Garrett Motion Inc. (NASDAQ:GTX) Q1 2024 Earnings Call Transcript April 25, 2024

Garrett Motion Inc. beats earnings expectations. Reported EPS is $0.28, expectations were $0.22. Garrett Motion Inc. isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here).

Operator: Good morning and hello. My name is Debbie and I will be your operator this morning. I would like to welcome everyone to the Garrett Motion First Quarter 2024 Financial Results Conference Call. This call is being recorded and a replay will be available later today. After the company’s presentation, there will be a Q&A session. And I would like to hand the call now over to Eric Burge, Garrett’s Head of Investor Relations. Please go ahead.

Eric Burge: Thank you, Debbie. Good day and welcome everyone. Thank you for attending the Garrett Motion first quarter 2024 financial results conference call. Before we begin, I would like to mention that today’s presentation and earnings press release are available on the IR section of the Garrett Motion website at investors.garrettmotion.com. There you will find a link to our SEC filings, along with other important information about our company. Turning to Slide 2. We note that this presentation contains forward-looking statements within the Securities and Exchange Act. We encourage you to read these risk factors contained in our filings and with the Securities and Exchange Act. Become aware of these risks and uncertainties in our business and understand that forward-looking statements are only estimates of future performance and should be taken as such.

The forward-looking statements presentation management’s expectations only as of today and the company disclaims any obligation to update them. Today’s presentation also includes non-GAAP measures to describe how we manage and operate our business. We reconcile each of these measures to the most directly comparable GAAP measure and you’re encouraged to examine those reconciliations in the appendix to the press release and the slide presentation. Also in today’s presentation and comments, we may refer to light vehicle diesel and light vehicle gasoline product simply as diesel and gasoline only. With us on today’s call is Olivier Rabiller, Garrett’s President and Chief Executive Officer; and Sean Deason, Garrett’s Senior Vice President and Chief Financial Officer.

I will now hand the call over to Olivier.

Olivier Rabiller: Thank you, Eric, and thanks everyone for joining Garrett’s first quarter 2024 earnings conference call. I will begin today’s remarks on Slide 3. First, I would like to thank the Garrett team for their drive, energy and focus to deliver another great quarter. I am pleased to report today that Garrett delivered a solid performance in Q1, achieving net sales of $915 million and adjusted EBITDA of $151 million. We indeed had a strong adjusted EBITDA margin of 16.5%, up 120 basis points from last quarter and adjusted free cash flow came in at $68 million in line with our outlook and expectations. Once again, we leverage our flexible cost structure and cash generation capability to enable us to adapt to industry softness mainly in Europe.

We expect the situation to improve during the second half of the year and Sean will take you through the financials in more details later in the presentation. The performance we achieved in the quarter enabled us to make some very significant progress on our capital allocation priorities. First, we previously stated that we would continue to deliver and on April 10, we made an early debt repayment of $100 million. Additionally, we continue to focus on returning value to our shareholders through our $350 million share repurchase program. And during the quarter, we repurchased $109 million of common stock. Finally, on April 3, we divested an equity interest in a non-core unconsolidated braking business, which resulted in a cash inflow of $46 million.

