Garrett Motion Inc. (NASDAQ:GTX) Q3 2023 Earnings Call Transcript October 24, 2023

Garrett Motion Inc. beats earnings expectations. Reported EPS is $0.23, expectations were $0.22.

Operator: Hello. My name is Drew and I’ll be your operator this morning. I would like to welcome everyone to the Garrett Motion Third Quarter Financial Results Conference Call. This call is being recorded and a replay will be available later today. [Operator Instructions] After the company’s presentation, there will be a Q&A session. I would now like to hand over the call to Eric Burge, Garrett’s Head of Investor Relations.

Eric Burge: Thank you, Drew. Good day everyone and welcome. Thank you for attending the Garrett Motion third quarter financial results conference call. Before we begin, I would like to mention that today’s presentation and press release are available on the IR section of the Garrett’s website at investors.garrettmotion.com. There will also find links to our SEC filings, along with other important information about our company. Turning to slide two. You will note that this presentation contains forward-looking statements within the meanings of the Securities and Exchange Act. We encourage you to read the risk factors contained within our filings — with the SEC become aware of the risks and uncertainties in our business and understand that forward-looking statements are only estimates of future performance and should be taken as such.

The forward-looking statements within our presentation represent management’s expectations only as of today and the company disclaims any obligation to update them. Today’s presentation also includes non-GAAP measures to describe how we manage and operate our business. We reconcile each of these measures to the most directly comparable GAAP measure and you’re encouraged to examine those reconciliations in the appendix to the press release and the slide presentation. Also in today’s presentation and comments, we may refer to light vehicle diesel and light vehicle gasoline in terms diesel and gasoline only. With us on today’s call is Olivier Rabiller; Garrett’s President and Chief Executive Officer; and Sean Deason; Garrett’s Senior Vice President and Chief Financial Officer.

I will now hand the call over to Olivier.

Olivier Rabiller: Thank you, Eric, and thanks everyone for joining Garrett third quarter earnings conference call. I will begin my remarks on slide number three. I am very pleased with our performance in Q3 and would like to thank the entire Garrett team for delivering a solid quarter through the continued focus on operational excellence and execution. On top of our financial performance, we continued to build momentum with our differentiated technologies in core turbo and zero emission vehicle products. And last, we executed against our capital allocation priorities, allowing us to deliver and return value to shareholders. Adjusted EBITDA this quarter was $152 million versus $146 million in the same period of last year. Strong productivity and operational performance more than offset the unfavorable product mix, increasing our adjusted EBITDA margin of 15.8%, up from 15.4% in Q3 of last year.

We also generated adjusted free cash flow of $57 million, down from $121 million in the same quarter the year prior, driven primarily by timing of working capital. Sean will share more details on our financial results in the coming slides. But since our last quarter’s results, we have seen a significant change in foreign exchange outlook for the Euro Dollar. While we continue to perform operationally in line with our prior outlook, the weaker euro is impacting our second-half and we are reflecting this in our updated 2023 outlook that Sean will take you through in more detail later in the presentation. We indeed continue to monitor the United Auto Worker strike, but to-date, there has been no impact on our operations. During the quarter, we repurchased $161 million of stock through our approval $250 million share repurchase program in line with our capital allocation priorities.

We also executed an early repayment of $200 million of debt within the quarter, a strong step delivering towards our target net leverage ratio of 2.0 times, consolidated EBITDA to net debt by the end of 2024.All of this contributed to Garrett being upgraded by Standard & Poor to a BB- stable rating. Turning now to slide four, let’s review together some significant updates to our product portfolio. Starting with our core turbo business, I am pleased to introduce Garrett’s largest turbo ever, the GT80. This product allows us to better serve our industrial and off-highway customers with an expanded product range and reflects our strategy of continued investment in our industrial turbo business. Let me remind you one more time that the commercial vehicle aftermarket and industrial businesses account for more than 30% of our sales and even more of our profits.

We also continue to make progress on our zero emission strategy. This quarter, we won two additional pre-development awards for our high-performance e-cooling compressor. We now have a total of five pre-developments wins this year in our zero-emission business, proof that our technology-differentiated products address the evolving needs of our customers when it comes to developing new generations of electric vehicles. We remain committed to our target of $1 billion of annual sales of products for zero emissions vehicles by 2030 at the same or better margin profile than our financials. I will now turn things over to Sean to provide more insights into our financial results.

Sean Deason: Thanks, Olivier. I will begin my remarks on slide five. Looking at the upper left-hand graph, you will see our reported net sales for the last seven quarters with Q3 2023 at $960 million, up from Q3 of 2022 by 2% on a GAAP basis and down 1% on a constant currency basis. This was driven by new product ramp ups in small engine gasoline products and offset by unfavorable mix from softness in commercial vehicle and diesel applications. Looking at the upper right-hand side of the page, Q3 2023 adjusted EBITDA of $152 million was up 4% or $6 million from $146 million last year, reflecting the continued strong productivity and operational execution allowing us to deliver an adjusted EBITDA margin of 15.8%, up from 15.4% last year.

