The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards General Cable Corporation (NYSE:BGC) .

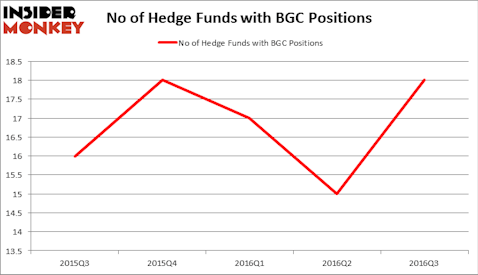

Is General Cable Corporation (NYSE:BGC) a healthy stock for your portfolio? Hedge funds are actually taking an optimistic view. The number of long hedge fund bets rose by 3 recently. BGC was in 18 hedge funds’ portfolios at the end of September. There were 15 hedge funds in our database with BGC positions at the end of the previous quarter. At the end of this article we will also compare BGC to other stocks including Chatham Lodging Trust (NYSE:CLDT), WL Ross Holding Corp (NASDAQ:NXEO), and TIER REIT Inc (NYSE:TIER) to get a better sense of its popularity.

Follow General Cable Corp (NASDAQ:BGC)

Follow General Cable Corp (NASDAQ:BGC)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Maxx-Studio/Shutterstock.com

Hedge fund activity in General Cable Corporation (NYSE:BGC)

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a gain of 20% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in BGC over the last 5 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Pzena Investment Management, led by Richard S. Pzena, holds the biggest position in General Cable Corporation (NYSE:BGC). Pzena Investment Management has a $25.6 million position in the stock. Coming in second is Royce & Associates, led by Chuck Royce, which holds a $24.3 million position. Remaining hedge funds and institutional investors that hold long positions contain Jim Simons’ Renaissance Technologies, Steve Cohen’s Point72 Asset Management and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.