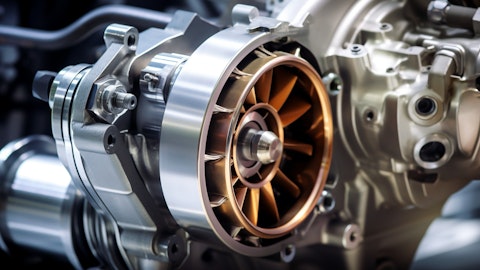

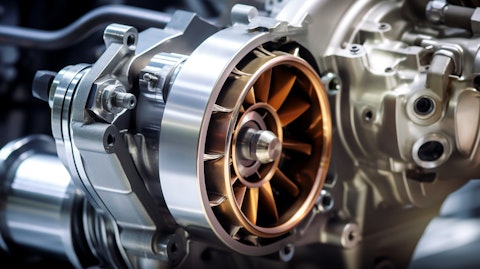

Turning now to Slide 4. We continue to innovate and bring new differentiated turbo offerings to our customers across all regions and all verticals. This includes not only additional wins and launches on hybrid vehicles but also natural gas application for heavy trucks, demonstrating our capabilities to support alternative fuels with our turbo technologies. During the first quarter, we also secured two new awards for our large industrial turbos. This is part of the plan we unveiled during our October Technology and Investor Day. Those large industrial turbos are key to the power generation equipment required by the global expansion of data center infrastructure a new industry for us. As we continue to advance our zero emission solutions, our success continues across all three new offerings: fuel cell compressors, E-Powertrain and E-Cooling compressors.

Garrett has already the broadest portfolio of high-speed fuel cell compressor applications. In Q1, we added two additional series production awards for our high speed fuel cell compressor. In addition, a few weeks back, we delivered and installed on the prototype our first breakthrough high speed E-Powertrain traction motor at a leading global OEM. This is a key milestone for the validation of this differentiated technology. In fact, we have been able to move from concept to drawings to product being tested on the vehicle at the customer in a record time. At the same time, we are also delivering our high power lightweight centrifugal E-Cooling compressors to a range of customers for hardware performance testing of this revolutionary thermal management device.

With this product, we are looking to enhance both fast charging and high load performance of battery electric vehicles. With all of that, I continue to be encouraged by the speed at which we progress and the interest we are generating with our customers for all these zero emission technologies. Turning now to Slide 5. And before Sean gets into the financials, I want to highlight the ways in which we are well positioned for success. We are the number one player in a technology driven industry and plan to keep expanding our turbo offerings, not only to serve the expected growth in hybrids but also to develop our position for larger turbos for industrial applications. At Garrett, we continue to enhance our operational framework that is highly cash generative through cycles and that allows us to invest in new technologies, while at the same time delivering and returning cash to shareholders through our share repurchase program.

Our priority remains to identify and focus on customers’ unmet needs, where we can leverage our innovation capabilities to develop differentiated and highly efficient solutions at scale. All the above is made possible by what I consider to be one of the best teams in the industry, being able to at the same time deliver strong operational performance and push the boundaries of innovation. I will now turn the call over to Sean to provide more insights into our financial results and outlook.

Sean Deason: Thanks, Olivier, and welcome everyone. I’ll begin my remarks on Slide 6. Overall, we delivered solid Q1 results in line with our full year outlook in an industry that is beginning to see deflation on some commodities along with demand softness primarily in Europe. We expect to see this trend continue into the second quarter and anticipate a stronger second half anticipate a stronger second half in 2024. Starting with reported net sales on the upper left hand graph, our net sales are trending down due to lower inflation pass through and softer global industry trends as just mentioned. Moving to the upper right hand side of the page, we delivered a strong adjusted EBITDA margin by flexing our cost continuing to perform operationally, as we navigated mix headwinds and a lower demand environment.

On the bottom left graph, we show that Garrett generated a strong adjusted free cash flow again in line with full year outlook and in a quarter that normally is seasonally weaker. Turning now to Slide 7, Q1 net sales were down 6% on a GAAP basis and down 5% on a constant currency basis, reflecting a decrease of $55 million over Q1 of 2023 driven by continued industry softness in gasoline, diesel and commercial vehicles primarily in Europe. This was partially offset by stronger aftermarket as well as lower inflation that passed through across all verticals. Lower industry volumes in Q1 were also affected by global supply chain disruptions that have impacted production at many of our OEM customers. Gasoline products were down 2% at constant currency decreasing $10 million in sales and comprised 42% of reported net sales flat from last year.

