In this article we are going to take a look at how hedge funds traded Freeport-McMoRan Inc. (NYSE:FCX) recently. There are two things are going on for FCX: global recession amid the coronavirus pandemic and long-term inflationary monetary policies to combat the recession. Global recession is clearly a major negative news for FCX in the short-term. However, we know that printing trillions of dollars will lead to inflation in the long-term (if not, we won’t need to work ever again and keep printing money forever) and FCX will be among the safe harbors that we will sought after by investors.

Heading into 2020 analysts were bullish about FCX. Here is how Morgan Stanley summarized its bull case:

• 2020 is a transition year for Freeport and MSR expects the company’s revenues and EBITDA to increase 12% and 50% YoY respectively in 2021. With a positive global growth backdrop, this growth is highly dependent on the successful ramp up of two of Indonesia’s underground mines, Grasberg Block Cave and Deep MLZ, which would take Indonesian production from an estimated 0.7B lbs of copper in 2020 to 1.3B lbs in 2021 and further to 1.6B lbs in 2022.

• Additionally, FCX is a play on global industrial production. When US PMIs have fallen below 48, the 12-month forward returns of the S&P M&M index have outperformed the S&P 500 by 40 pct. pts, on average. MSR still sees copper as best positioned to benefit from any demand recovery, forecasting 10% Y/Y upside, on anemic supply growth and low global inventories. With inventory so low, any good macro news would likely drive price sharply higher.

• Ultimately, another year of constrained supply will likely push the market into deficit in 2020, with the potential for a major squeeze if this is met by restocking activity as capex potentially inflects higher.

• With the expected improvement in EBITDA and FCF, MSR thinks that the company will return capital to shareholders through additional dividends and/or buybacks. The stock yields ~150bps.

• The team is OW with 35% upside to their bull case PT of $18.

Things didn’t go according to Morgan Stanley’s plans. Today, FCX is trading at half of MS’ price target.

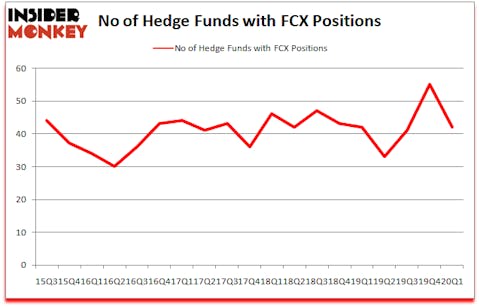

Freeport-McMoRan Inc. (NYSE:FCX) has seen a decrease in hedge fund sentiment of late. FCX was in 42 hedge funds’ portfolios at the end of the first quarter of 2020. There were 55 hedge funds in our database with FCX holdings at the end of the previous quarter. Our calculations also showed that FCX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of tools investors use to value stocks. A pair of the most underrated tools are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the elite hedge fund managers can outpace the S&P 500 by a significant margin (see the details here).

Scott Bessent of Key Square Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we are still not out of the woods in terms of the coronavirus pandemic. So, we checked out this successful trader’s “corona catalyst plays“. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to review the fresh hedge fund action encompassing Freeport-McMoRan Inc. (NYSE:FCX).

What have hedge funds been doing with Freeport-McMoRan Inc. (NYSE:FCX)?

At Q1’s end, a total of 42 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -24% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards FCX over the last 18 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

The largest stake in Freeport-McMoRan Inc. (NYSE:FCX) was held by Fisher Asset Management, which reported holding $258.3 million worth of stock at the end of September. It was followed by Icahn Capital LP with a $180.7 million position. Other investors bullish on the company included Citadel Investment Group, Slate Path Capital, and Contrarius Investment Management. In terms of the portfolio weights assigned to each position Slate Path Capital allocated the biggest weight to Freeport-McMoRan Inc. (NYSE:FCX), around 3.9% of its 13F portfolio. Contrarius Investment Management is also relatively very bullish on the stock, designating 3.38 percent of its 13F equity portfolio to FCX.

Because Freeport-McMoRan Inc. (NYSE:FCX) has faced declining sentiment from hedge fund managers, it’s safe to say that there lies a certain “tier” of money managers that decided to sell off their entire stakes last quarter. At the top of the heap, Robert Bishop’s Impala Asset Management dropped the biggest investment of all the hedgies tracked by Insider Monkey, totaling close to $56.6 million in stock, and Josh Donfeld and David Rogers’s Castle Hook Partners was right behind this move, as the fund said goodbye to about $43.7 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 13 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Freeport-McMoRan Inc. (NYSE:FCX). These stocks are Genuine Parts Company (NYSE:GPC), Hasbro, Inc. (NASDAQ:HAS), J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT), and Live Nation Entertainment, Inc. (NYSE:LYV). This group of stocks’ market caps are closest to FCX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPC | 22 | 164418 | 1 |

| HAS | 25 | 451618 | -11 |

| JBHT | 25 | 225951 | -3 |

| LYV | 46 | 1626857 | 2 |

| Average | 29.5 | 617211 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $617 million. That figure was $770 million in FCX’s case. Live Nation Entertainment, Inc. (NYSE:LYV) is the most popular stock in this table. On the other hand Genuine Parts Company (NYSE:GPC) is the least popular one with only 22 bullish hedge fund positions. Freeport-McMoRan Inc. (NYSE:FCX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May but still beat the market by 13.2 percentage points. Hedge funds were also right about betting on FCX as the stock returned 34.4% in Q2 (through the end of May) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Freeport-Mcmoran Inc (NYSE:FCX)

Follow Freeport-Mcmoran Inc (NYSE:FCX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.