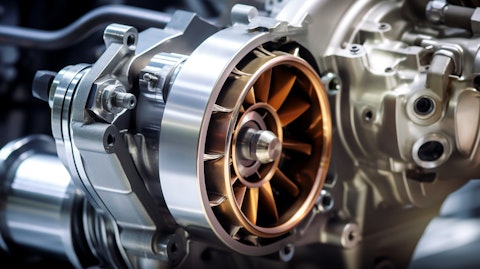

A close up of an engine piston with a commercial turbocharger attached.

And on the bottom left graph, we show that Garrett generated positive adjusted free cash flow of $57 million in Q3 of 2023, down from $120 million in Q3 of 2022. Compared to last year, this decrease is driven by working capital, primarily from the timing of disbursements within the quarter. We continue to see our free cash flow conversion to adjusted EBITDA trend at or above 60%, which is in line with our capital allocation framework for the year. Turning now to slide six. We show our Q3 net sales bridge by product category, as compared with the same period last year. Net sales were up 2% on a GAAP basis and down 1% on constant currency basis, reflecting an increase of $15 million over Q3 of 2022, as stated on the prior slide. Gasoline products were up 9% at constant currency, adding $37 million in sales and gasoline products now comprise 46% of reported net sales, up from 43% last year, driven by product ramp ups.

Diesel products decreased 9% at constant currency, a decrease of $21 million to sales and comprising 24% of sales — of total sales, slightly down 1 percentage point from 25% last year. Commercial vehicles decreased 14% in constant currency, primarily driven by softness in China and North America, where interest rates have risen and other macroeconomic conditions are at play. Commercial vehicles represented 16% of total net sales in Q3 of 2023, down from 19% in Q3 of 2022. Our aftermarket business remained stable in the quarter, delivering flat growth at constant currency over last year. It now comprises 12% of net sales, a similar level to last year. Our Q3 net sales were supported by an increase of $21 million of foreign exchange currency impact on a year-over-year basis.

But sequentially, we are seeing FX pressure and we’ll talk about this later in the presentation. Turning now to slide seven, we show our Q3 adjusted EBITDA bridge, compared with the same period last year. Adjusted EBITDA of $152 million, represented a $6 million improvement over the prior period. Increased volume accounted for $5 million of this and was offset by $23 million of unfavorable product mix impact as previously mentioned. Our overall operating performance was a net positive of $16 million and we continue to dedicate over 50% of the total R&D expenditure to electrification technologies. And we had an $8 million positive foreign currency impact, primarily from the strength of the euro against the U.S. dollar, when we compare to the same period last year in 2022.

Our solid third quarter results continue to demonstrate that over time and in extremely volatile macro and demand environments, Garrett continues to deliver solid results as we flex our variable cost structure to adapt to rapid changes across the industry. Moving now to slide eight, we show the adjusted EBITDA to adjusted free cash flow bridge for Q3 of 2023. In the quarter, Garrett delivered solid adjusted free cash flow of $57 million. As mentioned earlier, adjusted free cash flow was impacted by use of working capital of $41 million in the quarter, primarily due to the timing of disbursements. Capital expenditures and cash taxes were in line with expectation, and cash interest increased to $21 million cash, due to the issuance of our new $700 million term loan B in Q2.

Turning now to slide nine, we ended Q3 2023 with a strong liquidity position of $732 million, comprised of $570 million of undrawn revolving credit facility capacity and $162 million of unrestricted cash. We repaid $200 million of our term loan B during the quarter and finished with a net leverage ratio of 2.3 times in Q3 of 2023. With our consistent cash generation, we intend to continue to reduce our net leverage ratio toward our target of 2 times by no later than the end of 2024. During the quarter, we repurchased common stock amounting to $161 million and another $5 million so far in Q4 under our approved $250 million stock repurchase program as we continue to return value to our shareholders. And our capital allocation actions in 2023 of deleveraging and transforming our capital structure have resulted in a ratings upgrade from S&P, as Olivier mentioned, to BB- with a stable outlook during the quarter.

Moving now to slide 10, we continue to watch the regional macro environment and trends across all of our product verticals. However, we remain committed to delivering strong operational execution in the face of these potential headwinds. The outlook for foreign currency, particularly the euro to U.S. dollar exchange rate, remains volatile and as a result, we are revising our midpoint outlook and tightening the ranges to adjust for anticipated currency headwinds in the second-half. On this slide you can see the updated euro to U.S. dollar exchange assumption and financial ranges that imply the following midpoints still within our previous ranges. Net sales of $3.86 billion, net sales growth at constant currency of 8%, net income of $264 million, adjusted EBITDA of $630 million, implying an adjusted EBITDA margin of 16.3% for the full-year.

