our database that filed a 13F for the June 30 reporting period. Of those funds, Shah Capital’s long positions in companies worth $1 billion or more performed better than all but six other funds, with the ten qualifying holdings delivering weighted average returns of 29.6% for the period. That performance pushed Shah Capital’s year-to-date gains using the same methodology to 41.4%, which also ranks it among the very best performing funds in our database in 2016. It should be noted that our calculations may be different from the fund’s actual returns, as it does not factor in changes to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions.

Shah Capital recently released its 13F filing for the September 30 period, so let’s run through four of the fund’s top stock picks and see how it traded them during the third quarter, as well as how they performed.

Let’s start with Genworth Financial Inc (NYSE:GNW), Shah Capital’s second-most valuable holding on September, up from its third-most valuable on June 30. Shah Capital owned 3.54 million shares of the mortgage insurance services company on June 30, and those shares had a monster quarter, nearly doubling in value. Despite that, Shah Capital didn’t take much profit from the position, selling just 31,000 shares during the third quarter.

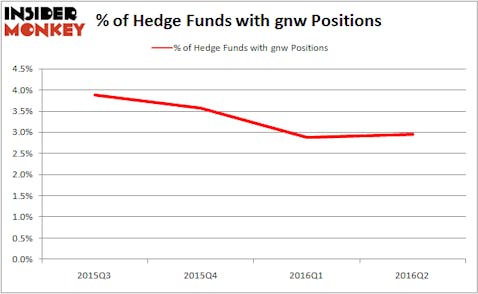

Hedge fund ownership of Genworth Financial Inc (NYSE:GNW) has drifted down over the past year. Heading into the third quarter of 2016, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in the stock. Solus Alternative Asset Management, managed by Christopher Pucillo, had a $38.7 million position in the stock on June 30, comprising 8.6% of its 13F portfolio. The second-largest stake was held by Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $19.5 million position. Some other members of the smart money with similar optimism include Richard S. Pzena’s Pzena Investment Management and Jim Simons’ Renaissance Technologies.

Follow Genworth Financial Inc (NYSE:GNW)

Follow Genworth Financial Inc (NYSE:GNW)

Receive real-time insider trading and news alerts

Next up is Coeur d’Alene Mines Corporation (NYSE:CDE), which flipped places with Genworth in Shah Capital’s portfolio in terms of value, dropping to third on September 30 from second on June 30, after Shah Capital trimmed its stake in the company by 20% during the third quarter, lowering its position to 1.80 million shares. It appears that Shah Capital did want to take some profit from this position, which only gained about 10% during the third quarter but has soared by over 350% this year.

Some of the other fortunate shareholders of Coeur d’Alene Mines Corporation (NYSE:CDE) as of June 30 among the funds in our system were GMT Capital, managed by Thomas E. Claugus ($69.7 million position) and Renaissance Technologies, managed by Jim Simons ($54.1 million position). Some other hedge funds and institutional investors that were bullish on Coeur d’Alene Mines Corporation (NYSE:CDE) comprised Eric Sprott’s Sprott Asset Management and Gilchrist Berg’s Water Street Capital.

Follow Coeur Mining Inc. (NYSE:CDE)

Follow Coeur Mining Inc. (NYSE:CDE)

Receive real-time insider trading and news alerts

We’ll check out two more favorite stocks of Shah Capital on the next page.

After a horrendous three-year run, Avon Products, Inc. (NYSE:AVP) shares have turned the corner this year, gaining over 45%. Most of those gains came during the third quarter, proving to be a coup for Shah Capital, which owned 2.74 million shares of the stock at the end of June. Shah Capital believes the run isn’t yet done, as it raised its stake in Avon by another 13% during the third quarter.

A total of 25 of the hedge funds tracked by Insider Monkey were bullish on Avon Products, Inc. (NYSE:AVP) as of June 30, down by 11% from a quarter earlier. Value investment firm Yacktman Asset Management, managed by Donald Yacktman, held the number one position in Avon Products, Inc. (NYSE:AVP) at the end of June, with a $96.8 million position in the stock. Sitting at #2 was Barington Capital Group, led by James A. Mitarotonda, holding a $27.7 million position; the fund had 28.1% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism included Jim Simons’ Renaissance Technologies and Wallace Weitz’s Wallace R. Weitz & Co.

Follow Avon Products Inc (NYSE:AVP)

Follow Avon Products Inc (NYSE:AVP)

Receive real-time insider trading and news alerts

Lastly is Deutsche Bank AG (USA) (NYSE:DB), which was a new addition to Shah Capital’s portfolio in the second quarter. Its position stood at 512,000 shares on June 30, and it hiked that to 700,000 shares as of September 30. Deutsche Bank AG (USA) (NYSE:DB)’s regulatory issues dragged its shares down by about 5% during the third quarter, but they have made half of that decline back in the fourth quarter. It could’ve been a lot worse for the stock, but fears have subsided that Deutsche Bank is in any trouble of going under.

15 of the hedge funds tracked by Insider Monkey were long this stock on June 30, a 50% jump from the end of the first quarter of 2016. Mike Masters’ Masters Capital Management has a large call position in Deutsche Bank AG (USA) (NYSE:DB) worth close to $13.7 million as of June 30. Other members of the smart money that are bullish on the investment bank include Thomas G. Maheras’ Tegean Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Ken Griffin’s Citadel Investment Group.

Follow Deutsche Bank Ag (NYSE:DB)

Follow Deutsche Bank Ag (NYSE:DB)

Receive real-time insider trading and news alerts

Disclosure: None