Solar stocks have mounted quite the comeback over the past year as both First Solar, Inc. (NASDAQ:FSLR) and SunPower Corporation (NASDAQ:SPWR) are up well over triple digits. As an investor who is interested in making green as so many are going green, it’s easy to wonder if there is still time to buy stock in First Solar, Inc. (NASDAQ:FSLR), or fear that the future is too cloudy. Let’s take a look at a couple of reasons why investors would want to buy the stock, as well as a big reason to beware.

Buy

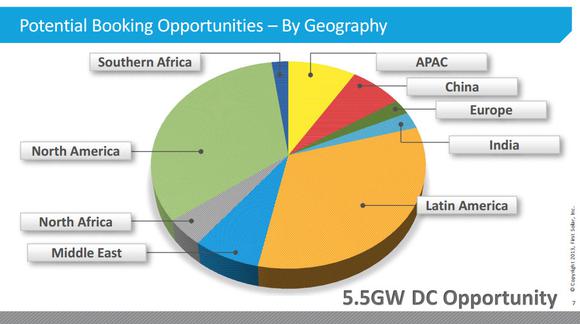

The opportunity for growth in the solar market is incredible. SunPower Corporation (NASDAQ:SPWR) for example believes it has just a 0.01% market share of the potential distributed generation market, while also only claiming 0.02% of the power plant market. It’s a similar story at First Solar, Inc. (NASDAQ:FSLR) which, for example, sees potential booking opportunities totaling 5.5 gigawatts, as you can see in the chart below:

Source: First Solar Investor Presentation (link opens a PDF)

Add to this that the company has an advanced stage pipeline of 3.1 gigawatts while also remaining focused on a one-to-one book-to-bill ratio, and you see a company which should enjoy sustained growth. Further, the company expects to generate about a billion dollars in operating cash flow this year along with earnings per share of between $4 and $4.50. When you add it all up, First Solar, Inc. (NASDAQ:FSLR)’s business is on solid ground.

Beware

All that being said, First Solar, Inc. (NASDAQ:FSLR) is in the process of selling nearly 10 million shares of its stock in a secondary offering. While this could raise up to $450 million in cash for the company, the $46 offering price is well below where shares were trading just a couple of weeks ago. As an investor, dilution like this while shoring up the balance sheet can really put a lid on the company’s stock price for a while as these new shares are digested by the market.

As fellow Fool Travis Hoium recently pointed out, First Solar, Inc. (NASDAQ:FSLR) already has a top notch balance sheet with more than $1.3 billion in cash and just $562 million in long-term debt. Unfortunately, as he also pointed out, that’s not enough capital to see the company through the build out of its two massive solar projects in the Southwest U.S. The large up-front capital costs of these and future projects could require First Solar to continue to use its stock as currency to fund its growth. Not only that but this most recent raising of capital cost First Solar more than a hundred million dollars as it sold stock at a discount to where it had been trading. While these moves could pay off in the long run, investors should get used to the volatility.

Foolish bottom line

As an investor that’s been burned by solar stocks in the past, I’d be one to stay away from solar. While the growth potential is very compelling, investors are in for a bumpy ride as the market continues to develop. It’s tough to see the balance between risk and reward being in favor of investors who buy First Solar’s stock today, especially in light of the run-up this year. The company saw it as an opportunity to sell its stock to bolster its balance sheet, meaning that the price might not be right for potential buyers.

That’s why the stakes have never been higher for current investors. You need to ensure that First Solar’s stock won’t burn you, which is why I’d encourage you to stay updated on the company whenever news breaks.

The article First Solar Stock: Buy or Beware originally appeared on Fool.com.

Fool contributor Matt DiLallo has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.