In that spirit, we three Fools have banded together to find the market’s best and worst stocks, which we’ll rate on The Motley Fool’s CAPS system as outperformers or underperformers. We’ll be accountable for every pick based on the sum of our knowledge and the balance of our decisions. Today, we’ll be discussing Ford Motor Company (NYSE:F).

Ford by the numbers

Here’s a quick snapshot of the company’s most important numbers:

| Statistic | Result (TTM or Most Recent Available) |

|---|---|

| Market Cap | $50.0 billion |

| P/E and forward P/E | 9.0 and 7.6 |

| Revenue | $134.3 billion |

| Operating margin | 4.7% |

| Net income | $5.7 billion |

| Free cash flow | $3.6 billion |

| Sales distribution |

|

| Key competitors |

Sources: Ford and Yahoo! Finance.

Travis’ take

The auto industry has historically been terrible to investors. Every time the economy turns south or gas prices rise, consumers change their spending habits and auto manufacturers are too slow to react. This is in part because manufacturing lines weren’t built to be adaptive to quick changes and labor union contracts constricted management’s ability to navigate through challenges.

Some of these structural challenges still exist, but since Alan Mulally took over at Ford Motor Company (NYSE:F), he’s been able to navigate them better than almost any other executive in the industry. He renegotiated union contracts, pushed retirement health care off the balance sheet, and brought innovation and style back to Ford’s cars.

His success led to a nice $5.7 billion for the company last year, leaving the stock with a 9.0 P/E ratio. I think there’s significant upside for investors, given that value and the trends for Ford. The North American market has stabilized, and Ford Motor Company (NYSE:F) is expecting growth this year, which should drive results higher. Revenue was up 47% in the Asia-Pacific region last year, and management is expecting more growth this year, adding to a small profit it made in the region. Europe will continue to be a drag, but if the continent ever returns to normal, it’s pure upside for Ford.

Add all of this together, and I’ll give Ford an outperform call, mainly because of the stock’s value and the vision of Alan Mulally.

Alex’s take

I’ve watched many of my fellow Fools get onto the Ford bandwagon in the past six months, telling me (and everyone else reading this site, of course) that the company is cheap, well managed, and full of good new technology and clever styling that will appeal to the younger generation of car buyers. You can see many of these arguments from Sean and Travis, so I won’t rehash them again.

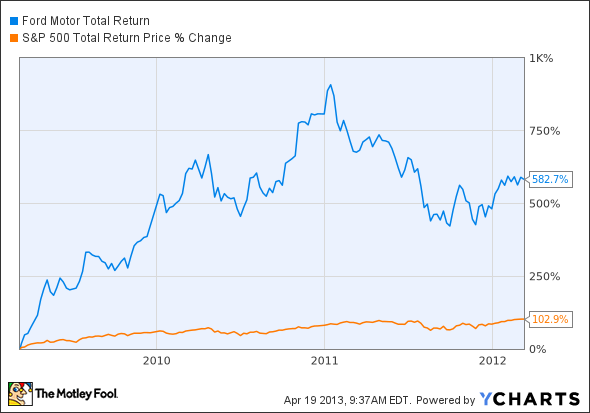

However, all of this feels to me like bandwagon jumping at precisely the wrong time. Here’s how Ford performed coming out of the recession, compared with a dividend-adjusted index return:

F Total Return Price data by YCharts

And this is how it’s performed over the past year:

F Total Return Price data by YCharts

Will Ford return to its index-trouncing ways for the rest of the year? I don’t really think so. As Travis already mentioned, automakers tend to be very reliant on economic tailwinds, and I pointed out earlier this week how closely Ford’s earnings match the rise and fall of the global economy. Ford Motor Company (NYSE:F) may say it expects growth this year, but an economic downturn can catch many people by surprise — just ask GM, which fell into bankruptcy several years ago, when the subprime bubble blew up in everyone’s faces. Or ask Ford, which was in pretty dire straits itself at the time.

I’m not saying that we’ll see anything that devastating in the near future, but economies rise and fall on relatively predictable timelines, and we’re now more than four years into one of the longer uninterrupted expansions in recent memory. No matter how good Ford’s become, it can’t singlehandedly reverse the basic human tendency to tighten the belt when the economy slows down.