Diesel products decreased 8% at constant currency, a decrease of $21 million in sales and comprised 26% of reported net sales down from 27% of reported net sales last year. Commercial vehicle sales decreased 11% at constant currency or $19 million and represented 18% of reported net sales again down from 19% last year. Our aftermarket business increased 2% at constant currency or $2 million and comprises 12% of reported net sales up from 11% in Q1 of 2023. And finally, we saw an unfavorable impact of $8 million due to foreign exchange on a year-over-year basis. Moving now to Slide 8, on top of the page, we show our Q1 adjusted EBITDA bridge compared with the same period last year. In Q1, we delivered an adjusted EBITDA of $151 million representing a $17 million decrease over the same period last year.

This decrease was due to volume declines and unfavorable mix primarily from a decrease in sales of diesel and commercial vehicles in Europe impacting adjusted EBITDA by approximately $23 million. Overall, operating performance was a net positive of $13 million as we continue to successfully pass through inflation and generate productivity, while dedicating over 50% of total R&D expenditures to zero emissions technologies. By leveraging our flexible cost structure, we were able to deliver a strong 16.5% adjusted EBITDA margin in this challenging macro environment. Turning now to Slide 9, we show adjusted EBITDA to adjusted free cash flow bridge for Q1 2024. Garrett continued to deliver a strong adjusted free cash flow of $68 million in line with our full year outlook.

This was driven by a use of working capital of $9 million primarily due to inventory seasonality, partially offset by strong collections. And capital expenditures came in at $32 million in the quarter, primarily due to timing but also in line with full year expectations. And finally, cash taxes and cash interest were also consistent with our outlook. Turning to Slide 10, as Olivier mentioned earlier, we continue to generate cash and execute on our capital allocation priorities. We ended the quarter with a strong liquidity position of $766 million comprised of $570 million of undrawn revolving credit facility capacity and $196 million of unrestricted cash. Our cash generation enabled us to return significant value to our shareholders in the quarter as we repurchased $109 million of common stock under our $350 million stock repurchase program.

Additionally, in the first two weeks of April just after the end of Q1, we completed a divestiture of an equity interest in an unconsolidated joint venture resulting in the receipt of $46 million of proceeds and we made an early debt repayment of $100 million on our term loan continuing to deleverage the company. We are also evaluating various debt refinancing strategies for our capital structure to extend debt maturity and lower interest expense given current market conditions. Moving to Slide 11, on this slide we are reaffirming our 2024 outlook communicated on our last earnings call. All ranges have remained the same and as mentioned earlier, we expect a stronger second half of the year. The midpoints for adjusted EBITDA, margin and adjusted free cash flow continue to be $620 million, 16% and $375 million respectively.

We continue to expect to dedicate approximately 60% of our research and development spending in 2024 to zero-emissions technologies with a total R&D representing approximately 4.5% of sales as we continue to see increasing customer interest across key regions and verticals for our zero-emission technologies. As we did in the first quarter, in 2024, we plan to continue to deliver productivity, pass through inflation and flex our variable cost structure to adapt to a dynamic production environment. And with that, I will now turn the call back to Olivier to conclude.

Olivier Rabiller : Thank you, Sean. Turning to Slide 12. It was a strong start of the year with solid first quarter. We are delivering on returning value to our shareholders through share repurchasing, divesting an interest in a non-core business and repayment of debt through our solid cash generation. We are maintaining our leadership position in turbo with awards and launches across light vehicles, commercial vehicles and industrial offerings. Additionally, momentum continues for our zero-emission technologies. With the progress we have seen, I am pleased to share that we are on target to achieve our target of $1 billion of annual sales of our zero-emission vehicle technology by 2030. And finally, given our solid performance this quarter, we are reassuming our 2024 full year outlook. Thank you for your time and operator we are now ready to begin the Q&A session.

See also 11 Oversold MidCap Stocks To Buy Now and 15 Most Affordable Grocery Stores In the US.

Q&A Session

Follow Garrett Motion Inc. (NASDAQ:GTX)

Follow Garrett Motion Inc. (NASDAQ:GTX)

Receive real-time insider trading and news alerts

Operator: [Operator Instructions] The first question comes from Hamed Khorsand with BWS Financial.

