We came across a bullish thesis on Garrett Motion Inc. (GTX) on Substack by Tyler Moody. In this article, we will summarize the bulls’ thesis on GTX. Garrett Motion Inc. (GTX)’s share was trading at $8.91 as of Dec 6th. GTX’s trailing and forward P/E were 7.30 and 7.21 respectively according to Yahoo Finance.

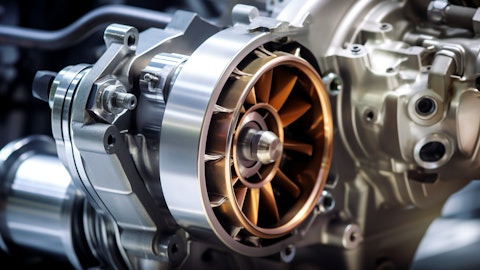

Photo by Danny Sleeuwenhoek on Unsplash

Garrett Motion (GTX) presents a compelling investment case, trading at a low free cash flow (FCF) multiple and offering substantial shareholder returns. Known for its advanced turbocharger technology, Garrett is benefiting from increasing demand for turbochargers as automakers aim to downsize engines while maintaining power and improving fuel efficiency. Additionally, the company is expanding into electric motor and battery cooling solutions for EVs and hybrids, positioning itself to capitalize on the electrification trend. Despite being saddled with asbestos liabilities during its spin-off from Honeywell in 2018, Garrett navigated Chapter 11 restructuring in 2020 and emerged with a leaner financial structure, paving the way for its current focus on growth and shareholder value.

Garrett’s recent financial performance underscores its resilience. While sales are down by 10% this year, the company is projected to generate approximately $280 million in FCF, translating to a compelling FCF multiple of 6.8 or a 14% yield. The company’s debt-to-EBITDA ratio of 2.2x is manageable, and ongoing debt reduction efforts aim to improve its BB- credit rating to investment grade. While Garrett’s negative shareholder equity—stemming from financial engineering during its restructuring—might be a concern, it is offset by robust asset management and the company’s ability to generate significant cash flow.

Garrett has been aggressive in returning cash to shareholders. This year alone, the company repurchased $226 million in shares, representing a meaningful portion of its $1.9 billion market cap. The recent announcement of a 2025 shareholder return plan aims to distribute 75% of FCF through buybacks and a new $50 million annual dividend. This strategy underscores management’s commitment to enhancing shareholder value and reflects confidence in Garrett’s long-term prospects.

Despite its strengths, Garrett faces challenges, including the cyclical nature of the automotive industry and potential revenue headwinds if a recession occurs. However, the company’s diversified product offerings, including those tailored to the EV transition, position it for healthy growth over the next five years. The market’s perception of Garrett as an “obsolete” company due to the rise of EVs appears misplaced, as its technologies improve efficiency for both traditional and electrified vehicles.

With its attractive valuation, strong cash flow generation, and shareholder-friendly policies, Garrett offers a compelling risk/reward profile. While cyclicality and debt remain concerns, the company’s ability to adapt and grow within a transforming automotive landscape makes it a stock worth considering for long-term investors.

Garrett Motion Inc. (GTX) is not on our list of the 31 Most Popular Stocks Among Hedge Funds. As per our database, 34 hedge fund portfolios held GTX at the end of the third quarter which was 32 in the previous quarter. While we acknowledge the risk and potential of GTX as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than GTX but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.