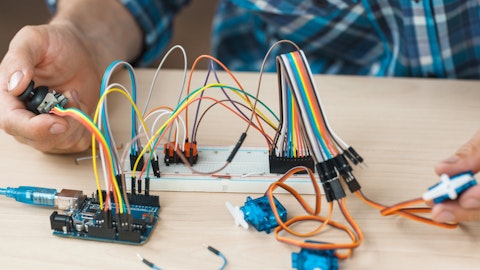

And again, these products are agnostic to the powertrain. We’re providing more than just hardware manufacturing from joint and full product design to much broader collaborative engagements. Automakers are investing in their own software and design capability and our ability to support their broader ecosystem requirements with a flexible business model is a differentiator for Flex. On that point, we also differentiate from EMS companies with our design capability, and we differentiate from full-service Tier 1 suppliers with our open and flexible business model, working with OEMs to design, jointly design or manufacture our customers’ designs. So let’s talk about how our design expertise is enabling growth. A great example is our partnership with NVIDIA on their DRIVE Orin, system-on-a-chip, that was announced in 2022 and highlighted at their recent GTC Developers Conference.

We worked in advance with NVIDIA to design a hardware platform around this chipset and then made it available to customers for their own application software development. This then led to multiple production programs based on a common platform building block, specifically focused on advanced driver assist. This is a great example of our role in the compute ecosystem using a Flex hardware design paired with an application software for complete solution. Another example is in the EV power electronics space, where we have invested in design capability for DC/DC and onboard chargers. Our 800-volt high-voltage designs have been selected for multiple production programs based on our superior performance and cost. This design was developed with the latest silicon carbide technology and was featured at the Consumer Electronics Show in cooperation with STMicro.

In this case, our role in the ecosystem is to provide a complete product solution, including both hardware and software. That technology that supports better dynamics while improving safety and autonomy will continue to evolve and continue to add further complexity to design and engineering, manufacturing and supply chain. And this trend benefits Flex, as we work directly with auto OEMs to solve these challenges and move up the stack. Our Automotive business is very well diversified across geographies and OEMs. We continue to expand with new platforms. We are seeing steady increases in electronics content per vehicle, and we expect all of this to drive growth well above the global light vehicle production forecast of roughly 2%. We expect our overall automotive business to grow at a high single to low double-digit CAGR over the next several years.

Today, Revathi, Michael and I spoke about longer-term technology transitions driving increasing compute and power requirements in multiple industries. And this certainly will fuel growth for our Automotive business. This opportunity goes beyond just the electric vehicle transition. As you can see, we expect increasing demand for more advanced power and compute solutions to drive business growth through 2029. With that, I’ll turn it over to Paul. Paul?

Paul Lundstrom: Thank you, Becky. Good morning, everyone. We’ve talked about the trends driving the industry, our focus areas for higher value growth and how we are capitalizing on these opportunities through our differentiation. I will talk about the positive implications to our longer-term financial framework. But first, I want to take a step back. The strategy we set five years ago was to go after and win the right kind of growth, expand our services and build on our operational excellence. Ultimately, this strategy is about solving complexity to drive new wins and build deeper relationships with our customers. We expected this approach to create shareholder value through profitable growth, margin expansion and lead to greater financial resiliency through the cycles.

This has been tested multiple times over the last several years, and we have clearly demonstrated that it is working. As David mentioned, we’ve moved NEXTracker to discontinued operations, which gives you clean multiyear visibility into our core business. Looking at how Flex has advanced over the last several years, we’ve executed on our transformative strategy to take advantage of long-term trends, focus on key end markets and drive further efficiencies and operational excellence. The underlying longer-term trends haven’t changed. But this last year, revenue growth was impacted by a significant shift in the macro cycle. But I want to pause here for just a moment because there is a very important takeaway here. In fact, it may be one of the most significant indicators of change this industry has seen in quite some time.

In a year when revenue was down 7%, margins still increased 50 basis points, and EPS grew 11%. That is resiliency. And it’s also the fourth year in a row, we’ve seen double-digit earnings growth, a trend we expect to continue. You’ve heard us talk before about maintaining a nimble operating model, so we can ramp up and ramp down quickly and that we’re hyper focused on discipline and operational execution. That agility and discipline puts us in good position to manage through the cycle. This strategy is how we navigated the COVID challenges, the supply chain shocks and now the current macro cycle, and we’re still delivering on our financial commitments. This is the proof that Flex has truly become a more resilient company and a leader in the next wave of the EMS industry.