Hamed Khorsand: So, first question I have is, could you just talk a little bit more about the dynamics of the market right now? Is it more of a OEMs waiting out on the inventory they have or are they just not ordering or are they re-changing the ordering patterns of what they want?

Olivier Rabiller: I think we have a lot of dynamics going on that are both regional and industry driven. So as an example, if I pick up the off-highway part of our commercial vehicle industry, we are notably impacted by the fact that the construction around the world is going down. Therefore, construction equipments are selling less, agricultural equipments as well. And you know, I’m pointing in terms of customers. And therefore, as a consequence, the part of the off-highway business is down. Now, on the other part of the business in off-highway, when I’m looking at the very big turbo and the very big engines, back to what we are sharing on those engines that are serving for data center backup power, the sales are booming. One is not compensating for the other.

And today, it’s not so much problem of inventory in between smaller prime of the end demand. For the rest, looking at the passenger vehicle industry, different dynamics around the world. In China, we see a slight recovery versus what we saw last year. But Japan and Korea are down significantly in Q1. Europe is down in terms of production and North America is up. Now, when you play with the size of all these things, you see that we are facing different dynamics, not always linked to some kind of stocking or destocking dynamics everywhere. There is overall and you should take a little bit of North America demand weakness that we are seeing and customers are adjusting to that. The rest of the commercial vehicle industry, we talked about off-highway.

We could have a bit of the same on the on-highway side. On-highway is quite weak in Europe, which is a place where we are quite strong on our on-highway business. It’s a bit better in the U.S., but our presence is probably relatively smaller than the one we are having in Europe and China. And in China, it’s recovering progressively. There is a shift going on from diesel to natural gas trucks, but still it’s a weak industry compared to what it was a few years back. So, there are a lot of different dynamics. The key for us is to be able to have obviously a position that is the broadest possible, so that when there is something doing well, we are compensating for customers or verticals that are doing less well and adapt our cost all the time and the strength of Garrett to have this very strong variable cost percentage as part of the total cost, which enables us to react.

You’ve seen what we did in Q1. We have a bit of a weakness on top-line, but at the same time, we are compensating with a higher margin as we could execute on everything we had in mind to preserve the earning capability of the company.

Hamed Khorsand: And then, Sean, could you just define when you’re talking about the second quarter being weak, is that on a year-over-year basis? Or are you thinking that there’s more downward move sequentially?

Sean Deason: No, I mean, as you saw, we were sequentially up from Q4 that we expect to be — we expect Q2 to be slightly up as certainly comp to the prior year will be down still. That’s what I meant Hamed. And the second half though improving on top of it sequentially again going forward.

Olivier Rabiller: But just to put things back in perspective, we knew that Q1 and Q2 last year we are really on the high node. So, there is no real surprise there.

Hamed Khorsand: And then the placement that you talked about for those large powertrains in China for the data center, are those going to be sales recognizable this year or is that just purely award for later on?

Olivier Rabiller: We are working at China speed, which means that we could recognize a few of those by the end of the year.

Operator: The next question is from Michael Ward with Freedom Capital.

Michael Ward : Two things. First on Germany, from the data that we see production in Germany was lower than expected, but based on what your comments are about the second half, you kind of expected it. Was there some planned downtime or was any transition going on? And is that what has given you confidence about the second half and your outlook for the year?

Olivier Rabiller: Sorry, production in Germany?

Michael Ward : For Germany, yes. Germany was weak, was lower than expected from the data that I see. But obviously you get some data.

Olivier Rabiller: Sure. Yes, I think we all have the same data when we look at IHS. It’s true that Europe was a bit weaker than anticipated and the reason why we’ve been a bit weaker on the top-line than what we had in mind. And if we see a recovery for the back end of the year, it’s a recovery that’s driven not only by Europe. It’s also driven by some recoveries that we would see in Asia as an example. So it’s really a mix. But it’s true that Germany was down in production in Q1 and that corresponds to the comment that we made that Europe was the driver of the weakness that we have seen overall.

