Been a while, isn’t it? That time is one with the dinosaurs, the Corvair and possibly honest members of congress. Still, despite all the travails the car companies have had, America – and much of the world – still runs on automobiles. At this point, entire cities are built around the idea of freely available cars and that people will use them for their generalized transportation needs.

Which is why the news this week that all of the major car companies reported strong growth in sales – most in double digits – from the same time last year is great news. Sales growth, year-over-year, for a major industry is a great sign for a growing economy and consumer – and business confidence. This is the sort of news that begins to feed on itself and leads to more good news. It’s possibly the best sign we could have.

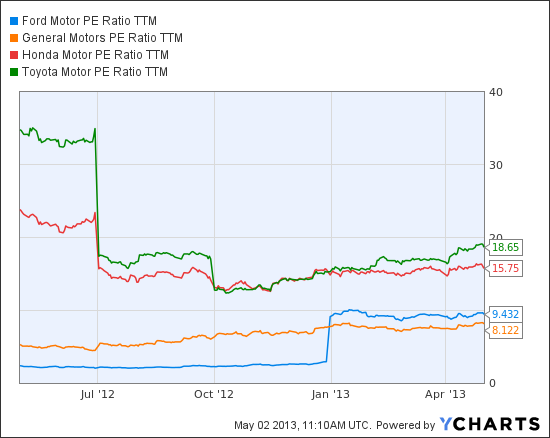

And auto companies are still undervalued, by my reckoning. Check out these P/E numbers:

F PE Ratio TTM data by YCharts

Winners in the U.S.A … mostly

Ford Motor Company (NYSE:F)

| Sales Growth | 12-Month Growth | P/E | EPS | Dividend Yield |

| 18% | 15.34% | 9.39 | 1.42 | 2.99% |

Ford Motor Company (NYSE:F) leads the pack in terms of sales year-over-year. Combine that with solid growth and a decent dividend and it looks eminently investment worthy. Both the newer Ford Motor Company (NYSE:F) Fusion and Escape set sales records and so did the relaunched Lincoln MKZ. Heck, the F-Series truck sales grew 24%! Given its newly reported sales figures and the share growth of the last six months, I’d say the time to buy is now. Yes, there were some lean years, but the economic conditions are right for Ford Motor Company (NYSE:F) to come back in a good way.

General Motors Company (NYSE:GM)

| Sales Growth | 12-Month Growth | P/E | EPS | Dividend Yield |

| 11% | 28.26% | 10.33 | 2.92 | n/a |

General Motors Company (NYSE:GM) – once the world’s largest company – had a harder time during the great recession. Still, the firm’s cars are selling again with Ram pickup sales increasing 49%. That’s a sign that not only are people buying cars…they’re buying expensive cars. Those Rams – good as they are – aren’t lightweight cheap vehicles. Shares in General Motors Company (NYSE:GM) have been on the move upward most of the year and this news won’t slow them down. Only the lack of confidence by not offering a dividend makes me rate General Motors Company (NYSE:GM) lower than Ford.

Honda Motor Co Ltd (ADR) (NYSE:HMC)

| Sales Growth | 12-Month Growth | P/E | EPS | Dividend Yield |

| 7% | 7.28% | 18.74 | 2.09 | 2.21% |

Not all the good news was from American automakers. Honda Motor Co Ltd (ADR) (NYSE:HMC) did pretty well, with it’s CR-V climbing the sales ladder. Again, that’s a small vehicle, but not as small as some. Honda Motor Co Ltd (ADR) (NYSE:HMC)’s been a rough investment to hold over the last twelve months as the shares haven’t kept pace with the S&P or the Dow. Still, there might be something worth hitting, there. I just think you’d be better off in one of the other two. But if – for some reason – you want to avoid them, Honda Motor Co Ltd (ADR) (NYSE:HMC) makes a good back up.

Not all good news

Toyota Motor Corporation (ADR) (NYSE:TM)

| Sales Growth | 12-Month Growth | P/E | EPS | Dividend Yield |

| -1% | 38.19% | 22.80 | 4.99 | 1.31% |

As one of only two major car companies to not see sales growth – the other was Volkswagen – Toyota Motor Corporation (ADR) (NYSE:TM) looks particularly bad in comparison. It’s true that the firm has had some bad PR lately, with several safety-oriented recalls making a lot of news, but still a lot of the raw numbers look good. EPS is good, 12-Month Growth is good. However, the growth has made the P/E for Toyota Motor Corporation (ADR) (NYSE:TM) look sort of wonky compared to the others on the list. I think Toyota Motor Corporation (ADR) (NYSE:TM) is slightly overvalued right now and it would be worth your time to avoid buying it. If you’re in, it’s time to sell and take what profit you can.

Cruising down the road…

Car companies aren’t something one has in a portfolio for sudden and explosive growth. These are mature firms in a well-developed industry. If you’re thinking about investing in any of these – and my top recco is Ford Motor Company (NYSE:F) – it should be with the thought that you want some large-scale manufacturing firms in your portfolio. They won’t be a main driver, but every portfolio needs solid, reliable growers to form the basis of it all. That’s why you should put some auto in your tank.

Good luck!

The article Are Cars a Good Investment Again? originally appeared on Fool.com and is written by Nate Wooley.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.