We’ve always said our job is to be disciplined custodians of your capital and to focus on delivering long-term value to shareholders. That is exactly what you have seen over the last several years. Following our capital allocation framework that we outlined in 2022, we continued to invest for value creation and profitable growth by way of CapEx and opportunistic M&A, balanced with returning capital to shareholders, investing in high-value growth opportunities could mean organic or inorganic. As we invest, we look for advanced technologies and expertise to build on our core capabilities and to keep us at the leading edge. We believe there are always opportunities to further improve efficiency through investments like footprint optimization and by further integrating next-gen automation, as Revathi discussed.

We’re making investments to continue building out margin-accretive opportunities through verticalization and value-added services. Most of this investment is internal and from CapEx, and we maintain that around 2% of revenue is the optimal target to support our strategy. Should we choose the M&A path, investments would follow the criteria I just mentioned, and our team would be confident in the value creation potential. That said, meaningful M&A opportunities are typically few and far between. And as we look to the landscape today, we continue to believe our best investment alternative is in Flex stock. And so turning to the next page. For fiscal year 2024, stock repurchases totaled $1.3 billion, which was the largest one-year program ever for Flex.

We took 42 million shares out of the count in FY2024. In Q4 alone, we bought back north of $500 million, and we will likely stay at that pace through at least Q1, as we continue to believe our intrinsic value is well above market. That makes Flex’ stock a great investment. You’ve seen us be active and opportunistic, balancing shareholder return with managing near-term working capital requirements through the cycle and of course, protecting our investment-grade rating. Turning to our financial outlook for Q1. For Q1, we expect revenue in the range of $5.6 billion to $6.2 billion, with operating income between $240 million and $280 million. Interest and other is expected to be around $53 million. We expect the tax rate to be around 19% for the quarter.

All of that translates to adjusted EPS between $0.37 and $0.45 a share based on approximately 415 million weighted average shares outstanding. For GAAP EPS, we expect between $0.11 and $0.19 a share. As for the segment outlook, for Reliability Solutions, we expect revenue to be down mid-teens, similar to Q4. We’re seeing continuing weakness in core industrial, renewables and medical equipment. On the other hand, we are seeing stable demand in auto and strength in cloud power solutions. Revenue in Agility is expected to also be down mid-teens. We’re facing headwinds from inventory digestion in comms and consumer-related end markets. However, we continue to see very strong AI-driven cloud spending. Now turning to our financial outlook for fiscal 2025.

We expect Flex revenue for the year to be flat to down 3% year-over-year in the range of $25.4 billion and $26.4 billion. We anticipate adjusted operating margins between 5.2% and 5.4%, as we continue to benefit from mix shift towards higher-value programs and services and further efficiency gains. As tax rates increase globally, we do expect some headwinds on our tax rate, likely landing in the 18% to 20% range. Finally, we expect adjusted earnings per share between $2.30 and $2.50 and we expect to generate at least $800 million in free cash flow. Looking at the segments. It’s a highly dynamic market, but we want to provide some visibility based on what we see today. For Reliability, we expect revenue to be in the range of down low single-digit to up low single digits.

We’re balancing the uncertain timing for the recovery in core industrial and medical equipment with continued strength in power, automotive and also for medical devices. For Agility, we expect revenue to be flat to down mid-single digits. We’re taking a conservative view on inventory digestion in comms and enterprise along with consumer spending trends. We also anticipate continued strength in hyperscale cloud. As we did in 2022, we want to provide a longer-term financial framework based on what we’re seeing. Today, the team highlighted our strong value proposition with multiple drivers that will help us continue to drive profitable growth and margin expansion, as you’ve seen over the last several years. For example, we talked about our opportunities with the combination of compute expertise and our power portfolio in cloud and automotive.

We think those two alone can grow to about 40% of revenue through fiscal 2029. However, we also need to balance our current outlook for the long-term opportunities with the short-term market fluctuations we’re seeing today. So at this point, we’re expecting a low to mid-single-digit revenue growth through 2027, largely based on the higher macro uncertainty over the next four to six quarters and then improving beyond that. On our current path, we expect to reach a 5.8% to 6% adjusted operating margin by the end of fiscal 2027. So how do we get there? Well, we’ve talked about the three areas of margin contribution: productivity, mix and services. We discussed how we’ll get continued long-term efficiency and productivity gains through the adoption of advanced automation technologies, including various forms of AI.

Our margins will also benefit from continued mix improvement by growing in markets where we deliver more value. We talked about our cloud power business in industrial, which is now a $1 billion business, growing at a 20% rate and with above corporate average margins. We talked about our cloud business in CEC. This is a little over $2 billion and also expected to grow at least 20% and is also typically margin accretive. So our cloud revenue between CEC and power all-in, is $3 billion plus, making it a sizable end market with attractive growth and margins. We are also seeing some networking, compute and storage solutions shift to cloud-based applications, but we’re not even counting those here today. We also talked about automotive. In FY2024, it was $3.8 billion, also a margin driver, and we expect it to grow at a low to mid-teens growth rate through 2027 and crossing through $5 billion as a business.