Michael Ward : And I’m curious on the conversations you had with vehicle manufacturers as it relates to hybrids. I think in Europe, the hybrids are already a strong portion of the market and it’s growing considerably in North America. Have you seen vehicle manufacturers getting back and talking to you or picking up the pace of the discussions as it relates to hybrids in some of your applications?

Olivier Rabiller: Absolutely. That’s a very good point. First, we indeed see that in Europe there is obviously a strong position on hybrid, not only in Europe by the way, when you consider China. China there is a very strong production of hybrid as well. And in Europe, we’ve seen also something else coming in, but it’s very early is that diesel has not decreased to the extent we were expecting diesel to decrease this year. Meaning, if you take some countries like Germany, the end of the incentives on BEVs have been pushing people to buy more diesel. So, it’s too early for everyone to reschedule their production and everything, But we have seen a little bit of a better production results there than what we’re anticipating. Back to hybrid, and I think your question is probably more into the regions that are less on hybrid like North America.

It’s indeed attracting a lot of discussions with customers on understanding what are the powertrains that we need to develop with them. Now, it’s not for the next three months, obviously, when we develop a powertrain. It’s further down the line but those discussions have really intensified for the last six months.

Michael Ward : And is it — am I right that when I look at one of the trends with the vehicle manufacturers is their investment or demand for the latest technology is higher than it’s been in the past? In the past, they might have been looking for old applications. They’re really trying to push the envelope with the latest and greatest technology, which is one of your product strengths, correct?

Olivier Rabiller: Well, you have two points. The first one is that, obviously, there is hybrid — the hybrid push from the car makers, but at the same time, you probably know that in the U.S., we are planning for new emission regulations that on their own are driving for an increased level of technology. And that’s the reason why we are talking with everyone, because it’s not as simple as just saying I’m taking that old engine I was having somewhere in the world and then putting an hybrid architecture on top and everything will be fine. The car makers are really taking that prime statement with a much deeper view on what is the way to optimize, not only in light of what’s expected from these hybrid powertrains in the coming years, but also what are the emission regulations that need to be faced. All-in-all, it’s a good discussion for us.

Michael Ward : Sean, one quick question. What is the current share count or what will be the share count on the Q?

Sean Deason: Let me look. I want to say it is 230 or so 233. But let me look at that. I mean look through my Q real quick. I believe it’s around 233.

Michael Ward : No, that was the average, but like where is it now? Because it seems like a lot of the share repurchase occurred late in the quarter.

Olivier Rabiller: Yes. Well, we obviously, we didn’t authorize the new program until we reported our earnings. So and then we started after that our Q4 earnings. So in the middle of February. At that point then, we had authorized the new share repurchase program. We started then. So we got about half the quarter.

Michael Ward : So as we look to 2Q and 3Q going forward, we should see it assuming you’re able to go through a chunk of the repo program, we should see it come down by year-end somewhere in the $210 million range. Is that the right way to think about it?

Olivier Rabiller: Yes. I mean, we’re going to — we will continue to be in the market repurchasing shares and also the luxury of delevering as you saw this quarter. But we’re being smart about it as well. We’re trying to support the price and buy on the dip. So I can’t — I don’t want to give you a guide as to how much we purchased by the end of the year. But if you look at we realized almost most of the program we had in place last year and we’re going to try to do the same assuming we can do it in a reasonable way.

Eric Burge: Thank you, Debbie. I think that’s the last call we’ll take today. And thank you everybody for joining us on our Q1 results conference call. And if you have any other questions, please feel free to follow-up with myself.

Operator: The conference is now concluded. Thank you for attending today’s presentation. You may now disconnect.

Follow Garrett Motion Inc. (NASDAQ:GTX)

Follow Garrett Motion Inc. (NASDAQ:GTX)

Receive real-time insider trading and news alerts