We are still in an overall bull market and many stocks that smart money investors were piling into surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained more than 57% each. Hedge funds’ top 3 stock picks returned 45.7% last year and beat the S&P 500 ETFs by more than 14 percentage points. That’s a big deal. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

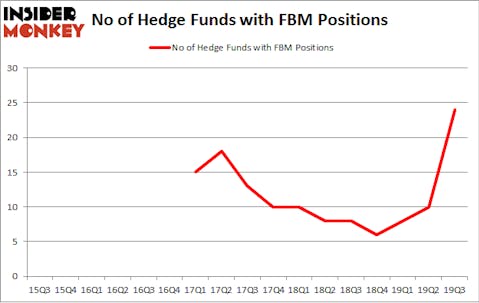

Is Foundation Building Materials, Inc. (NYSE:FBM) a marvelous investment now? The best stock pickers are becoming more confident. The number of bullish hedge fund bets went up by 14 recently. Our calculations also showed that FBM isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind let’s go over the latest hedge fund action regarding Foundation Building Materials, Inc. (NYSE:FBM).

How have hedgies been trading Foundation Building Materials, Inc. (NYSE:FBM)?

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 140% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FBM over the last 17 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies has the largest position in Foundation Building Materials, Inc. (NYSE:FBM), worth close to $16.9 million, accounting for less than 0.1%% of its total 13F portfolio. On Renaissance Technologies’s heels is Joseph Samuels of Islet Management, with a $10.2 million position; the fund has 1.3% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, David E. Shaw’s D E Shaw and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Islet Management allocated the biggest weight to Foundation Building Materials, Inc. (NYSE:FBM), around 1.27% of its 13F portfolio. Scoggin is also relatively very bullish on the stock, setting aside 0.73 percent of its 13F equity portfolio to FBM.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Islet Management, managed by Joseph Samuels, assembled the most outsized position in Foundation Building Materials, Inc. (NYSE:FBM). Islet Management had $10.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $5.8 million investment in the stock during the quarter. The other funds with brand new FBM positions are Paul Marshall and Ian Wace’s Marshall Wace, Curtis Schenker and Craig Effron’s Scoggin, and Benjamin A. Smith’s Laurion Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Foundation Building Materials, Inc. (NYSE:FBM) but similarly valued. These stocks are Plug Power, Inc. (NASDAQ:PLUG), Barrett Business Services, Inc. (NASDAQ:BBSI), Houghton Mifflin Harcourt Co (NASDAQ:HMHC), and Global Partners LP (NYSE:GLP). This group of stocks’ market valuations are closest to FBM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLUG | 9 | 44087 | 1 |

| BBSI | 11 | 76189 | 0 |

| HMHC | 13 | 191389 | -1 |

| GLP | 2 | 461 | -1 |

| Average | 8.75 | 78032 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $78 million. That figure was $75 million in FBM’s case. Houghton Mifflin Harcourt Co (NASDAQ:HMHC) is the most popular stock in this table. On the other hand Global Partners LP (NYSE:GLP) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Foundation Building Materials, Inc. (NYSE:FBM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on FBM as the stock returned 132.9% in 2019 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.