Lastly, we mentioned our vertical and value-added services. These are areas of additional differentiation that drive customer stickiness and profitability. Combined, they contributed about $1 billion in revenue in FY2024, above corporate growth and margin rates. You roll all this up with continued buybacks, we expect adjusted earnings per share to grow in the low teens through fiscal 2027, and we also expect strong cash generation at an 80%-plus adjusted free cash flow conversion rate on an annual basis. Again, this brings us back to one of the most important takeaways. Our strategy is working. Flex is a more resilient company, and we have and will continue to manage through the cycle and drive profitable growth, leading to a further margin expansion, EPS growth and cash generation.

Before we begin Q&A, here’s what’s important to remember from today. We have aligned our portfolio strategy with strong longer-term macro and secular drivers and are focused on large, high-value markets, such as cloud, automotive, health care, industrial and energy applications. We have created differentiation through a winning combination of end-to-end services and cross-industry expertise, which has positioned us well in multiple markets, like the ones you heard us talk about today. Michael told you about our cloud integrated rack solution services, including GPU and compute for AI applications. And we’re the only EMS provider with our own comprehensive cloud power products from embedded to critical facilities with a portfolio that is truly grid to chip.

Becky showed you how this same combination of power and compute is also driving growth in other industries, such as our automotive business. Add to all of that, our supply chain resiliency and our global footprint. We continue to improve our technical and advanced manufacturing capabilities, driving operational excellence and efficiency and equally important, prepare us for the future. These competitive advantages have uniquely positioned us to capture growth and deliver profitable revenue with margin expansion and cash generation, ultimately creating value for our shareholders and creating value for our many customers. Now I’d like to hand it over to Kyra Whitten, who heads up Marketing, Communications and Sustainability, and she’s going to walk us through the Q&A.

Kyra?

Q – :

A – Kyra Whitten: Thank you, Paul. As a reminder, Q&A today will be through the event platform. You may submit your questions in the Q&A chat box on the lower right side of your screen. With that, let’s get started. Our first question comes from Steven Fox with Fox Advisors. Can you talk about how successful to date you have been in attracting vertical solutions and aftermarket services to data center rack programs in the past and whether you can drive that attach rate higher? And if so, how?

Revathi Advaithi: Kyra, I’ll start, and then Michael, I’ll turn it over to you. First, Steven, thanks for the question. I’ll start by saying that we’re really excited to share the story we did with you in terms of compute and power in the data centers, which like Michael said in his presentation, is we are one of the few companies that can actually look at power products and the integration that it provides with compute, and we know that the future of the data center is all about the proliferation of the requirement of power and we have a unique value proposition. On top of that, what Michael talked about is the addition of all the services that we have end-to-end in terms of – and adding to our manufacturing services portfolio. So really a great story there. Michael, I’m sure there’s a lot more to add on that?

Michael Hartung: Absolutely. I’ll build on your comments there because as you know, we talk a lot about the role value-added services plays in enabling the growth across Flex, but in the data center, in particular. So maybe I’ll start by just first reiterating our strategy from a manufacturing standpoint for the cloud. And that’s simply to combine as many services as possible in each opportunity. And the reason I think that’s important is that we have a consistent concerted effort to look at how we can continue to increase our penetration into things like vertical integration and aftermarket. When you look back, say, three or four years, the good news is that both of those elements of our business have grown at a double-digit growth rate.

And since that time, we’ve had a lot of penetration in both of our cloud business, our customers and in that market in particular. And there’s no better example to give them the one that’s been asked about the data center. So if you think back what we talked about was not only the scale in manufacturing and integrating the rack itself, but our unique ability to vertically integrate components of that rack. And it starts with our ability to fabricate sheet metal racks and enclosures. We also include our private label components and we even integrate our embedded power products as well. So vertical integration is a key enabler in the data center itself. But it doesn’t stop there. We also venture into the post-production market with our aftermarket services, in particular, in our Global Services business, which is already operating at scale as well.

We operate in 25 factories in 18 countries, and that really does enable us to do two things. It enables us to attach value-added fulfillment capabilities, which really enables customers to lower their lead time, improve their flexibility. But maybe more importantly, it enables us to attach our circular economy solutions, which really help our customers achieve their sustainability objectives by bringing those same products back from the market for repair, refurbishment or recycling. So we really like the progress we’ve made so far and how we’re positioned for the future.

Kyra Whitten: Thank you, Michael. Our next question comes from Samik Chatterjee with JPMorgan. Between auto and cloud, you’re talking about $8 billion of revenue growth over the next five years. How should we think about the margin profile, the $8 billion revenue translates at? And how do we think about the opportunities to increase margin run rate in these businesses?