Net cash provided by operating activities of $438 million, and adjusted free cash flow of $375 million. Again, I want to reinforce that operationally, we have not deteriorated from our outlook as discussed in July. And the only adjustment to the midpoint of our full-year outlook is for the weaker euro versus the U.S. dollar. I’ll now turn it back to Olivier for his closing comments.

Olivier Rabiller: Thanks, Sean. Wrapping up summary of Q3 on slide 11, we delivered solid financials in the quarter with earnings expansion and continued cash performance. We also executed on our capital allocation priorities with the early repayment of $200 million of debt and the repurchase of $161 million of shares, returning value to our shoulders. Our continued differentiated technologies during the quarter has kept up on track with our goals as we introduce our largest turbo yet, the GT80. We are expanding our product range for customers in industrial and off-highway with this product. We also continue to build momentum towards achieving $1 billion of revenue from zero-emission vehicle products by 2030, with the award of two new pre-development awards in E-Cooling.

This is again proof that our strategy and differentiated zero-emission vehicle technologies are recognized by our customers. Last, we are really revising our 2023 full-year outlook for foreign currency impacts, as Sean stated earlier, while continuing to execute operationally. I am very pleased with the quarter and I want to thank the entire team again, the Garrett team for their hard work and dedication that has been instrumental in achieving our goals. In closing, I would also like to mention that today is a very important day for us as we are hosting our Investor and Technology Day. This is a fantastic opportunity to have a better view of the strengths of the company that we have been transforming for the past five years and understand our trajectory for the future.

If you are not participating I would invite you to review material that will be available on our website. Thank you for your time and operator we are now ready to start the Q&A session.

See also 30 Dying Professions to Avoid Like a Plague and 30 Best Paying Jobs With High School Degrees.

Q&A Session

Follow Garrett Motion Inc. (NASDAQ:GTX)

Follow Garrett Motion Inc. (NASDAQ:GTX)

Receive real-time insider trading and news alerts

Operator: We will now begin the question-and-answer session. [Operator Instructions] The first question comes from Hamed Khorsand with BWS. Please go ahead.

Hamed Khorsand: Good morning. Apologies if there’s background noise. First question is, what’s the inflection point or an event that would create a risk for you related to this UAW strike?

Olivier Rabiller: That’s a good question. What we do is that we are currently monitoring the factories that are impacted by the UAW strike. So far we’ve seen limited impact to the turbos, because turbos are going on engines and then they are going into vehicle plants. We’ve seen limited impact on the turbos that we are delivering to some engine factories, because those engine factories keep on running, because they are feeding some vehicle plants that are not stopped yet. So that’s the point we are monitoring and we are monitoring that on a daily basis. So it doesn’t mean that we’ll not see any impact so far in Q3, we had zero impact.

Hamed Khorsand: And then could you just talk about this foreign currency impact? How are you able to offset it anyway? Are you able to capture new sales or new customers to help you offset that? Or what’s the strategy there?

Olivier Rabiller: So first point on that, we are obviously a global business. And as you know from the split we have across the regions, we have a strong part of our sales in Europe. We have a very strong part of our sales also in Asia and a relatively lower part of our sales in North America. What primarily dictates our sales is the turbo penetration that you see in the different region. The size of the industry first and then the turbo penetration. China and Europe are both car markets that are bigger than North America and on which there is higher turbo penetration and our exposure. What we are seeing in North America is that we are more and more successful with customers on the light-vehicle side. We are already very successful on off-highway and industrial vehicle, but on the light commercial vehicle side, on the light vehicle side, sorry, cars, pickup trucks, we are seeing both increasing success for our product and at the same time an increasing turbo penetration that is linked to emission standards that are getting tougher and tougher.

So as we are monitoring the emissions regulation moving forward, as they get tougher, as [Indiscernible] turbo penetration, think about the next to be decided Tier 4 or the next to be implemented Tier 4 regulation, we are expecting that our exposure to North America will increase.

Hamed Khorsand: Okay, and then on the GT80 that you’ve introduced, is that going to be a new customer potential lens for you? Or is that really just expanding what you already have on the product line?

Olivier Rabiller: Well, that will do both. There is an increasing need for technology for big engines. Think about these engines being used in power gen applications, locomotives, marine applications. There is a quest also in those applications to go for new energy and we are talking about diesel fuel engine, but not only, more and more gas, natural gas, and therefore there is a need for technology. We like these industries, because obviously some of our customers are strong and need our product, but we are also seeing new customers that would like to get something new in those areas. Those areas are not always for vehicles. Think about genset or power gen equipment for data centers. More and more data centers need backup power. They want that backup power to be up and running in a fraction of a second. They are ready to pay for technology. And this is obviously very interesting for us to introduce new technologies on those big turbos.