Should investors take profits now or is there more upside left?

Well Diversified, Solid Fundamentals

General Electric Company (NYSE:GE) has come a long way from its founding in 1892. Today it is a well diversified conglomerate that produces everything from jet engines to light bulbs to CT scanners. GE is one of the largest companies in the world with an enterprise value of $450 billion and market capitalization of $250. Many of GE’s divisions such as GE capital, GE Aviation, GE Healthcare, GE Rail, and GE Power and Water are all sector leaders in their respective fields.

CEO Jeff Immelt has been trying to diversify away from GE Capital to focus more on the industrial groups. Even though GE Capital is a cash cow that produced 47% of GE operating earnings last year, it is extremely fickle. The unit almost brought down the entire company in 2009 when the market for commercial paper disappeared. Immelt’s goal is to limit GE Capital’s contribution to 30% of earnings and get the ‘ending net investment’ (ENI) of GE Capital for the balance sheet down to $300-$350 billion.

Immelt has made progress in that regard. Last quarter, the ENI of GE Capital was $402 billion, down from $436 billion a year earlier. This quarter the ENI for GE capital was only $391 billion down 9% from a year earlier. As planned, earnings for GE capital fell 9% in line with the ENI reduction while the industrial segment profit increased 2%.

Valuation-wise, General Electric Company (NYSE:GE) shares are trading at 17 times this year’s earnings and only 13.5 next year’s earnings. Management has shown that it is committed to its shareholders. GE is a solid dividend payer at roughly 3% a year with a payout ratio of only 54%. Year to date, General Electric Company (NYSE:GE) has returned $9.9 billion back to shareholders through dividends and buybacks.

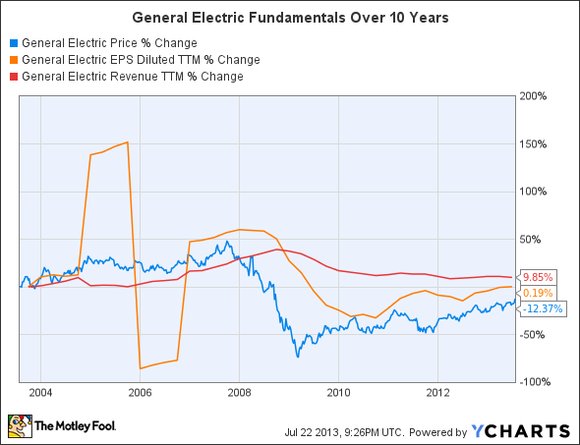

General Electric Company (NYSE:GE) earnings and revenues have recovered as the broader US economy has recovered. While revenue growth has been relatively flat, earnings have grown as margins have reflated from the financial crisis. GE has an expected next five year annual EPS growth rate of 11%.

Second Quarter Results

GE second quarter results were a mixed bag. Revenue fell to $35.1 billion while profits fell to $3.69 billion or 36 cents per share. Both numbers were down from last year’s numbers of $36.5 billion and $4.01 billion or 38 cents per share. GE’s top-line did not beat analyst expectations of $35.56 billion but the bottom-line of 36 cents per share beat analyst expectations by one penny.

Although the financials for the past have been rather disappointing, GE’s guidance is upbeat. GE’s order book, a reflection of how much work it has received from customers, is up 20 percent in the United States and 4 percent globally. General Electric Company (NYSE:GE) has now a record industrial backlog of $223 billion. The company is guiding that it will return $18 billion of capital back to shareholders for 2013 through a mixture of buybacks and dividends.