Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before last year’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to GDS Holdings Limited (NASDAQ:GDS) changed recently.

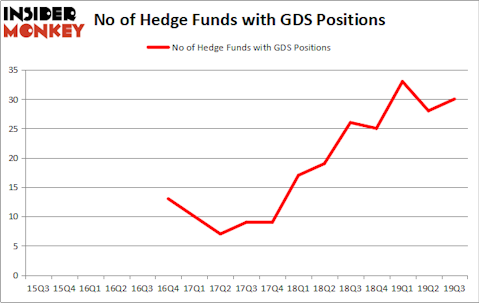

GDS Holdings Limited (NASDAQ:GDS) was in 30 hedge funds’ portfolios at the end of September. GDS investors should pay attention to an increase in activity from the world’s largest hedge funds lately. There were 28 hedge funds in our database with GDS positions at the end of the previous quarter. Our calculations also showed that GDS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now we’re going to review the latest hedge fund action regarding GDS Holdings Limited (NASDAQ:GDS).

Hedge fund activity in GDS Holdings Limited (NASDAQ:GDS)

Heading into the fourth quarter of 2019, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the previous quarter. On the other hand, there were a total of 26 hedge funds with a bullish position in GDS a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, 12 West Capital Management, managed by Joel Ramin, holds the biggest position in GDS Holdings Limited (NASDAQ:GDS). 12 West Capital Management has a $438.6 million position in the stock, comprising 28.2% of its 13F portfolio. Sitting at the No. 2 spot is Tiger Global Management, led by Chase Coleman, holding a $229.7 million position; 1.2% of its 13F portfolio is allocated to the company. Remaining professional money managers that hold long positions comprise Ted Kang’s Kylin Management, Scott Ferguson’s Sachem Head Capital and David E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position 12 West Capital Management allocated the biggest weight to GDS Holdings Limited (NASDAQ:GDS), around 28.23% of its 13F portfolio. Kylin Management is also relatively very bullish on the stock, designating 17.43 percent of its 13F equity portfolio to GDS.

Now, specific money managers were leading the bulls’ herd. Sachem Head Capital, managed by Scott Ferguson, created the most valuable position in GDS Holdings Limited (NASDAQ:GDS). Sachem Head Capital had $56.1 million invested in the company at the end of the quarter. Philippe Laffont’s Coatue Management also made a $7.7 million investment in the stock during the quarter. The other funds with brand new GDS positions are David E. Shaw’s D E Shaw, Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, and Rob Citrone’s Discovery Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as GDS Holdings Limited (NASDAQ:GDS) but similarly valued. We will take a look at Sonoco Products Company (NYSE:SON), CDK Global Inc (NASDAQ:CDK), Enel Chile S.A. (NYSE:ENIC), and Wix.Com Ltd (NASDAQ:WIX). This group of stocks’ market valuations resemble GDS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SON | 20 | 117152 | 1 |

| CDK | 28 | 473046 | -1 |

| ENIC | 8 | 26016 | 2 |

| WIX | 31 | 986992 | 5 |

| Average | 21.75 | 400802 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $401 million. That figure was $1127 million in GDS’s case. Wix.Com Ltd (NASDAQ:WIX) is the most popular stock in this table. On the other hand Enel Chile S.A. (NYSE:ENIC) is the least popular one with only 8 bullish hedge fund positions. GDS Holdings Limited (NASDAQ:GDS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on GDS as the stock returned 121.2% in 2019 (through December 23rd) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.